The following is an official comment submitted on behalf of the Institute for Energy Research, by IER’s Policy Director Kenny Stein, regarding Docket ID No. EPA-HQ-OAR-2021-0427.

A PDF of the comment is available for download here

_______

The Renewable Fuel Standard (RFS) is a flawed program, created in the hope that government planning could overcome basic economic and physical realities. The end of the overoptimistic mandated volumes from Congress should have been an opportunity to reassess the overall value and purpose of the RFS. Unfortunately, with this proposed rule the Environmental Protection Agency has made little attempt to grapple with the market changes in US oil supply and demand or the limitations to ethanol production and use that have been exposed in the last 15 years. Even worse, not only has EPA failed to address the known deficiencies of the RFS, it now seeks in inject even more distortions and complexity in pursuit of extending RFS subsidies to electric vehicles.

This proposed rule is flawed in numerous ways, however in this comment we focus on three key errors: (1) the rule inadequately addresses the substantial market changes over the 15 years since the RFS was last revised by Congress; (2) the rule does not address the manifest failure of the attempt to create a product category of cellulosic ethanol; and (3) the rule illegally seeks to expand the RFS to encompass electric vehicles.

I. EPA’s Review of Other Calendar Year Factors is Deficient

In its review of the list of factors under 42 U.S.C. § 7545(o)(2)(B)(ii), EPA acknowledges the huge growth in domestic oil production in the 15 years since the last modification of the RFS. EPA then ignores how that massive supply growth alters the assumptions underlying the RFS. The primary goal of the RFS was to reduce American reliance on foreign oil, but the US is now a net exporter of oil, not to mention a net exporter of refined products. This has to change how the 6 balancing factors under the RFS are analyzed. If the main goal of the RFS has been achieved, then there is little justification for the EPA’s attempts to further expand the program. Despite acknowledging domestic supply growth, EPA fails to analyze how that supply growth changes how the RFS should be implemented. By giving insufficient weight to the sea change in market conditions, EPA has failed to accurately analyze the RFS factors that inform its choices of future mandates.

This failure extends to most of EPA’s factor analysis, but we will focus one factor to illustrate this analysis deficiency by the EPA. During discussion of factor II, impact on US energy security, EPA treats each unit of ethanol as displacing a unit of foreign oil, and thus ascribes positive energy security value to ethanol blending. But this is a flawed method of analysis for several reasons:

First, Imports of oil are so dramatically lower than 15 years ago that EPA’s assumption is a false comparison. It is at least as likely, perhaps more likely, that ethanol supply is actually displacing domestic American supplies of oil. If ethanol blending is competing with domestic oil supply, then the RFS is actually undermining US energy security. EPA fails to even consider this possibility in its analysis.

Second, oil that is still being imported to the US is imported for very specific reasons that ethanol production does not affect:

- In California and New England, oil is imported because those states refuse to allow pipeline construction which would transport oil from domestic sources.

- Refineries on the Gulf Coast still import certain grades of crude because that is what the refineries are optimized to process. Increasing ethanol blending is not going to replace those imports.

- Certain refineries import oil due the ownership of the refinery, preferring to use oil supplied by the company itself. Here again, ethanol blending does nothing to change those imports.

Third, EPA in several instances refers to the ample projected global supplies of ethanol (especially from palm oil) that could help meet RFS mandated volumes. But this undermines the supposed positive energy security value of ethanol. Replacing imported oil with imported ethanol does not improve US energy security. And if that imported ethanol is displacing domestic oil supply, then the contradiction is even more egregious.

II. Cellulosic Ethanol is Not Real

For more than a decade now, EPA has repeatedly waived the mandated volumes for the cellulosic category of ethanol under the RFS. This has been for the simple fact that commercial production of cellulosic ethanol has been nearly nonexistent, despite the promise of hefty subsidy through the RFS. The end of Congress’s wildly over-optimistic volume mandates should be an opportunity for EPA to reassess the entire cellulosic category. It is clear at this point that reality has not comported with Congress’s hopes 15 years ago. This should be the perfect application of 42 U.S.C. § 7545(o)(2)(B)(ii)(III), the “expected annual rate of future commercial production of renewable fuels” factor. There is no expected future commercial production. This factor was Congress giving EPA the ability to rationalize the RFS.

