With its detailed blueprint for global dominance, authoritarian China threatens to become a world superpower. An aspect of its plan is to exercise control over the supply chain of critical materials and rare earths. China already dominates the supply chain for most of the key future industries—electric vehicles (dependent on lithium-ion batteries and key materials cobalt, nickel, manganese, graphite, lithium, and rare earths), green energy such as solar panels and wind turbines (dependent on rare earths), and portable electronic devices (dependent on batteries and rare earths). Many of the rare earths are also critical to the military and aerospace industries.

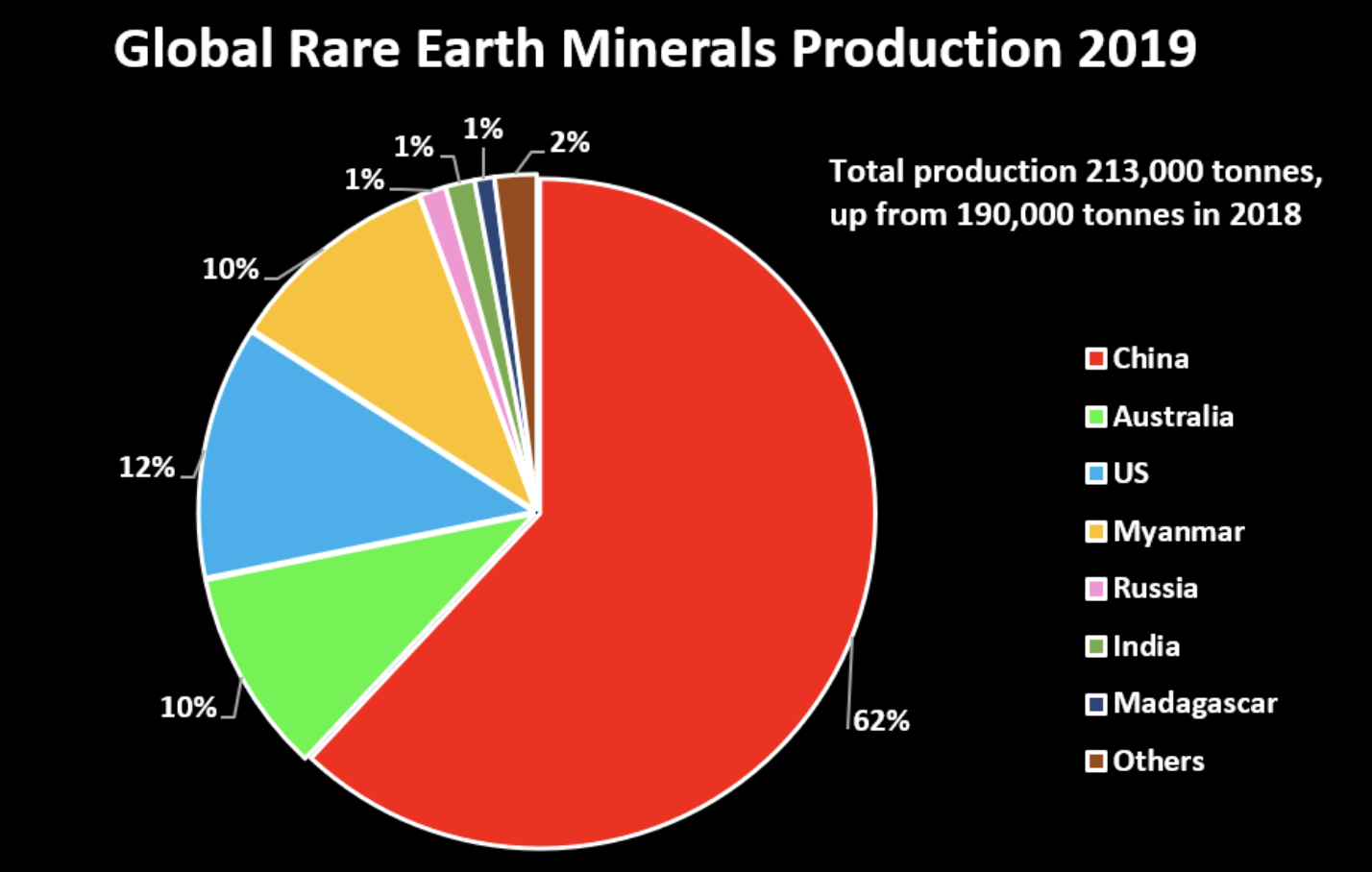

China already has 80 to 90 percent of the global rare earth market. Further, over 70 percent of all mined cobalt needed in the electric vehicle industry comes from the Democratic Republic of the Congo, and most of that cobalt is controlled by China. That means massive U.S. policies to “go green” with renewable energy sources and electric vehicles are in fact, “going red,” as in handing over power to the Chinese Communist Party. An energy policy based upon principles of the Green New Deal is a policy of guaranteeing overwhelming dependence for our energy on China. China’s control over these energy sources is much greater than the control OPEC ever exercised over world oil production.

