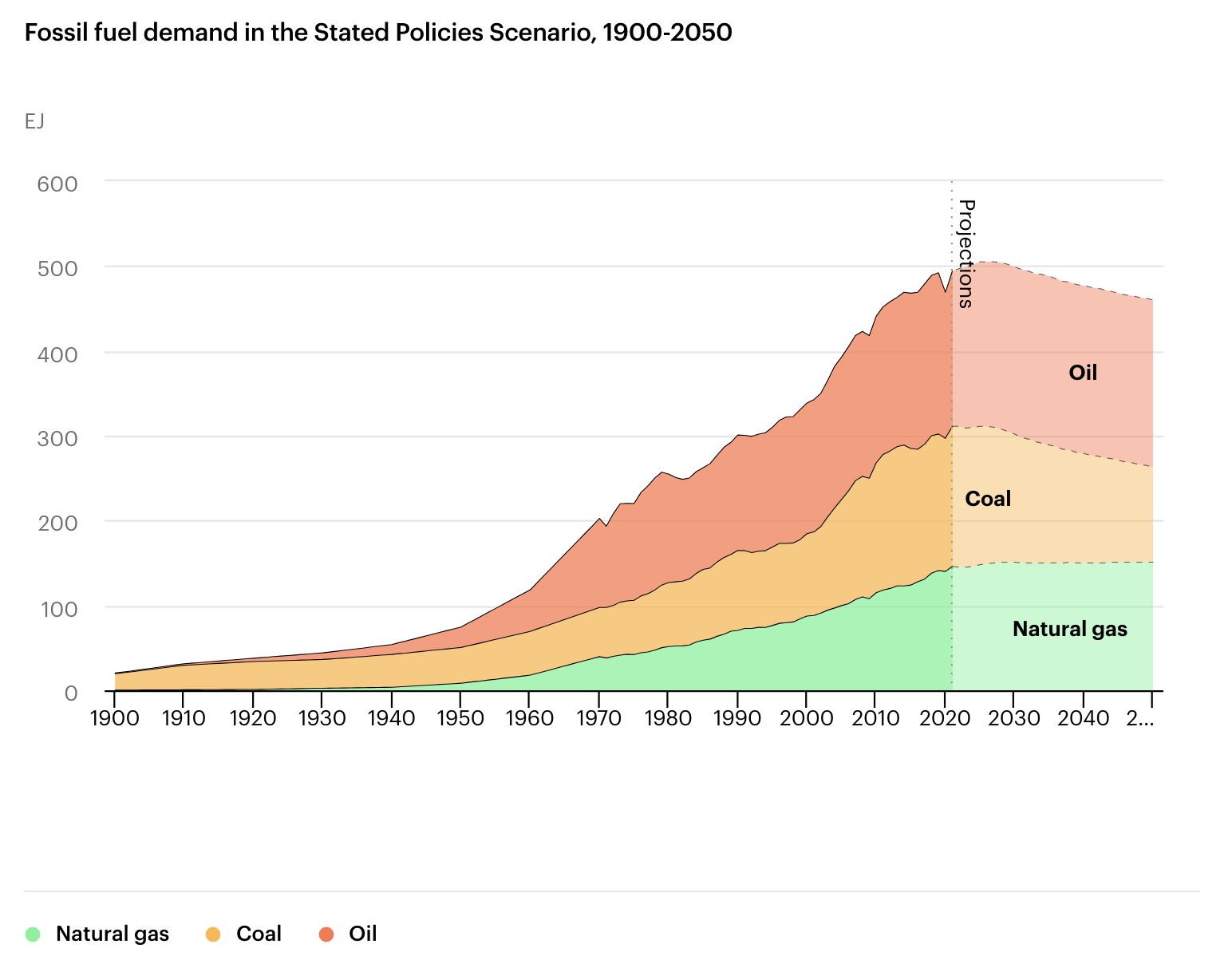

According to the International Energy Agency (IEA)’s World Energy Outlook (WEO) 2022, fossil fuel demand will peak in this decade as the European energy crisis moves further toward investment in renewable energy and away from Russian energy due to its invasion of Ukraine. For the first time, the IEA scenario based on current government policies and settings expects global demand for every fossil fuel showing a peak or plateau within the forecast period. Natural gas, frequently thought of as a bridge fuel, is expected to peak around 2030 in IEA’s latest forecasts. In the Stated Policies Scenario (STEPS) scenario, coal use, which is rising, is expected to fall back within the next few years, natural gas demand is expected to reach a plateau by the end of this decade, and oil demand is expected to level off in the mid-2030s before ebbing slightly to mid-century, as sales of electric vehicles increase.

Europe might align somewhat with IEA’s forecast, but it is unlikely that the Chinas and Indias of the world will fall in step, as reliable energy is the backbone of economic development and quality of life. Only fossil fuels and nuclear power provide that reliability consistently 24/7. While IEA does see India as a major energy growth area, it expects compliance with climate goals for much of the world. According to the New York Times, just 26 of 193 countries that agreed last year to step up their climate actions have followed through with those plans.

Nonetheless, IEA assumes that Europe’s climate policies accelerate the shift away from natural gas, that new supply brings prices down by the mid-2020s, and LNG becomes more important to gas security as the WEO predicts that Russian fossil fuel exports never return to their 2021 levels. IEA predicts that within 10 years, Russia’s share of internationally traded oil and natural gas will fall by half and that renewable energy will continue to surge and eat into the share of coal and gas in the power sector.

Russia has been the world’s largest exporter of fossil fuels, but its curtailments of natural gas supply to Europe and European sanctions on imports of oil and coal from Russia are causing its exports to fall and IEA expects them to continue to decline. Russia’s curtailment of natural gas to Europe has exposed consumers to higher energy bills and supply shortages.