Instead of rationalizing the program, EPA has attempted to stretch the cellulosic category beyond any rational definition of what Congress authorized. EPA has already done this by the wave of a regulatory hand, deeming LNG and CNG to qualify as “cellulosic” biofuel, even though that was not what was envisioned by the RFS at the outset. In this proposed rulemaking, EPA now pretends that the growth in LNG and CNG for fuel means that the supply of “cellulosic” ethanol is growing. But the actual supply of liquid cellulosic fuels as originally envisioned by the RFS is still nearly non-existent. In this rulemaking the EPA acknowledges that such supply is nonexistent, but rather than adjusting the program to match reality, EPA wants to attempt more regulatory finagling to expand the definition of “cellulosic” even further allowing electricity to qualify as “cellulosic ethanol.” This is an absurd contortion of language and reality in order to avoid taking the obvious, and entirely authorized step of simply zeroing out the failed cellulosic category.

III. Proposed eRINs Program

The most egregious, and transparently illegal, part of this proposed rule is the attempt to create an “eRINs” program. There is no support in statute for including electricity generation in the RFS and such inclusion is in conflict with the plain language of the statute. Congress made clear in the EISA of 2007 that electricity and electric vehicles were not included in the RFS, requesting that EPA study and report back to Congress about the feasibility such an inclusion. This attempt to completely redesign the RFS to provide subsidies for electric vehicles is a major departure from the existing understanding and implementation of the RFS and thus must raise major questions. EPA cannot point to a clear statement of Congress authorizing this major alteration in the RFS; indeed, the clear statement of Congress is that electric vehicles are NOT to be included in the RFS until Congress has had an opportunity to review EPA’s study on the matter.

For many years, EPA rejected comments and proposals from parties seeking to allow the generation of eRINs from renewable biomass then used as transportation fuel. Those decisions were correct. There are many sound policy reasons for EPA not to modify the RFS program to incorporate eRINs. Not least, as EPA acknowledges, is that “the inclusion of a new regulatory program for eRINs significantly increases the uncertainty of [EPA’s] cellulosic biofuel projections for 2024 and 2025,” and “EPA has no history projecting the generation of eRINs under the RFS program.” More fundamentally, however, EPA’s proposed eRINs program is contrary to statute. Electricity for EVs and their batteries, regardless of how generated, does not fall within the scope of the RFS program established by Congress. The statute instead requires a physical shift of the fossil fuel volume contained in the liquid and gaseous transportation fuels that the RFS covers. Indeed, Congress specifically expressed in the EISA of 2007 that any expansion of the RFS to electric vehicles should merely be studied by EPA—and not even piloted—for report to Congress for any future implementation.

A. EPA Has No Legal Authority to Adopt Its Proposed eRINs Program

In the EISA of 2007, Congress modified the RFS program first authorized through the Energy Policy Act of 2005. As amended, the RFS program requires, for each year, that EPA “ensure that transportation fuel sold or introduced into commerce in the United States … contains at least the applicable volume of renewable fuel … in accordance with subparagraph (B) and … achieves at least a 20 percent reduction in lifecycle greenhouse gas emissions compared to baseline lifecycle greenhouse gas emissions.” 42 U.S.C. § 7545(o)(2)(A)(i)(emphasis added). Of note:

- “The term ‘transportation fuel’ means fuel for use in motor vehicles, motor vehicle engines, nonroad vehicles, or nonroad engines (except for ocean-going vessels).” 42 U.S.C. § 7545(o)(1)(L).

- “The term ‘renewable fuel’ means fuel that is produced from renewable biomass and that is used to replace or reduce the quantity of fossil fuel present in a transportation fuel.” 42 U.S.C. § 7545(o)(1)(L).

- “The term ‘additional renewable fuel’ means fuel that is produced from renewable biomass and that is used to replace or reduce the quantity of fossil fuel present in home heating oil or jet fuel.” 42 U.S.C. § 7545(o)(1)(A).

