While Democratic Party presidential candidate Joe Biden is touting his $2 trillion climate plan as a way to stimulate the U.S. economy from the lockdown caused by the coronavirus, China is building coal-fired plants and is using record amounts of diesel in its construction program. China is currently planning to build over 200 gigawatts of coal-fired generating capacity—almost the same amount of coal-fired capacity that the United States currently has in its generating fleet. Once built, China will have more coal-fired capacity than the entire generating fleet in the United States considering all power sources.

Since 2000, China’s coal fleet has grown five-fold and now totals 1,040 gigawatts—nearly half the global total or about 5 times as large as the coal fleet in the United States. China is one of 80 countries in the world using coal power—up from 66 in 2000. Coal generated 36 percent of the world’s electricity in 2019, close to its highest share in decades and a greater share than any other generating fuel. China, however, almost doubled that share, generating 65 percent of its electricity from coal in 2019, using a very young coal fleet with generators averaging 14 years of age and capable of operating for 40 years or more.

China is investing heavily in the country’s infrastructure, building power plants, new roads, railway lines, and sewage systems and manufacturing the equipment necessary for those projects. These large investments helped make China the first major economy to see its economy rebound after the coronavirus outbreak, with output increasing 3.2 percent from April through June compared to the same period last year.

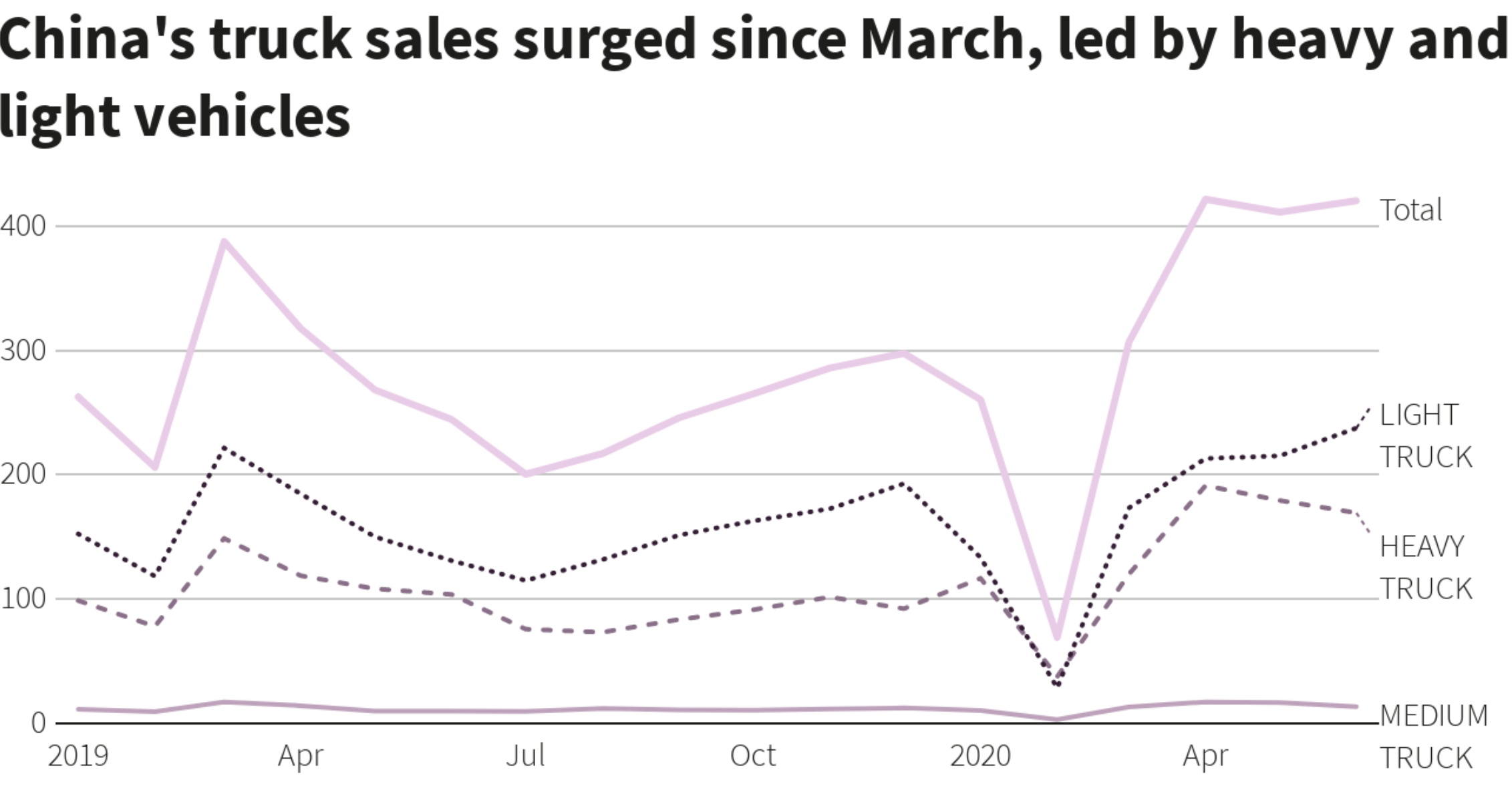

Truck sales in China—the world’s largest freight market—are expected to hit a record of 3.76 million vehicles in 2020, up by 18 percent from 2019. Heavy-duty truck sales are expected to top 1.4 million units this year, following growth of over 50 percent each month between April and June.

Booming online shopping during the lockdown resulted in an increase in express deliveries. In June, China’s deliveries hit a record 7.47 billion, or nearly 3,000 deliveries every second. As a result, sales of light trucks, which are widely used for deliveries and moving construction materials, are estimated to increase 18 percent this year.

Diesel Demand

China’s construction and delivery boom is expected to result in diesel demand reaching a record this year powered by trucking activity. Diesel accounts for about 30 percent of China’s oil demand and is expected to increase by about 2 percent in 2020, which translates into a 60,000 to 90,000 barrel-per-day increase in total diesel consumption, reaching a record of 3.8 to 4.1 million barrels per day. The rebound began in March/April, shortly after China began to reopen its economy from the coronavirus lockdown. Diesel’s boom is a result of government stimulus spending on infrastructure, robust mining activities, and an e-commerce boom.

