The International Energy Agency (IEA) annually estimates global fossil-fuel consumption subsidies that measure what many, mostly-developing countries spend to provide below-market cost fuel to their citizens. In 2022, IEA found that fossil fuel consumption subsidies more than doubled from the previous year’s level to an all-time high of $1.097 trillion due to national energy policies and interventions. Subsidies for natural gas and electricity consumption more than doubled compared with 2021 and oil subsidies rose by around 85 percent. The subsidies are mainly concentrated in emerging market and developing economies, and more than half were in fossil-fuel exporting countries.

In addition to these consumption subsidies, the IEA found more than $500 billion in extra spending to reduce energy bills in 2022, mainly in advanced economies, of which around $350 billion was in Europe. IEA does not represent this spending as a fossil fuel consumption subsidy because as the agency states, “average end-user prices are still sufficiently high to cover the value of the market fuel in question.” According to IEA, in Europe, average end-use prices were close, in some cases, to the market reference values.

IEA’s assessment also does not take into account environmental externalities such as carbon prices. The agency writes, “incorporating a carbon price in the assessment of the ‘true value’ of these fuels would increase the reference values and, all else being equal, push up the estimate of fossil fuel subsidies.”

Fossil Fuel End-Use Subsidies by Fuel Type

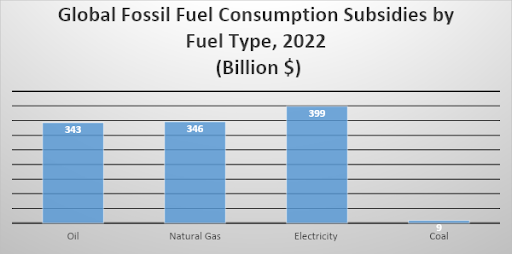

Oil subsidies made up 31 percent ($343 billion) of the total fossil fuel consumption subsidies, while electricity made up 36 percent ($399 billion), natural gas 32 percent ($346 billion) and coal 0.8 percent ($9 billion). According to IEA’s methodology, the United States does not have any consumption subsidies for oil, coal, electricity or natural gas.

In many cases in 2022, estimated subsidy levels increased because of the gap between fixed end-use prices and international reference levels, which was the case in many countries in the Middle East. In 2022, governments also found multiple ways to avoid passing on high and volatile prices to consumers. In some instances, there were direct allocations from national budgets; in other cases (notably among the fossil fuel exporters), domestic prices were kept much lower than international benchmarks.

IEA concludes that high energy prices are not the best way to reach the climate goals of Western economies. The agency notes that in some cases in 2022 price increases prompted higher use of more carbon-intensive fuels, i.e. a switch from natural gas to coal as was seen in many areas of Europe. Also, inflationary pressures push up borrowing costs to the detriment of capital-intensive renewable and “clean” energy investments. These energy sources are heavily subsidized and mandated by governments but are not included in the IEA’s fossil energy end-use subsidy report as they are supply-side interventions. Further, high energy prices hit the poor the hardest, prompting countries to promote policies that counter the price increase.

Examples of Interventions in 2022

The following examples of interventions are not necessarily fossil fuel consumption subsidies by IEA’s methodology.

Fixing prices or capping price increases, e.g.:

- The Peruvian government in April 2022 temporarily included a number of transport fuels in the State Fuel Price Stabilization Fund to reduce the increase in prices.

- Thailand introduced a diesel price cap of $0.85 per liter.

- El Salvador introduced price caps for gasoline and diesel products.

- Egypt extended the period for subsidizing electricity from the previous target of the end of fiscal year 2021-2022.

- France enacted a “tariff shield” that initially froze electricity and gas retail tariffs for households and then limited the possibility for increases in price.

Exemptions from various taxes and levies, e.g.:

- South Africa froze the general fuel levy on petrol and diesel from February 2022, and reduced it by $0.9 per liter from April to June 2022.

- Guyana removed the excise tax on gasoline and diesel in March.

- The United Kingdom cut fuel duty.

- Belgium reduced the value-added tax (VAT) on electricity bills from 21 percent to 6 percent.

Easing payment terms or banning disconnections for non-payment:

- Japan eased gas and electricity payment terms for those struggling to pay.

- Spain enacted a “vital minimum supply” obligation for utilities from September 2021, ensuring vulnerable households unable to pay their electricity bills would still get supplied for a period of 10 months.

Compensation mechanisms for different affected groups of consumers, including households, businesses and industrial consumers:

- India introduced a subsidy scheme, which supports access to LPG for the poorest segments of the population, reaching $820 million. Propane is widely used throughout India for basic needs because of a lack of pipeline infrastructure.

- Germany implemented several additional payments to help vulnerable communities pay their heating bills (households on housing benefits, apprentices and students with student loans).

- Korea provided vouchers for energy expenses including electricity, gas, LPG and heating to around 1.2 million vulnerable households in 2022, and the voucher amounts were increased twice during the year.

The IEA is a part of the Organization for Economic Cooperation and Development (OECD), which represents the developed nations of the world. IEA’s subsidy study focuses on countries that artificially lower energy prices to their citizens, paying the difference from their government resources. These wealth transfers are differentiable from subsidies that are intended to support inefficient energy sources such as wind and solar technologies toward commercialization. The United States and other countries support energy production of all types in the form of tax credits, loan guarantees or mandates, which are not included in IEA’s fossil fuel consumption subsidy methodology since they are directed towards production rather than consumption of the fuel.

Energy Consumption Subsidies Were Intended to Alleviate Poverty

Fossil fuel consumption subsidies are often used by developing countries to alleviate energy poverty, but are an inefficient means for doing so, creating market distortions that result in wasteful energy consumption. As such, there has been political pressure to remove fossil fuel consumption subsidies, especially from OECD countries focused upon man-made climate change.

Conclusion

Many Americans are confused by the large amount of global fossil fuel consumption subsidies that the IEA calculates, not realizing that these subsidies have nothing to do with tax policy, research and development or loan guarantees, where most U.S. programs are directed. Fossil fuel consumption subsidies are common and even pervasive in the developing world, particularly in economies with state-owned energy companies. The IEA has been advocating for years that fossil fuel consumption subsidies should be eliminated since they encourage wasteful consumption. It is also true that the richer nations of the OECD who tax energy consumption heavily and use their taxation and subsidy programs to encourage renewable energy might be concerned about poorer countries inducing economic growth with the use of more conventional and affordable fuels.

Fossil fuel consumption subsidies are essentially welfare transfers that can be differentiated from subsidies in the name of commercializing or sustaining inefficient energy sources such as on-grid wind or solar, which the United States and other industrialized and OECD countries have been subsidizing and/or mandating. These latter forms of energy subsidies that help promote production of inefficient energy sources can be abolished without detrimental effects to the U.S. economy or its citizens.

The OECD countries find fault with developing countries for subsidizing the costs of energy purchased by their citizens, but those same OECD nations are busy subsidizing and mandating the use of inefficient forms of energy which will make energy more expensive and less reliable for their citizens. The EU is now accusing the United States of too many green energy subsidies under Biden’s “Inflation Reduction Act” flowing to corporate interests and are increasing their own green subsidies in response. The economies would be better off if all such support by governments were abolished.