Yet EPA is “proposing that qualifying renewable electricity” that is “produced and put on a commercial electrical grid serving the conterminous U.S. could be contracted for eRIN generation so long as the OEM [Original Equipment Manufacturer; i.e., an automaker] demonstrates that the vehicles it produced have used a corresponding quantity of electricity. Under the proposed approach, EPA would establish requirements for biogas generators and electricity producers, but only an OEM would be allowed to generate the eRIN.” There are several independent reasons why EPA lacks the statutory authority to implement such a program.

B. Electricity for EVs is not a “Fuel” or “Renewable Fuel,” nor is Biogas Used for Such Electricity Contained in “Transportation Fuel”

A court reviewing EPA authority to incorporate eRINs for electricity into the RFS program will start, as it must, with the language of the statute. Electricity used to power EVs, regardless of the source of generation, is not a “fuel,” a “renewable fuel,” or contained in “transportation fuel.” Nor is the biogas used to generate electricity for an EV.

Congress did not characterize electricity as a “fuel” in the RFS. In fact, elsewhere in EISA, Congress recognized electricity as an alternative source of “motive power of the vehicle” from “electric current that is external to the vehicle.” Neither electricity nor the battery that stores it in a motor vehicle are a “renewable” or “transportation” fuel.

Biogas is a fuel. Biogas can also meet the definition of “advanced biofuel.” Biogas- generated electricity does not, however, qualify as a “renewable fuel” in the RFS. A “renewable fuel” must “replace or reduce the quantity of fossil fuel present in a transportation fuel.” 42 U.S.C.

- 7545(o)(1)(L). The RFS program thus requires a physical reduction in the “volume” of “fossil fuel” that is “contain[ed]” in the regulated “transportation fuel.” 42 U.S.C. § 7545(o)(2)(A)(i). Biogas burned for electricity is not present “in” a “transportation fuel” actually “in motor vehicles, motor vehicle engines, nonroad vehicles, or nonroad engines.” Nor does such biogas reduce the physical “volume” of “fossil fuel” in such fuels. Such biogas might theoretically reduce the total, lifecycle GHGs associated with an entirely different kind of vehicle engine outside the scope of the RFS—i.e., EVs. But Congress did not authorize this in the RFS.

In fact, EPA apparently recognized that the RFS does not encompass biogas-generated electricity. While EPA purported to previously establish “a RIN-generating pathway for electricity made from biogas,” “EPA has not, to date registered any party to generate RINs from renewable electricity” on account of “policy and implementation questions that needed to be resolved prior to registering any party.” Indeed, those problems cannot be—and are not—resolved by the EPA’s proposed eRINs regulations. Biogas-generated electricity does not fall within the statutory scope of the RFS.

Nor can EPA avoid the obligation to comply with the statute by vaguely pointing to the 2010 rule and declaring that EPA is “not reopening the 2010 decision to allow for the generation of RINs for renewable electricity,” nor “reopening the lifecycle analysis for the 2014 promulgation of RIN-generating pathways for renewable electricity.” EPA’s current proposal is, in fact, “reopening” those decisions. EPA is now displacing and replacing the limits in regulations that EPA previously put on use of renewable electricity in the RFS program. The regulated industry and public relied on those limits—and the lack of any tangible indication that the pathway ever would or could be approved and used (as it was not)—when concluding that there was not injury in fact, fairly traceable, and redressable by an invalidation of these requirements. EPA cannot now avoid its obligations under the Clean Air Act and Administrative Procedures Act to engage in reasoned decision making by declaring EPA is not reopening a prior decision and revising regulatory requirements that EPA is, in fact, proposing to revisit and revise.

