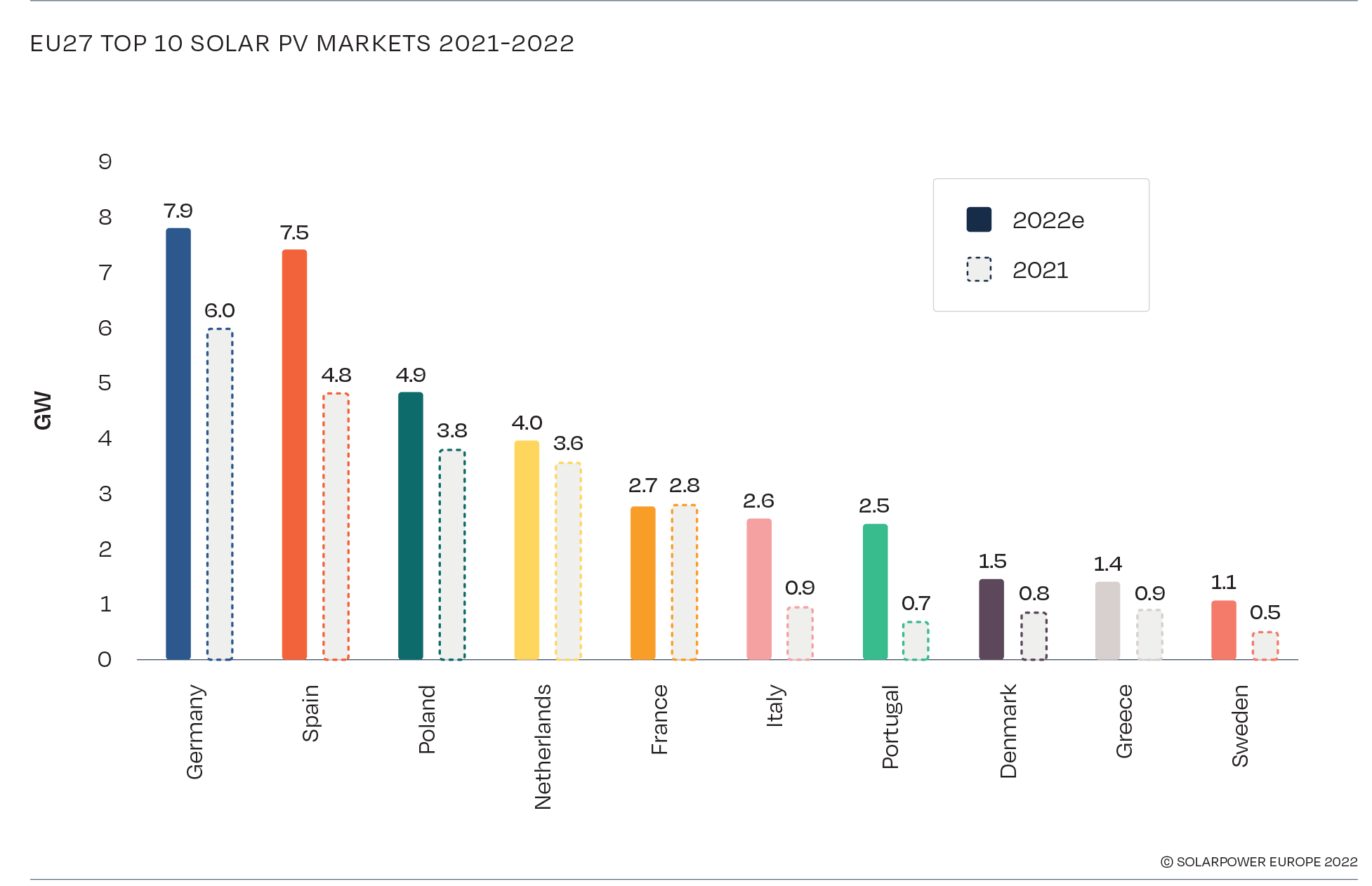

The European Union added 41.4 gigawatts of solar capacity in 2022, increasing 47 percent from the 28.1 gigawatts added in 2021. It was led by Germany with 7.9 gigawatts of solar capacity added and Spain with 7.5 gigawatts. Other European countries also added solar capacity in 2022 as follows: Poland (4.9 gigawatts), the Netherlands (4 gigawatts), France (2.7 gigawatts), Italy (2.6 gigawatts), Portugal (2.5 gigawatts), Denmark (1.5 gigawatts), Greece (1.4 gigawatts), and Sweden (1.1 gigawatts), rounding out the top 10 European buyers of solar power. It seems that Europe has not yet learned from the foibles incurred from its energy dependence on Russia, as it is now turning to China to buy solar panels–the largest solar panel producer in the world–as the continent continues with its energy transition to renewable generating technologies.

