Liquid helium, an inert gas extracted from natural gas harvesting, has several properties that are leveraged in the semiconductor manufacturing process. Because helium is an “inert” gas, it does not react with other elements, which makes it ideal for manufacturing semiconductors. Chemical reactions that take place during the processing of semiconductors are generally gas- or liquid-based, so using inert gas around the silicon prevents unwanted reactions. Also, because helium has a high thermal conductivity, it conducts heat away effectively, which helps to control the temperature of the silicon during the manufacturing process and makes miniaturization of the semiconductors possible.

Semiconductors are increasingly present in nearly every application that can be imagined. For example, semiconductor-based electric vehicle components represent 35 percent of vehicle-manufacturing costs, and by 2030 they could represent half of the manufacturing cost as other components become more affordable. In the United States, the largest use of helium (30 percent) is for health care, mainly magnetic resonance imaging (MRI), analytical and laboratory applications (17 percent), and engineering and scientific applications (6 percent).

Without oil and gas production from which helium production is a secondary product, today’s modern semiconductor manufacturing would not be possible. Intel’s factories would not be able to operate without helium recovered from oil and gas operations and the processing of natural gas. Despite that, some have called for the end to oil and gas leasing on federal lands, controlled by the Department of Interior.

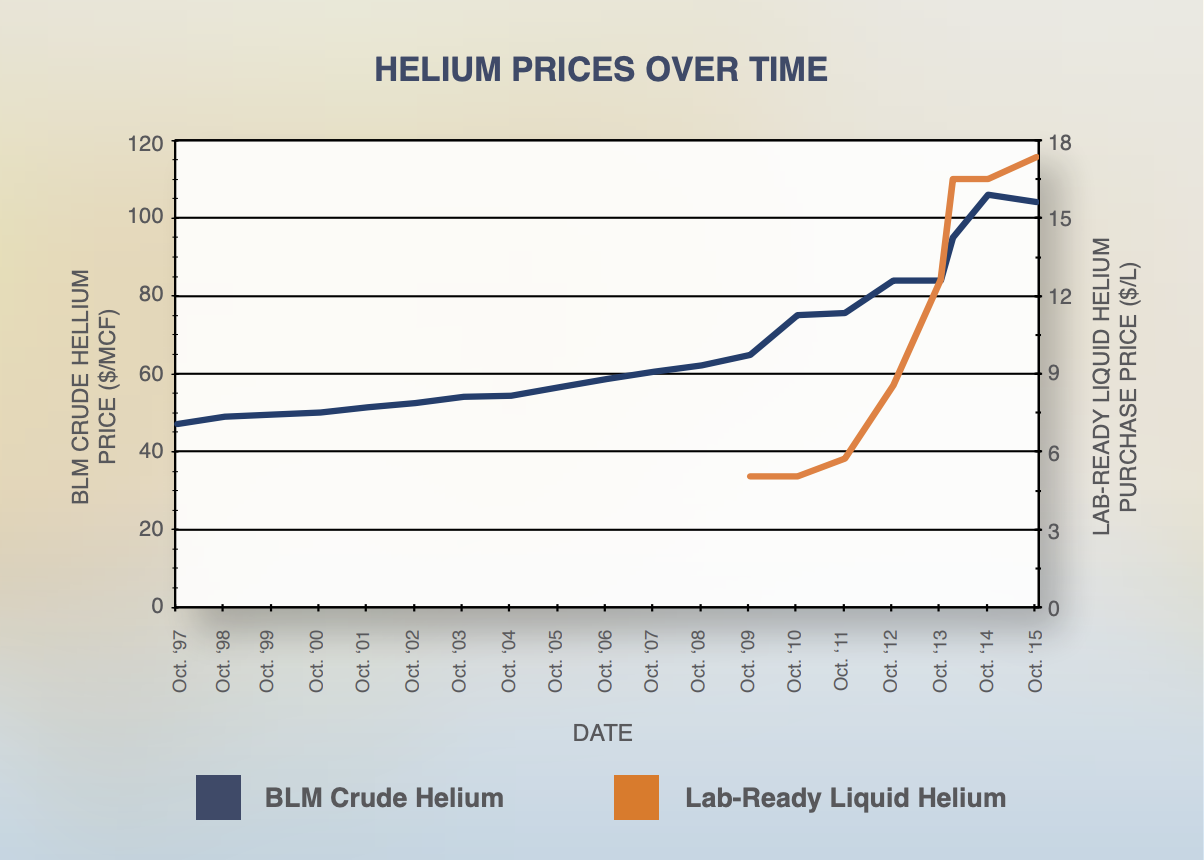

Because of the cooling required to liquefy gaseous helium, its limited availability, the difficult process to separate helium from natural gas, and its storage requirements, it can be expensive. In fact, the cost of helium increased more than 250 percent in the first 5 years of the last decade. As a result and also because of its uses by NASA, helium is on the Department of the Interior’s list of elements critical to national security.