And having reopened that issue, EPA now has an obligation to assess the GHG lifecycle analysis for biogas-generated electricity for electric vehicles. That requires an assessment of “the aggregate quantity of greenhouse gas emissions (including direct emissions and significant indirect emissions such as significant emissions from land use changes), as determined by the Administrator, related to the full fuel lifecycle, including all stages of fuel and feedstock production and distribution, from feedstock generation or extraction through the distribution and delivery and use of the finished fuel to the ultimate consumer.” 42 U.S.C. § 7545(o)(1)(H). In the context of biogas-generated electricity for EVs, this statutory provision facially requires EPA to now assess, at a minimum—and produce for public review and comment—the “greenhouse gases…adjusted to account for their relative global warming potential” of: the feedstock production and distribution of the biogas itself, the combustion of that biogas for electricity, the transmission and distribution of that electricity to charging stations where used (including for efficiency losses over distance, the GHG emissions from the mining and transportation of critical minerals for use in batteries for such electric vehicles, and the need to construct new power generation, transmission and distribution infrastructure, including additional substations, feeders, circuits, conductors, trenching, and metering ). These emission estimates should also account for real-world additional power consumption and use by BEVs that are not accounted for in EPA’s existing BEV fuel economy testing requirements, which unlike the test for gasoline vehicles, ignores energy consumption during hot and cold weather, and rapid acceleration, and for greater charging losses when charging on equipment with different voltage and amperage than EPA’s laboratory test methods, as well as higher electric losses when charging batteries in a partial state-of-charge that is more representative of the real world than EPA’s methods. EPA should also account for energy consumed by EVs while idle, often referred to as “vampire drain” that provides functions such as heating or cooling the battery, operating surveillance cameras and other equipment. EPA’s failure to do so will otherwise produce arbitrary and capricious decision-making.

C. Motor Vehicle Manufacturers are not Eligible to Receive RFS Credits and, Even if They Were, EPA’s eRIN Generation Methodology is Fatally Flawed

EPA’s proposal to have automobile manufacturers receive RFS credits for contracting with biogas producers also runs afoul of the statute. And this certainly does not fall within the scope of any prior EPA decision relating to renewable-generated electricity. Congress included “biogas” within the scope of “advanced biofuels,” and so biogas may be within the scope of renewable fuels that can satisfy the nation’s annual “applicable volume of renewable fuel.” See 42 U.S.C. § 7545(o)(2)(B). But renewable fuels—including biogas—can only be used to generate credits if used in particular transportation fuels. Specifically, only a person that “refines, blends, or imports” renewable fuels for “gasoline,” “biodiesel,” or “home heating oil or jet fuel” is authorized to generate “credits” which can be used “for the purpose of complying with” the renewable volume obligation. 42 U.S.C. § 7545(o)(5)(A) & (E).

An auto manufacturer that has contracted for the production of electricity from biogas is not “refin[ing], blend[ing], or import[ing]” the biogas. Such an entity is also not doing so for use in “gasoline,” “biodiesel,” “home heating oil” or “jet fuel.” Moreover, EPA’s eRIN proposal cannot be fixed by shifting the eRIN credit to the biogas producer contracting with an OEM. Such an entity would similarly not be refining, blending, or importing the biogas into gasoline, biodiesel, home heating oil, or jet fuel. EPA all but concedes its lack of authority to supply OEMS with credits, stating “[t]he Clean Air Act, however, does not provide us with explicit authority, and we do not interpret the Clean Air Act’s silence in this case as allowing us to direct where eRIN revenue is used.” 87 Fed. Reg. 80,664.

There are also many problems with EPAs theoretical construct that electrons from the combustion of biogas can be traced to particular motor vehicles. The electric power grid(s) in the United States are vast and complex. The US power grid has three major interconnects: the Eastern Interconnect, the Western Interconnect and ERCOT. There are only very limited connections between these interconnects, only 1.3 GW between the Eastern and Western Interconnects, and just 800 MW between the Eastern and Texas Interconnects. With such limited capacity, even assuming that all transfer capacity is used by “renewable electricity,” there is not enough capacity to connect biogas electricity from one region to theoretical supply to EVs in another region. EPA’s proposal ignores this.

And EPA ignores that the demand for load is not static, but shifting over time, including from changes in the number and location of populations, changes in consumer and industrial demand for power, such that any contract to claim the on-paper renewable attributes or renewable energy credit associated with the supply of biogas electricity to the grid cannot match in space or time the use of the same amount of electricity at an electric vehicle charging station. With all of the competing and growing demands for electricity, any increase in biogas-based electricity contributing to the U.S. power grid is too minute and fractional to be assumed to reducing the proportion of fossil-fuel-generated electricity truly powering EV batteries from the grid(s).