The gradual closure of Western factories and en masse job transfer from West to East has been occurring for decades. The recent U.S.-China trade war and the coronavirus pandemic have made the Western world realize that it has a heavy reliance on China’s supply chain. The U.S. Senate has discussed restoring the U.S. supply chain of critical materials and rare earths, but it is moving very slowly. Senator Ted Cruz has proposed a bill to provide funding to both rare earth production projects and massive tax breaks for companies using U.S.-made magnets. Recently, Senate Republicans have issued proposed legislation to provide COVID-19 relief, the Health, Economic Assistance, Liability Protection, and Schools (HEALS) Act, which includes provisions to fund research and development for rare earth element extraction. The Trump Administration’s Department of Defense has recently committed the funding for two rare earth separation plants in the United States.

However, by 2029, it is expected that the United States will have only 3 lithium-ion battery mega-factories compared to China’s 88—of a total of 115 lithium-ion battery mega-factories planned. Europe is making a more concerted effort to build up their battery supply chain and by 2029, will have 17 percent compared to China’s 69 percent and North America’s 8 percent.

Rare Earths

Rare earths are a group of 17 metallic elements that are embedded in most high-tech products, including wind, solar, and electric vehicle technology. Despite their name, rare earths are relatively abundant. However, the process of separating them into commercially viable products poses technical and environmental challenges. China’s market dominance enables it to control prices and put pressure on challengers that threaten its ‘Made in China 2025’ strategy to create a vertically integrated supply chain encompassing mining, magnets, and high-tech manufacturing. To break China’s supply chain of rare earths requires a mix of direct government support, alliances with other countries, and a long-term focus on the six-stage process chain from ore to rare earth magnet.

The United States reopened its Mountain Pass rare earths mine in California, which went bankrupt in 2017. The mine produced 26,000 metric tons of light rare earth oxide in concentrate form in 2019 and accounted for 12 percent of global production, according to the U.S. Geologic Survey. This helped reduce China’s dominance of the first-stage of the global rare earths chain as did a displacement of heavy rare earths mining from China to Myanmar, which produced 22,000 metric tons of concentrate in 2019. However, China’s control of global processing capacity is almost total, with the exception of Australia’s Lynas Corporation, which operates a separation plant in Malaysia.

The rare earth ore that the United States currently mines at Mountain Pass gets shipped to China to be upgraded into compounds and products which are then shipped back to the United States. MP Materials, who mines Mountain Pass, is one of the three companies chosen to receive direct government funding for a separation plant. However, that is only after a review of its Chinese shareholder, Shenghe Resources, is completed. Australia’s Lynas is teaming with Texas-based Blue Line on a heavy rare earths separation plant. But, once the oxide is generated at the separation plants, they may still have to go to China for further processing.

The United States currently has virtually no capacity to produce neodymium-iron-boron magnets—the most common end-use application for rare earths and one that is set for major growth as electric vehicles increase their market share. Rare earth magnets are also key inputs to many other applications from wind turbines to the F-35 fighter jets. General Motors had one of the two original patents for the magnets but sold the rights to China. Japan’s Sumitomo sold the other patent to Hitachi, which is now the primary supplier outside of China.

To build the full mine-to-magnet chain will require customer and government support. In 2017, Mountain Pass closed and the United States exited the rare earths business because of China’s competitive prices, opposition from environmentalists, and U.S. environmental regulations escalating the cost of production. Car companies, of course, would choose lower-priced Chinese magnets over those produced by higher-priced Western companies. Lynas’ project in Australia only succeeded due to the support of the Japanese government, which extended loans and lowered interest rates during the start-up phase. Generating profits from rare earths has proved elusive for non-Chinese companies and low prices make the funding of new projects difficult to justify.

China Can Use Rare Earths to Retaliate

China indicated recently that it would impose sanctions on Lockheed Martin in retaliation for a U.S. decision to sell missiles to Taiwan. China could “cut off material supply including rare earths, which are crucial to advanced weapons production.” That would mark the latest phase in the weaponization of rare earths.

Analysts say a move to restrict rare earths supplies to Lockheed, the largest arms manufacturer in the United States, could intensify a U.S. push towards a technological decoupling with China and booster efforts to create a non-Chinese supply chain in a global industry worth up to $5 billion a year. As mentioned above, steps are underway in the United States, Australia, and the European Union to bolster the security of supply of rare earths.

In November, Australia signed an agreement with the United States, which mandated both nations’ geological agencies to work together to assess the potential for new supply. Australia has a sixth of the world’s rare earths deposits and is home to Lynas Corp, the only large non-Chinese rare earths producer. Australia identified 15 rare earth and critical minerals projects hoping to attract commercial funding and is offering state-backed loans to help develop them.

Conclusion

Put simply—“Control the supply chain, control the world”—is what China’s 2025 strategy is all about. China is way ahead of the game and only with governmental commitment and alliances with friendly nations can the United States come out of the hole past policies created. The West needs to move rapidly to regain control of its industrial future; green energy policies that foster an overwhelming dependence on China threaten it.