- Fatih Birol, the head of the International Energy Agency, in a recent op-ed, indicated that oil, natural gas, and coal demand will “peak” by the end of the decade.

- Other modelers and OPEC do not agree with Birol’s assertion.

- Current data show growing global demand for all 3 sources as developing countries consume more coal, oil and gas as they seek to achieve the wealth of OECD nations.

Fatih Birol, the head of the International Energy Agency (IEA), in an op-ed published on September 12, 2023, declared that the world will reach peak fossil fuel demand by the end of the decade. According to Birol,

“Peaks for the three fossil fuels are a welcome sight, showing that the shift to cleaner and more secure energy systems is speeding up and that efforts to avoid the worst effects of climate change are making headway.”

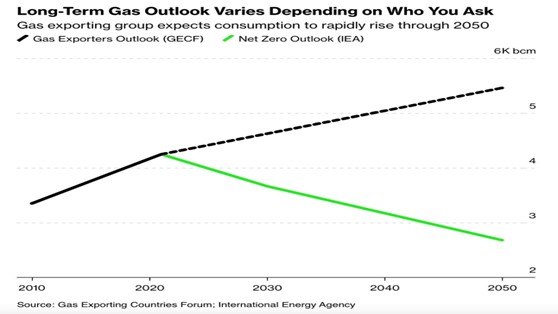

Birol claims that cheap solar panels, electric vehicles, and shifts in the Chinese economy–away from energy-intensive heavy industries–along with Europe’s hastened transition away from natural gas after Russia’s invasion of Ukraine will make his propaganda come true. Fossil fuel companies, however, disagree and they are investing in the long run. Birol’s IEA Outlook for natural gas, for example, is vastly different than the outlook of the natural gas exporters, as the graph below depicts. They expect the transition to a green energy future to require much more natural gas. As investing,com indicates, “…[the] track record on these types of predictions has been flat-out wrong and misleading. It has also led to a diversion of capital that has left us trillions of dollars short of the fossil fuel investments that we desperately need.”

Nevertheless, from Shell Plc to Chevron Corp., the world’s top producers plan to accelerate investments in natural gas, as Bloomberg reported. China keeps signing deals to buy liquefied natural gas past 2050, with European importers not far behind. And, the United States is forging ahead with new projects that will make it the world’s top LNG exporter for the foreseeable future.

Further, coal is not losing its dominance of the electricity market. Despite the increases in non-hydroelectric renewables, coal’s global share of the electricity market in 2022 was 35.4 percent, compared to 35.8 percent in 2021. China and India are both continuing to increase coal capacity in their electric generation programs that are growing at a fast pace. With the trillions of dollars being invested in non-hydroelectric renewables, mainly solar and wind, along with their heavy government subsidization, those fuels increased their market share in the global electricity generation sector from just 12.8 percent in 2021 to 14.4 percent in 2022.

Despite governments announcing bans on internal combustion vehicles in favor of electric vehicles, the reality of such a change in the next decade or so is wishful thinking as no electric grid is capable of replacing all their fossil fuel consumption with politically correct renewable energy or be ready to handle the doubling of demand from electric vehicles with renewable energy generators in that time frame. Gasoline and diesel will still be required to keep economies moving and their demand is increasing.

IEA Forecast

The International Energy Agency (IEA) projects that fossil fuel consumption will peak before 2030 and fall into permanent decline as climate policies take effect. The IEA’s energy outlook report, due to be published next month, is expected to show that oil, gas and coal are on course to hit a peak this decade under existing climate policies, earlier than many have anticipated.

Birol at the IEA has also taken to social media to make the case that the cost of implementing clean energy policies is steadily decreasing, posting a price index for clean energy equipment showing a nearly 60 percent decline over the last ten years. The price index, however, shows a plateauing of price since about 2019. It is also interesting to note that the cost increases that offshore wind and other renewable developers have asked for in their price agreement negotiations are not showing up in the price index, as evidenced by these numbers cited for New York. On top of that, Birol’s agency has shown that the investments for developing the critical minerals for the “green” transition he applauds will need to be enormous, if they are possible at all. Price increases for the minerals will be required to fund massive new mines and processing facilities.

OPEC Disagrees with Birol’s Energy Forecast

OPEC notes that consistent and data-based forecasts do not support Birol’s assertion and OPEC stated that such a development would lead to global economic and social chaos. In a statement released by OPEC, its Secretary-General H.E. Haitham Al Ghais took issue with the IEA’s assessment, saying such a drastic cut to hydrocarbons fuels “would lead to energy chaos on a potentially unprecedented scale, with dire consequences for economies and billions of people across the world.” The statement called the IEA’s agenda to phase out fossil fuels “extremely risky and impractical” and noted that although peaking of supply or demand had been predicted before, recently, such “dangerous” predictions are being packaged with efforts to stop investing in new oil and gas ventures. In the statement, OPEC accused the IEA of being “ideologically driven, rather than fact-based.”

OPEC also indicated that many populations are experiencing buyer’s remorse after dealing with the real-world impact of implementing renewable energy policies like net-zero carbon emissions. … “[W]e have seen energy issues climb back to the top of the agenda for populations as many glimpse how experimental net zero policies and targets impact their lives. They have legitimate concerns. How much will they cost in their current form? What benefits will they bring? Will they work as hyped? Are there other options to help reduce emissions? And what will happen if these forecasts, policies and targets do not materialize?” the statement read. This OPEC statement deviates significantly from most of its pronouncements in both its bluntness and tone.

Exxon’s Forecast to 2050

Exxon expects natural gas to increase its market share through 2050, the end of the forecast period, reaching almost 30 percent of all energy demand. Oil demand is expected to decline slightly by 2050, but it is still expected to play a dominant role, with growing demand in commercial transportation and in feedstocks for the chemicals industry. Coal use is expected to remain significant in parts of the developing world, but its global share is expected to drop below 15 percent by 2050 as China and developed nations are expected to shift toward lower-emission sources like renewables, nuclear and natural gas. Renewables and nuclear both are expected to see growth, contributing around 70 percent of incremental energy supplies to meet demand growth. (See figure below.)

Conclusion

The IEA continues its propaganda against fossil fuels driven by wishful thinking and determination to ignore economic, scientific, and engineering realities. Because fossil fuels are overwhelmingly the most efficient forms of energy available now or in the future, market forces alone will not result in a massive shift away from them toward uncompetitive and unreliable forms of energy such as wind and solar power. The small shift in market share that is occurring is due to large government subsidies and other policy-driven interventions. Any major market shift would need to take place over decades as part of the long-term process of capital depreciation, investment, and changes in resource allocation. To obtain large reductions in emissions would require large reductions in the consumption of fossil fuels and correspondingly large increases in energy costs, which would affect the price and availability of all things that sustain human life. Consumers are already seeing increases in energy cost even with small shifts in what is supposedly “free” renewable energy. The IEA is an increasingly political, rather than data-driven agency seeking to tell its bosses in the OECD what they wish to hear through its models.