EPA’s draft Regulatory Impact Analysis provides various estimates in Table 6.1.4.2.1-1 of “Domestic Biogas-Derived Electric Power Generation.” However, EPA appears to incorrectly include some combustion and incineration of municipal solid waste (MSW) that is not biogenic and not a gas. In any case, EPA’s data suggests, at best, that biogas-derived electric power generation is on the order of ~10,000 GWh/yr. EIA’s Electric Power Annual shows that U.S. power consumption was 3,805,874 GWh in 2021; therefore, in 2021, no more than ~0.26% of electricity supplied by regional power grids to all customers—residential, commercial, industrial, and transportation— was from biogas-derived electricity. EPA cannot show otherwise and cannot create on-paper contracts that do not comport with the physical reality of the power grid in order to create a credit and financial subsidy to OEMs for actions that did not take place. As DOE’s electric grid 101 tutorial explains, “[e]lectricity is the flow of electrical power or charge” and “[t]he electricity we use is neither renewable nor nonrenewable.” EPA’s proposal clearly conflicts with the reality of how the electric grid operates. It is physically impossible to demonstrate the claims that the EPA proposal allows. Moreover, allowing OEMs to make these claims is deceptive to consumers and the public.

Notwithstanding EPA’s lack of authority to award RINs to OEMs, EPA’s top-down eRIN generation methodology is replete with errors and inaccuracies. First, EPA places the OEM in charge of self-reporting a variety of data that will determine how many RINs they are awarded. Among the criteria that factor into EPA’s methodology are the “quantity of light-duty electric vehicles they manufactured (BEVs and PHEVs) which are legally registered in a state in the conterminous 48 states, and thereby part of the in-use fleet each quarter.” 87 Fed. Reg. 80,651. EPA then proposes to allow OEMs to “translate their fleet size and disposition data into a quantity of megawatt hours of electricity used by the fleet on a quarterly basis” by assuming “an average EV efficiency value of 0.32 kWh/mi and an “annual eVMT for BEVs of 7200 mi/yr”. EPA cites its own 2021 Automotive Trends Report as the source of its estimate of 0.32 kWh/mi. However, that report does not include such an estimate and does not even attempt to communicate “a representative average value for all electrified vehicles.”

Moreover, the estimates in the report of some specific BEV models consumption of kWh/mi are derived from EPA’s own, highly inaccurate laboratory testing of BEV fuel economy. Those testing procedures are vastly different than the much more rigorous fuel economy procedures required for gasoline and diesel vehicles. Therefore, EPA’s estimate is decidedly not representative of real-world operation and significantly underestimates the amount of electricity consumed by EVs during regular use. For example, EPA’s assumption are based on calculations of EV operation in ideal temperature conditions (about 70 degrees F) for EV batteries with no operation of any heating or cooling systems, including for the cabin or the battery. EPA’s estimates ignore that BEV efficiency can drop by 50 – 80% in cold weather and 20% or more in hot weather.

EPA’s assumptions are also based on testing conditions for voltage and amperage and state- of-charge conditions that are not representative of real-world charging. EPA’s test method also ignores “vampire drain” of the battery from BEV systems that continue operating even when the BEV is parked and idle. (See, “What is Tesla Phantom Drain or Vampire Drain?” Battery Manager (evspeedy.com); “Testing the Vampire Drain Problem & Other Tesla Folklore” (recurrentauto.com); Tesla’s Owners Website.) In short, EPA provides zero real-world data, across the entire fleet of existing BEVs, to justify an estimate of 0.32 kWh/mi. Similarly, EPA provides no actual data to support its proposal to allow OEMs to assume that BEVs travel 7,200 miles per year. EPA simply provides some mileage from what appears to be a very small sample of BEVs that were possibly collected by the “IHS VMT from Light Duty Vehicle Center Dataset,” but EPA’s supporting data and references are not provided and not clearly stated, respectively. EPA should release all of the data, for each vehicle, by location, by year and the actual VMT, to show how the Agency arrived at its estimate. As it stands, EPA has not been transparent with these estimates and thus it is impossible to determine if they are reasonable. Moreover, numerous studies have estimated that BEVs tend to be purchased as second or third vehicles for wealthy families and in urban areas and, therefore, are driven much fewer miles than gasoline vehicles. EPA’s non- transparent assumption gives no assurance of reasonableness. EPA must go back to the drawing board and cannot allow OEMs to self-certify their own invoices for RIN payments based on these inaccurate assumptions. Fortunately, none of these assumptions are relevant, because there is no basis for claiming that any BEV that recharges at a property served by the regional power grid is operating on a renewable transportation fuel.

