China is surpassing the United States this year as the world’s largest refiner as government climate goals and regulation cause U.S. refiners to close facilities. China is expected to have 18.81 million barrels per day of refining capacity while the United States has 17.7 million barrels per day of operating refinery capacity and about 0.4 million barrels per day of idled capacity. While additional refinery closures are expected in the United States, China is expected to add capacity, capping the country’s primary refining capacity at 20 million barrels per day by 2025 and boosting utilization rates of its refining facilities to above 80 percent. Refining is the manufacturing of petroleum products from raw materials, producing gasoline, diesel and aviation fuel that Americans need and adding value, wealth and jobs via the processing.

Due to growing domestic demand, U.S. operating refineries are running all out with utilization rates averaging above 90 percent. But refined stockpiles are low, indicating a shortage that could result in rationing, particularly for diesel fuel on the East Coast. President Biden recently wrote a letter to energy executives, acknowledging a global refining capacity shortage, and asking for their help. He directed industry, “to work with my aAdministration to bring forward concrete, near-term solutions that address the crisis.” According to Biden, about 3.0 million barrels per day of global refining capacity has shuttered since the beginning of the COVID pandemic, 801,000 barrels per day in the United States.

In late May, Biden searched for spare refining capacity, but apparently found little to none. In his letter, he told refiners that “unprecedented” profit margins are unacceptable and called for “immediate action” to improve capacity as the price of gasoline keeps increasing, feeding record inflation and fears of a recession. Biden called on companies to provide an explanation of why they have cut capacity and what could be done to address gas prices that average more than $5 per gallon nationwide. Apparently, oil and gas companies and their investors have listened to policymakers’ calls for less investment in fossil fuels and have heeded those calls. For example, Shell operated 54 oil refineries in 2004, but cut the figure to 8 refineries to reduce the company’s climate footprint. By 2025, the company plans to operate 5 refineries.

While there is almost no ability for the U.S. refining industry to grow capacity domestically, significant spare capacity exists in China and Russia. As western energy companies cut capacity to meet politicians’ promised climate goals, China expanded its capacity as noted above. In 2016, China allowed independent oil refineries to export oil products for the first time, and the government was happy to meet the world’s demand for gasoline and diesel. But, in mid-2021, China cut petroleum product exports by more than half. Despite margins increasing and domestic demand falling as China is in continual lockdowns due to a zero-COVID policy, the country continues to export less gasoline and diesel, stockpiling the fuels instead.