Helium Is Not Renewable

Oil and gas companies harvest helium trapped deep beneath the earth’s surface in natural gas chambers. Over millions of years, radioactive decay causes uranium rock to disperse helium into these chambers. Most of the known helium reserves were discovered by accident.

Shortages of helium have occurred because it cannot be made quickly. While it is the second-most abundant element in the universe (behind hydrogen) and the sun produces about 600 million metric tons each second, the earth’s supply is limited. And once used, the lightweight element escapes into the atmosphere.

The United States has been the largest producer of helium since 1925. Historically most U.S. helium production has come from underground gas fields in the area between Amarillo, Texas and Hugoton, Kansas, fields which have a high concentration of helium. The Federal Helium Reserve system, created in the 1960’s, was established near these fields to store crude helium for later processing. This system stores about a third of the world’s helium in crude form in the Cliffside gas field. The porous underground rock spanning portions of Texas, Oklahoma and Kansas holds the gas, which is capped above by calcium anhydrite and on the sides by water. Some speculate that U.S. Federal Helium Reserve may only be able to produce helium until 2025.

Luckily, the United States has other helium resources. Exxon Mobil’s Shute Creek in Wyoming is expected to produce helium and natural gas for an additional 50 or more years, unless government policies targeting oil and gas shut it down. Shute Creek produces about 20 percent of the world’s helium supply.

Liquid helium can be expensive and different factors influence its price. One of the factors is the high price of its liquefaction since helium must be cooled to -269 °C. The large amount of energy to accomplish this is expensive. Other factors include the cost of separating the helium from the natural gas and storing the helium, which are time-consuming and difficult processes. In 2019, a store owner in the UK indicated that the cost of the helium had risen three times in that year—between 8 percent and 10 percent each time. The price of helium varies around the world, depending on location within the supply chain and whether it is in liquid or gaseous form.

Countries That Produce Helium

Besides the United States, other countries with helium reserves include Qatar, Algeria and Russia. New and expanded liquefied natural gas plants that produce helium as a by-product are expected to begin operation in Qatar and Algeria this year. By the middle of 2021, Russia’s Gazprom is expected to start up its new Amur natural gas processing and helium production facility in Siberia and become a major exporter. The company will export canisters of cryogenically cooled liquid helium from the Pacific Ocean port of Vladivostok, which is well positioned to supply China and the technology industry on the U.S. West Coast.

In September 2020, Gazprom’s Siberian helium facility was more than 60 percent complete. When it opens, it will be the largest helium plant in the world. After ramping up to full production in the middle of this decade, Russia expects to produce 25 to 30 percent of all helium consumed worldwide. Its reserves are vast. Gazprom has the ability to reserve extracted helium by injecting it back into the natural gas fields in Siberia—essentially taking its helium off the market—which is a reason for concern about future price manipulation.

Production levels of the countries producing helium in 2019 are noted in the graph below.

Will the U.S. Become a Net Importer of Helium?

Once the Federal Helium Reserve is out of business in the mid-2020’s, the United States will become much more susceptible to foreign supply interruptions and foreign price manipulation and most likely be beholden to Russia for helium imports. This is akin to China’s manipulation of the rare earth mineral market that they commandeered after environmental regulatory costs made it uneconomic for the United States to remain the major producer of rare earth minerals.

The federal government needs to be cautious in its future decision-making regarding helium or its fate will be the same as with rare earth minerals. Because future new helium supplies will most likely come from the development of federal lands in the West and if Biden’s plan to ban permitting of oil and gas on federal lands is implemented, the United States will become dependent on Russia and a few other nations for its helium supplies. As helium is designated a critical mineral by the federal government, the U.S. Congress and future administrations need to be aware of its importance to American well-being and plan accordingly. Similar to China’s production and processing of rare earth minerals, Qatar and Russia will not worry about environmental correctness as they strive to dominate world helium production and supply.

Conclusion

There is no replacement for liquid helium. Helium is unique among all elements for its ability to reach ultra-cold temperatures. The United States is currently the leading producer of helium, but other countries are developing processing plants to increase their production. Russia is developing a facility in Siberia and is looking to become the world’s major supplier of helium by mid-century. As a result of price increases and its limited availability, helium is on the U.S. Department of the Interior’s list of elements critical to national security. Efforts to stop oil and gas production in the United States will strain the nation’s ability to meet the need for this critical element used in the manufacturing of semiconductors.