D. Statutory Context Confirms That The eRINs Proposal Is Unlawful

The broader statutory context of the RFS generally, and EISA specifically, confirms that electricity generated from biogas for EV batteries does not qualify as “renewable fuel” for “transportation fuel.” Notably, all of the terminology and verbiage of the statute is geared toward and assumes that biomass-based renewable fuels will (and must) be used for directly reducing the volume of fossil fuel physically contained in existing transportation fuel. The statute speaks to “contain[ing] at least the applicable volume of renewable fuel.” The Congressionally-mandated volumes are stated “in billions of gallons.”

The RFS also requires that “transportation fuel” achieve “at least a 20 percent reduction in lifecycle greenhouse gas emissions compared to baseline lifecycle greenhouse gas emissions.” 42 U.S.C. § 7545(o)(2)(A)(i). “Baseline lifecycle greenhouse gas emissions” is then specifically defined as “for gasoline or diesel (whichever is being replaced by the renewable fuel) sold or distributed as transportation fuel in 2005.” 42 U.S.C. § 7545(o)(1)(C). This reflects Congressional intent for the RFS program to effect a physical change in the composition of those specific transportation fuels from a 2005 baseline. Neither electricity, a battery storing electricity for EVs, nor biogas used to generate such electricity does so.

In fact, other context in EISA clearly reflects Congress’s design of the current RFS program as solely for physically modifying existing liquid and gaseous transportation fuels, and not for electric vehicles. Congress expressly dealt with electric vehicles in an entirely different section of EISA, and used entirely different language and terminology to describe them. EISA § 206 directs EPA to “study” the “feasibility of issuing credits under the program established under section 211(o) of the Clean Air Act to electric vehicles powered by electricity produced from renewable energy sources.” This confirms that Clean Air Act Section 211(o) does not authorize such EPA action now. EISA § 206 was enacted in the same statute in which Congress modified the original renewable fuels program to produce the current program. In fact, Congress specifically differentiates between what it terms “renewable electricity to power electric vehicles” and its “renewable fuels mandate” in the same sentence. Congress’s simultaneous use of different terminology for electric vehicles, in the same statute, at the same time, confirms that the authority of EISA § 202 cannot be stretched to also encompass electric vehicles.

Notably, the “report” to Congress was to present alternatives for “a pilot program to determine the feasibility of using renewable electricity to power electric vehicles as an adjunct to a renewable fuels mandate.” EISA § 206 (c)(2)(A). Congress thus wished to assess for itself the alternatives for “identifying the source of electricity used to power electric vehicles,” id. § 206(c)(2)(C), as well as for “equating specific quantities of electricity to quantities of renewable fuel under section 211(o).” And Congress separately reserved all of this authority and oversight at the very same time—and in the very same statute—where Congress was nevertheless laying out the six factors for EPA to later consider for setting “applicable volumes” “after the calendar years specified in the tables.” Those six factors—and the statute more generally—thus cannot be warped as an implied delegation to EPA to now adopt an eRINs program incorporating “electricity used to power electric vehicles” that Congress chose not authorize in EISA. In short, Congress expressly set electric vehicles aside in EISA. And EPA is directed to “report” to Congress. Critically, EPA doesn’t even have the statutory authority to pilot an eRINs proposal at this time. EPA’s eRINs proposal must not be finalized.