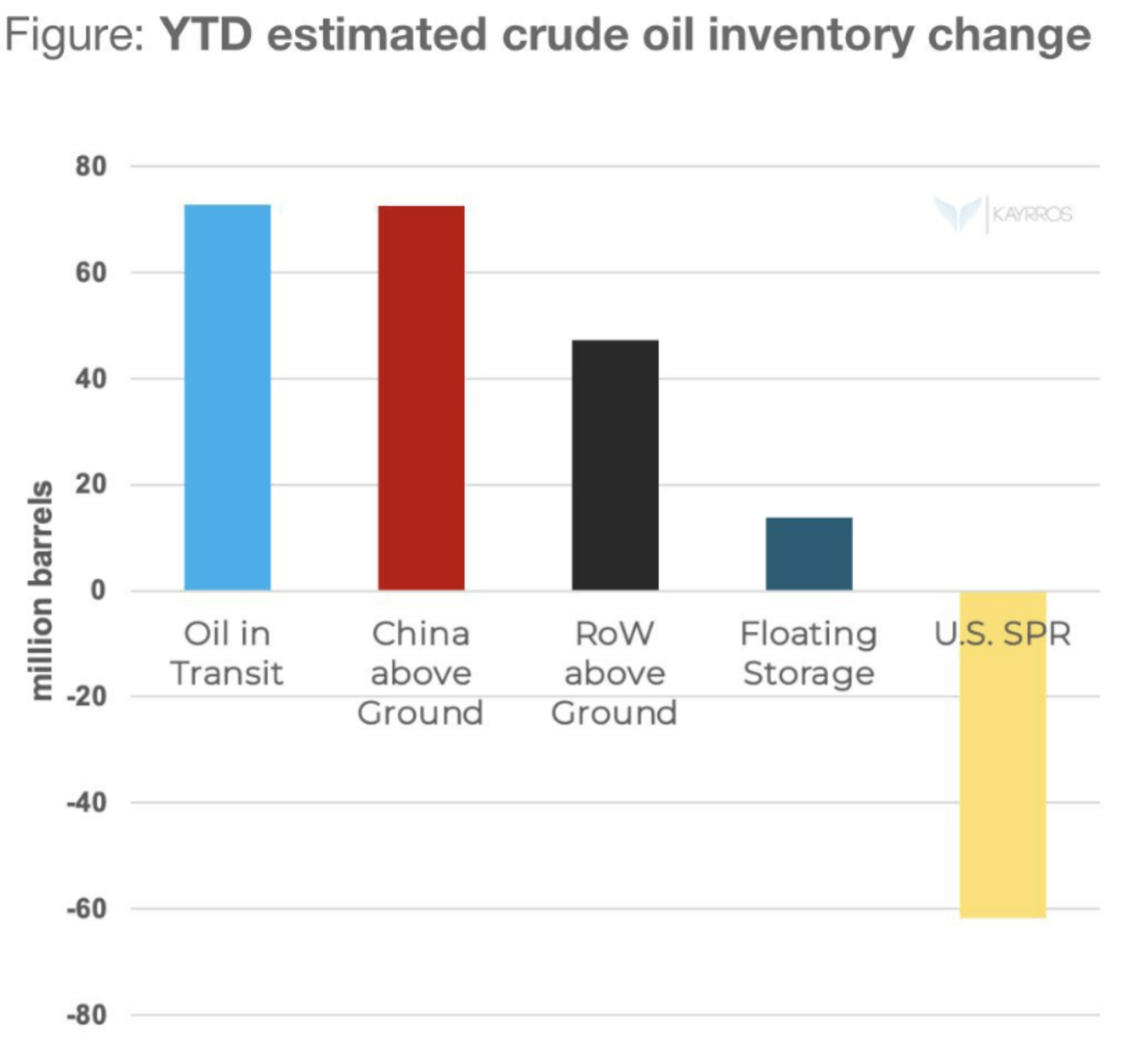

China has also refused to play Biden’s game. Biden thought he had coordinated a global effort to release more than 1 million barrels per day of strategic oil reserves in order to reduce gasoline and diesel prices since he expected those reserves to be refined and sold to consumers. However, for every barrel of reserve the President has sold, China has taken a barrel off the global market, adding it to Chinese stockpiles. China’s stockpiling eliminated any benefit to U.S. consumers from the SPR release, instead reducing U.S. energy security while strengthening China’s energy security.

No new major oil refinery has been built in the United States since the Carter administration and Biden’s climate policies and regulations will ensure that none are built in the future. Due to the renewable fuel standard and tax credits, some of the refineries that have not shuttered are being converted to biofuel facilities. Those incentives, for example, resulted in renewable diesel obtaining a $3.70 a gallon premium over regular diesel in California in early 2022, benefiting from the $1 a gallon federal tax credit and regulatory credits under California’s low-carbon fuel standard. With over 1 million barrels per day of capacity being converted to bio-fuel processing, the U.S. refining industry’s ability to respond to rising petroleum prices is definitely handicapped.

While the U.S. refining industry has closed or converted much of its refining capacity in recent decades, the United States is still a net exporter of petroleum products. Analogous to the ban on oil exports from the United States that lasted for about 40 years, the Biden administration may look to implement a petroleum product export ban. It is unclear, however, what the ramifications of such a ban would be.

China Continues Its Refinery Production Drop

China’s refinery throughput in May fell 10.9 percent from the same month a year earlier in the steepest year-on-year drop in at least a decade. Oil throughput in May was about 12.7 million barrels per day, slightly more than the 12.61 million barrels per day throughput in April, which was the lowest in two years, and 1.55 million barrels per day below the year earlier level. Processing volumes for the January to May period were down 5.3 percent at 13.4 million barrels per day. May trade data, however, showed a continued reduction in exports, down 40 percent year on year and about 15 percent month on month. Although reduced exports will impact profitability for state-owned refiners, the policy has the benefit of reducing costs for consumers and industry, allowing the government to stimulate the economy and export inflationary pressure to the rest of the world.

The data also showed a 3.6 percent increase in China’s oil production to 4.14 million barrels per day.

Conclusion

It is no wonder that China and Russia have excess refining capacity and that the United States has none. U.S. climate policy and regulatory policy under the Obama and Biden administrations will ensure no new refineries get built in the United States and will make it difficult for existing refineries to get operating permits from the EPA. Increasing credit prices under the renewable fuel standard have driven some small, independent refineries out of business and many of those that seek a temporary exemption from the mandates by showing a “disproportionate economic hardship” have been denied. About 69 waiver requests have been recently denied by Biden’s EPA that has also increased biofuel blending volumes to “unachievable” levels, according to the refining industry.

The end result is that Americans can expect higher gasoline and diesel prices because there is simply a shortage of U.S. petroleum refineries and Biden’s only answer is to rebuke those that are operating for their profit margins that have resulted from government policies to “transition” from oil. Oil and gas companies and their investors have listened to Biden’s calls for less investment in fossil fuels and have heeded those calls. Consumers and the economy are feeling the effects every day.