IEA’s India Forecast

According to the IEA, India will become the world’s most populous country by 2025. IEA expects the world’s largest increase in energy demand in this decade to be in India, with demand climbing 3 percent annually due to urbanization and industrialization and energy use necessary to lift millions out of poverty. The WEO predicts that India will use renewable energy to meet 60 percent of the growth in the demand for electricity, and account for 35 percent of the electricity mix by 2030 with solar PV accounting for more than 15 percent. Coal generation is projected to continue to expand in absolute terms, peaking around 2030, though its share of electricity generation is expected to fall from just below 75 percent to 55 percent over this period. Coal-fired power capacity increases from 240 gigawatts in 2021 to 275 gigawatts in 2030. Natural gas generates less than 5 percent of the increase in total power generation, raising its demand by 10 billion cubic meters.

Coal is expected to meet a third of India’s overall energy demand by 2030. IEA sees India’s coal demand rising above 770 million metric tons of coal equivalent by 2030, and continuing thereafter before peaking in the early 2030s. India became the world’s second-largest coal producer in 2021, overtaking Australia and Indonesia, and it plans to increase domestic production by more than 100 million metric tons of coal equivalent from current levels to 2025. Strong economic growth – India’s economy expands 90 percent between 2021 and 2030—brings with it more demand for coal-fired power generation and in the use of coal to produce iron and steel and cement. Coal supply increases from about 450 million metric tons of coal equivalent in 2021 to 550 million metric tons of coal equivalent in 2030 in the STEPS scenario.

IEA expects natural gas demand to reach 115 billion cubic meters by 2030 from 66 billion cubic meters in 2021. Most of the growth comes from manufacturing and other industry, helped by the expansion of city gas distribution networks. Natural gas imports double to reach nearly 70 billion cubic meters by 2030 before reaching 90 billion cubic meters by 2050.

Oil demand meets a quarter of India’s energy demand growth, increasing to 6.7 million barrels per day by 2030 and 7.4 million barrels per day by 2040, from 4.7 million barrels per day in 2021. Oil imports double between 2021 and 2050 because of limited local resources despite the government’s recent announcement doubling its license area for oil and gas exploration. India’s combined import bill for fossil fuels doubles over the next two decades, with oil by far the largest component. Despite sanctions, India has been buying oil from Russia.

India does not expect to reach net zero carbon emissions until 2070.

China’s Energy Use Still Dependent on Coal

In April, China announced it will increase coal output by 300 million tons this year—that increase alone being about half of total U.S. coal production. Despite Chinese President Xi Jinping pledging last year that China would start cutting coal consumption in 2026, state think tanks are expecting coal-fired power generation capacity to increase by 150 gigawatts over the 2021-2025 period. These plants easily operate for 4 or 5 decades. The new plants would put China’s known coal-fired generation capacity at 1,230 gigawatts—about 6 times the U.S. coal-fired generating capacity. China already accounts for over half of all global coal-fired electricity production. Between 2000 and 2021, China’s coal consumption tripled, with coal supplying 55 percent of China’s energy in 2021. China generated 63 percent of its electricity from coal in 2021—almost 3 times coal’s share in the United States. China is using its cheap coal generation to make it a leader in critical mineral processing, renewable energy manufacture and in the EV battery supply chain. China makes over half the world’s steel and uses over half the world’s coal, over 8 times that of the United States.

China’s coal consumption produced over 70 percent of China’s carbon dioxide emissions in 2021—a growth rate of 2.5 percent from 2020. China’s carbon dioxide emissions in 2020 were over twice those of the United States and are growing. In fact, China’s emissions were equal to the emissions of the United States, EU27, India and Japan combined.

European Countries Pursue Fossil Fuels

Even countries in Europe are pursuing fossil fuel production. Italy plans to double its national gas production to 6 billion cubic meters per year from the current 3 billion cubic meters in an effort to cut the country’s dependence on Russian supplies. Italy’s government will also authorize new offshore drilling in the Adriatic Sea, to diversify energy sources to its offshore gas reserves. Italy expects to build on its existing pipeline structure, building new gas pipelines and extending to the EastMed project. A potential pipeline project being considered would run between Spain and Italy through the Western Mediterranean Sea.

In Germany, the utility RWE is dismantling a wind turbine farm of 8 or so turbines to make room for the expansion of an open-cast lignite coal mine. The country has turned to coal to get by this winter given Russia’s gas curtailment and Germany’s large dependence on Russian gas exports. Lignite, or brown coal, has been mined from the Garzweiler coal fields for over 100 years. Three lignite-fired coal units, each with a capacity of 300 megawatts that were previously on standby will begin operating on schedule in October. Their deployment contributes to strengthening the security of supply in Germany and reducing natural gas in electricity generation.

Conclusion

IEA is forecasting a world of steep reductions in fossil fuels because the agency believes that Europe’s energy crisis provides an opportunity for the world to transition more quickly to renewable energy. That transition is proving extraordinarily expensive in both national and economic security for the region. IEA sees Russian fossil fuel exports falling by half, helping to rid the world of fossil fuels and forcing countries to transition to renewable energy more quickly. However, India and China are still way deep into coal and their demand for other fossil fuels is growing. Neither country obeyed Western sanctions, rather they capitalized on lower prices importing Russian oil.

Even European countries are planning to produce more natural gas and coal for they need reliable energy to keep their residents warm in the winter and their manufacturing companies in business. IEA should go back to the drawing board and produce a new forecast more consistent with reality than their recent preoccupation with forcing renewable energy upon people. Some are already saying that IEA’s insistence on renewable energy sources contributed to the energy security situation Europe now finds itself in.