E. EPA’s Proposal to Transform the RFS Program into A Subsidy for Electric Vehicles Raises Major Questions

Congress made entirely clear that Clean Air Act Section 211(o) created the renewable fuels program to physically change U.S. fossil-fuel-based transportation fuels to increase their biomass- based contents. And EISA section 206 reflects that putative renewable electricity for EVs would be addressed separately, with Congress itself to determine if, when, and how to incorporate renewable electricity. Regardless, EPA’s proposal to unilaterally modify the RFS program raises major questions. The EPA must point to a “clear statement” from Congress authorizing EPA to incorporate OEM-allocated eRINs into the RFS program. There is no such statement.

The major questions doctrine applies because EPA’s eRINs proposal is unilaterally redirecting or creating monetary subsidies for recipients chosen by EPA instead of Congress’s intended beneficiaries. The RFS is effectively a regressive tax—primarily on gasoline and diesel— that increases the cost of transportation, goods and services, especially for lower- and middle-income Americans. But rather than directly collect money for each gallon of transportation fuel sold (and then redistribute the funds by appropriations), the RFS operates by requiring obligated parties to physically refine or blend renewable fuels into their transportation fuels. That activity is tracked through RIN “credits.” Because renewable fuels are generally more costly by volume than fossil fuels, this regulatory requirement implicitly taxes such fuels—a tax which is primarily passed on to consumers in the form of higher prices.

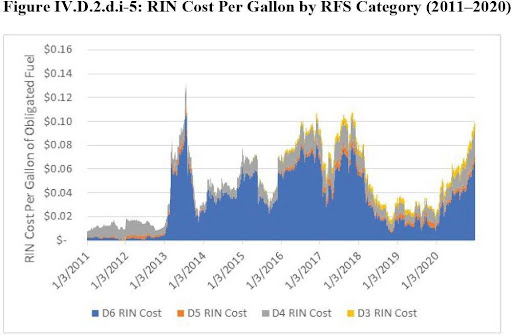

As EPA recently explained, “the RFS program imposes the same cost on all parties that produce (or import) gasoline or diesel fuel nationwide because the market price for all gasoline and diesel fuel increases to reflect this RIN price (RIN cost passthrough), much as it would increase in response to a new tax.” From there, ““The RFS program functions as a cross-subsidy, where RINs increase the market price of petroleum fuel (lines 2-3 and 4-3) and decrease the net price of renewable fuel (lines 2-5 and 4-6).” Thus, under Congress’s design, the revenues from the effective “tax” is subsidizing biomass-based supplements for gasoline, diesel, aviation, and home heating oil. EPA calculated this tax as approximately $0.10 per gallon in late 2020, with prices at the end of 2021 for most RIN categories then pushing to “50–100% greater than RIN prices at the end of 2020 (see Figure IV.D.2.d.i-5).”

Through its eRINs proposal, EPA is nevertheless arrogating the authority to redirect or add to the revenues of Congress’s implied tax to then subsidize an entirely different industry. That is incredible. By recognizing eRIN credits in manufacturers of EVs, EPA will steer subsidies away from the producers of biofuels and the farmers, foresters, and other agricultural interests who provide the biomass that goes into such liquid- and gaseous-based fuels. Subsidies from the implied tax on gasoline will instead flow to automakers—some of the largest, most profitable companies in the world. And these are companies that Congress itself has recently decided whether, how, and how much to subsidize in the Infrastructure Investment and Jobs Act of 2021 and Inflation Reduction Act of 2022. EPA does not have the statutory authority to use the RFS to direct even more subsidy to them.

Moreover, these subsidies to automakers will do nothing to achieve Congress’s primary requirement and directive to EPA for the RFS program. EPA is to “ensure that transportation fuel sold or introduced into commerce in the United States … contains at least the applicable volume of renewable fuel.” 42 U.S.C. § 7545(o)(2)(A)(i)(emphasis added). The eRINs would instead use the implied tax on gasoline to change one source of power for the nation’s electrical grid. EPA’s proposal to redirect monies from Congress’s intended subsidy beneficiaries to another industry is plainly a question of “vast ‘economic and political significance.’” And there is no clear statement from Congress authorizing the eRINs proposal. Rather, the text of the statute clearly does not permit them. EPA’s proposed eRINs program is unlawful and must not be finalized.

_______