The increase in E.U.’s solar capacity is due to taxpayer-funded incentives for solar power. For example, Italy introduced its Superbonus 110% incentive scheme in 2020. Under the program, homeowners are entitled to a tax credit of up to 110 percent on the cost of upgrading their home, such as installing insulation systems, heat pumps and solar panels or replacing an old boiler, or undertaking other projects that reduce the risk of damage from seismic activity. People claim the subsidy by subtracting the costs of the projects from their tax returns over a five-year period, or pass the credit on to the building contractor, who subtracts it from its taxes or sells the credit to a bank, which in turn is refunded by the government. The extra 10 percent covers bank interest. So far, the Italian government has paid out about €21 billion ($22 billion) since launching the program in July 2020 as part of the country’s post-pandemic recovery strategy.

Poland took third place in solar capacity additions despite switching from net metering to net billing this past spring. The new provisions established that all new PV “micro-installations” up to 50 kilowatts had to operate under a new net billing system. The new net billing system replaced net metering that was in place since 2016. Under the old net metering rules, owners of PV systems with capacities up to 10 kilowatts could supply up to 80 percent of their power to the grid, and PV systems ranging from 10 kilowatts to 50 kilowatts were allowed to supply up to 70 percent of their electricity to the grid. Under the new net billing rules, a bill is prepared that includes the energy generated. The price is calculated according to a model related to the price of a kilowatt-hour during the “day-ahead trading.” The new net billing provisions also allow PV system owners who submitted correct grid-connection applications by March 31 to have access to the country’s rebate program, launched in July 2019, for the next 15 years.

E.U.’s Total Solar Capacity

The E.U.’s total solar power capacity increased by 25 percent, from 167.5 gigawatts in 2021 to 208.9 gigawatts in 2022. SolarPower Europe forecasts annual PV growth in Europe to be 53.6 gigawatts in 2023 and 85 gigawatts in 2026, with the E.U. solar market more than doubling within four years, reaching 484 gigawatts by 2026. There are five key areas for getting Europe ready for increasing solar power: expanding the pool of solar installers, maintaining regulatory stability, improving grid stability, streamlining administrative procedures, and strengthening European manufacturing.

E.U. Buys Solar Panels from China

As Europe pivots from Russian fossil fuels, the Chinese solar industry is expected to gain—potentially at the expense of E.U.’s energy security. Chinese solar panels have increased in popularity among European consumers in addition to electric blankets, hand warmers, candles and wood as they face a cold winter with less access to natural gas.

The E.U. depends on China for the bulk of its solar panels. Chinese customs data show a steep increase in its exports of solar panels to Europe with the value of solar panels sales to the E.U. more than doubling. Solar panel sales to the E.U. from January to August this year were over $16 billion compared to $7.2 billion over the same period last year.

According to the International Energy Agency, in 2021, China accounted for 75 percent of global solar panel production, compared to only 2.8 percent for Europe. And, China has an even greater market control on the components and materials required to make solar panels, such as solar cells, silicon wafers, and polysilicon. At one time Germany was the leader in solar panel production, but China with its cheap energy and “slave” labor overtook Germany in solar panel production in 2015. According to Clean Energy Wire, “the overall drop in employment has been mostly due to the collapse of Germany’s solar power industry over the past decade, as many companies were forced out of business thanks to cheaper competitors from China scooping up most of the market.”

From January to August, China’s solar PV exports reached $35.77 billion, exceeding the value of solar PV exports in all of 2021. The soaring demand stretched supplies and raised the prices of silicon, the raw material for PV products, to a high of 308 yuan ($42.41) per kilogram, the highest in a decade. China’s production capacity for silicon is expected to exceed 1.2 million tons at the end of this year, and to double to 2.4 million tons next year. Silicon products are largely made in Xinjiang, the world’s most important production base for polysilicon where Muslim Uyghurs are used as labor and coal-based electricity is generated at an extremely low cost of 3 cents per kilowatt hour.

Europe needs caution in rushing from Russia to China for energy. China, like Russia, uses economic relations for political goals. For instance, after Lithuania showed support for Taiwan, Chinese customs blocked Lithuanian goods and China led a corporate boycott of multinationals with ties to Lithuania. Similarly, in 2010, China cut off rare earth mineral exports to Japan (which are critical to renewable technologies and in which China dominates) because of a territorial dispute.

Conclusion

Europe is continuing with its transition to intermittent renewable energy by increasing its solar power capacity additions by almost 50 percent this year. Germany and Spain led the additions with each adding over 7 gigawatts of solar capacity. Germany was once a leader in solar panel manufacturing, but has been replaced by China because of China’s cheap energy and “slave” labor. Now that Europe has moved away from buying energy from one authoritarian government, Russia, it is turning to another, China, who dominates the solar market and its components. Europe should be worried more about energy security than it has shown in the last decade when it turned away from its own production of oil, natural gas and coal, shuttering fossil fuel generators, cutting lease ales, and banning hydraulic fracturing and horizontal drilling.

America should not follow–but is–following in Europe’s energy transition footsteps and can look forward to energy price increases in the future, along with less secure energy supplies. The West’s preoccupation with renewable energy sources as a “solution to global warming” does not stand up to the tests of its own interests in energy, economics, and national security. Despite the clear writing on the wall, it has chosen to ignore all the signs and plunge ahead. It appears there are still lessons that need to be learned.