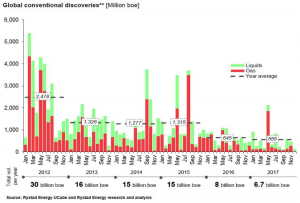

Global discoveries of new conventional oil and gas in 2017 totaled only 7 billion barrels of oil equivalence—a level last seen in the 1940s. (See chart below.) According to Rystad Energy, not only did the 2017 total volume of discovered resources decrease, but the resources per field also declined. In 2017, average offshore discoveries held 100 million barrels—down from 150 million barrels in 2012. The reserves replacement ratio reached just 11 percent for oil and natural gas in 2017—the eleventh straight year it was below 100 percent. The last time the reserve replacement ratio reached 100 percent was in 2006. Since 2014, exploration expenditures fell over 60 percent most likely due to low oil prices. Further, the world consumes 79 percent more hydrocarbons than it discovers. The Trump administration’s plan to open up most U.S. offshore areas to oil and gas drilling, however, could help boost investment in the sector by billions of dollars and open up access to billions of barrels of oil.

Source: Oil & Gas Journal

Trump’s Offshore Leasing Plan Could Increase Discoveries

Low discovered volumes of oil can be an indicator of coming supply shortages and resulting price increases—10 years or more in the future. For this reason, the Trump administration is opening the majority of the U.S. Outer Continental Shelf (OCS) to leasing in the 2019 to 2024 time period with over 40 lease sales planned in the Department of the Interior’s proposal.

According to Rystad Energy, the U.S. offshore sector held approximately 180 billion barrels of oil-equivalent oil and gas combined, before the first offshore production took place. In the Gulf of Mexico, which is the world’s most mature offshore region, nearly 50 percent of these original resources have been translated into production since the 1960s. The remaining 50 percent, or 90 billion barrels of oil equivalent, have yet to be discovered in the OCS. Out of the 90 billion barrels, Rystad Energy estimates a possible discovery of about 65 billion barrels of oil equivalent. That figure excludes resource potential from western and central areas of the Gulf of Mexico, but includes the eastern part of that region, which is currently under statutory moratorium until the end of June 2022.

Source: Rystad Energy

The Trump administration’s proposed policy has the potential to attract billions of dollars of investment. If operators use the full potential of the offshore areas, exploration activity could reach a new peak after 2030, with as many as 200 exploration wells drilled per year on average, implying annual investment levels of about $15 billion. According to Rystad, this is a “high-case scenario,” assuming all of the unexplored areas undergo exploration activity, regardless of capital constraints, infrastructure issues, or environmental concerns.

However, during the last three years, there was little interest in exploration in the deep-water Gulf of Mexico. Instead, exploration and production spending was in U.S. shale basins, with U.S. companies directing over 60 percent of their total investments to shale. That percentage could increase to 70 percent in the coming decade. If this occurs, it could impose a risk to offshore exploration.

Conclusion

The U.S. is currently benefiting from an abundance of oil and gas due to investments in shale deposits and technology used largely on non-federal lands. When oil prices are low, it is easy for people to forget that benefits such as lower gasoline and heating costs and increased investment and new jobs come as a result of longterm due diligence on behalf of the private sector. Indeed, some policymakers cite today’s prices to argue that we need not plan for new exploration.

However, it takes eight or more years to develop an offshore oil or gas field after leasing and permitting is approved for production to begin. It can take significantly longer in those areas without existing infrastructure. It also requires a large amount of investment. Due to the enormous cost, Congress provided the industry with incentives to develop the first deep-water offshore fields in the 1990s. While oil supplies are currently abundant as evinced by moderate prices, the supply could be diminished in the next 10 or 15 years. Policymakers should be aware of the recent history of conventional oil discoveries worldwide. Having a life line to other supplies is important to energy security and the future supply needs of the world.