China’s Refinery Production

China’s refinery output increased 12 percent in July from the same month a year earlier, hitting the highest on record for any single month, as several major state plants resumed operations after maintenance overhauls. Two of Sinopec Corp’s top plants—Zhenhai and Tianjin—and PetroChina’s Dalian plant resumed production after being off-line for several months. China processed 59.56 million metric tons of crude oil in July—about 14.03 million barrels per day. Refinery throughput for the first seven months of this year totaled 378.65 million metric tons, or about 12.98 million barrels per day—an increase of 2.3 percent from the same period a year ago.

Oil and Natural Gas Production

China’s domestic crude oil production increased 0.6 percent in July compared with the same month a year ago to 16.46 million metric tons—about 3.88 million barrels per day. Production for the first 7 months of this year totaled 113.5 million metric tons—1.4 percent higher than the same period last year.

Natural gas production increased 4.8 percent in July from a year earlier reaching 14.2 billion cubic meters, and production for the first seven months of this year increased 9.5 percent to 108.3 billion cubic meters.

China Continues to Import Crude Oil

Not only is China producing more domestic oil, but it is also importing oil. China is the world’s biggest oil importer, and it continues to import despite its storage tanks being filled to capacity. According to brokers, at least 80 ships have been waiting for more than a month to unload their cargo in northern Chinese ports where congestion is the most severe. Over half of the vessels are very large crude carriers, which can move up to two million barrels each in a single sailing.

As demand for oil has declined during the coronavirus pandemic, freight rates have declined from an average $129,000 a day in March and $176,000 in April to about $15,400 on the benchmark Middle East-to-China route, which is at least $12,000 below average break-even levels for such ships. China is capitalizing on the lower rates by moving as much as possible at COVID-induced bargain-basement rates.

Conclusion

China’s economic approach in the wake of the coronavirus differs significantly from Joe Biden’s $2 trillion climate plan to reduce fossil energy use. China is increasing fossil energy use—building coal-fired power plants, increasing its oil and natural gas production and refinery output, and importing crude oil. Given that coal plants can easily last half a century or more, with a fleet of over 1,000 gigawatts in coal, it does not look like China is taking action toward its commitment to the Paris Agreement any time soon. Rather, it is helping its economy recover by using fossil energy—the fuel that has fired the furnaces of progress since the dawn of the Industrial Revolution.