The U.S. Congress recently passed a massive spending bill that includes $35 billion in energy research and development programs, a two-year extension of the Investment Tax Credit for solar power, a one-year extension of the Production Tax Credit for wind power, and an extension through 2025 for offshore wind tax credits. These energy provisions are included in a $1.4 trillion federal spending and tax extension package. The wind and solar industries claim that utility-scale solar and wind power is already cost-competitive against coal-fired power across the world and with natural-gas-fired power in many markets and yet both industries act like they need the tax credits to exist. Despite billions of dollars in subsidies and state mandates requiring them, wind and solar power provided less than 10 percent of the nation’s electricity in 2019.

The solar and wind industries, however, did not get everything that they wanted. They were unable to obtain a “direct-pay” provision to allow tax credits to be converted into direct payments from the federal government, rather than being claimed by investors seeking to offset tax liability. Although the impact on taxpayers is the same, it would have allowed companies who do not pay taxes to get direct cash payments. Currently companies must have a tax obligation to receive the credit against taxes owed.

Solar Tax Credit

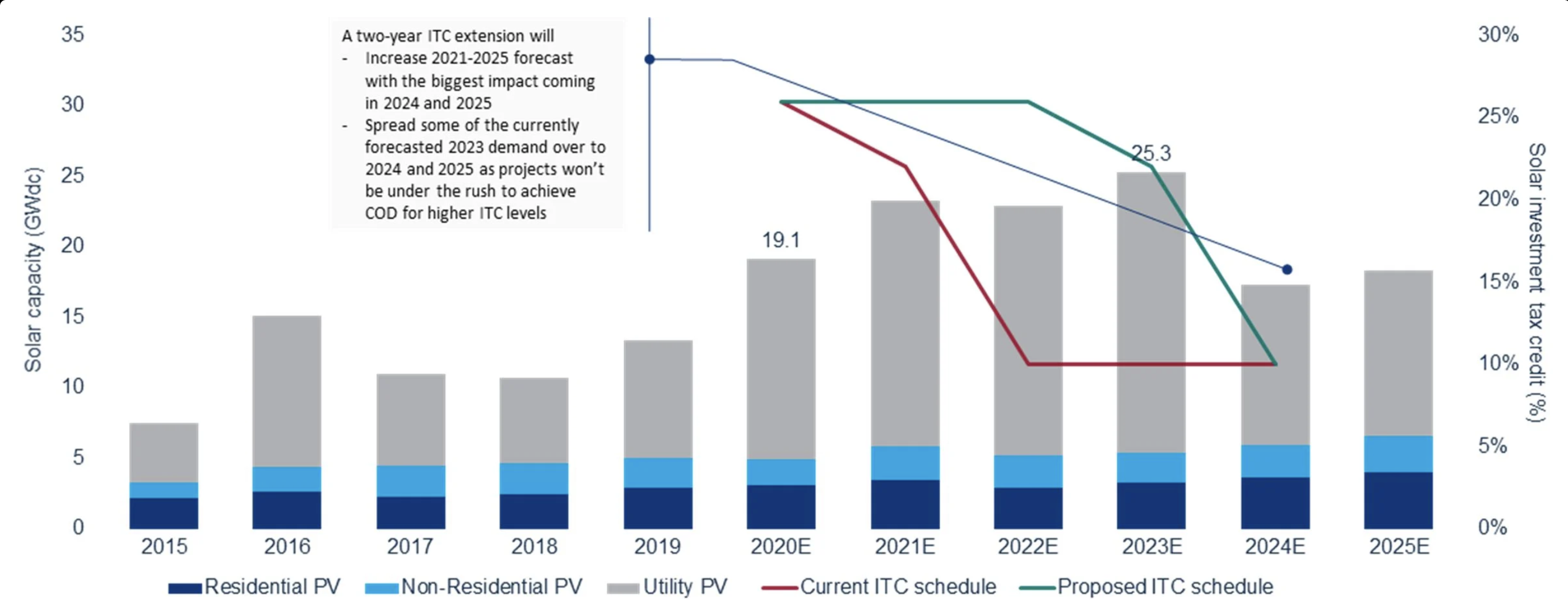

The two-year extension of the federal Investment Tax Credit (ITC) for solar projects will retain the current 26 percent credit for projects that begin construction through the end of 2022, rather than expiring at the end of 2020. The ITC will fall to a 22 percent rate for projects that begin construction by the end of 2023, and then fall permanently to 10 percent for large-scale solar projects and to zero percent for small scale solar projects in 2024.

Many of the large-scale solar development set to be completed through 2023 used “safe-harbor” provisions to secure the original 30 percent ITC credit. The Internal Revenue Service extended the “safe harbor” provisions under the wind and solar tax credits to account for delays companies faced due to the coronavirus pandemic. Under the safe harbor provisions, developers can qualify for the federal tax incentives if they demonstrate there is continuous construction on their project over a certain period of time. The tax credit extension will provide additional solar growth in 2022 through 2025, as more projects can secure the 26 percent and 22 percent tax credits.

Wind Tax Credit

The Production Tax Credit (PTC) for wind power projects, usually claimed by onshore developers, will remain at 60 percent for projects that begin construction by the end of 2021, rather than being reduced to 40 percent as called for in previous law. The PTC will be reduced to zero starting in 2022.

Offshore wind can claim the ITC in lieu of the PTC. Under previous law, any wind project seeking to use the ITC option would have its availability expire completely as the PTC is phased down over the next two years. The new ITC rules will allow offshore wind projects to retain access to a full 30 percent credit paid by taxpayers for projects that begin construction through 2025. There are an estimated 28.5 gigawatts of offshore wind projects being planned for the U.S. East Coast through 2035, some of which have pushed back completion dates awaiting federal permitting approval.

Cost Impact of Tax Credits

According to a December 21 estimate from the Joint Committee on Taxation, the extension of the ITC for solar will cost the American treasury another $7 billion between now and 2030. The extension of the wind industry’s PTC will cost another $1.7 billion. The tax credit extension for offshore wind will cost an additional $362 million. Those billions will be added to the $27 billion in ITC tax credits that were already designated for the solar sector and $34 billion in PTC that will be collected by the wind industry between now and 2029, according to the Treasury Department. The figure below provides the federal tax subsidies for electricity generation across all technologies between 2010 and 2019.

The figure below shows the trends in U.S. net generation for each resource from 2010 to 2019. While wind and solar have risen steadily, they still only comprised 7.4 percent and 2.3 percent, respectively, of U.S. net generation in 2019. In 2019, however, wind did overtake hydroelectric as the largest source of renewable electricity in the United States.

Dividing total federal subsidies from 2010 to 2019 by total electricity generated provides the cost of the subsidies to taxpayers per unit of electricity produced. Solar received the most subsidies per unit of electricity because it is one of the largest recipients of subsidies while producing the second least amount of electricity since 2010. Wind is second because it is still a small part of the U.S. electricity mix. Nuclear and fossil fuels generate much more electricity relative to the subsidies they received, which indicates they are less dependent on subsidies for their revenue and profitability than wind and solar. (See Figure below.)

Between 2010 and 2019, the American solar industry got roughly 211 times as much in federal tax incentives as the oil and gas sector, when compared by the amount of electricity produced. And the wind sector received 48 times as much as the oil and gas sector.

The numbers clearly show that in absolute terms renewables received far more in federal tax incentives than hydrocarbons or nuclear power between 2010 and 2019. But when comparing the dollars per unit of electricity produced, that comparison shows that the subsidies given to hydrocarbons and nuclear are dwarfed by the amount of federal taxpayer cash that is being handed to the wind and solar sectors.

The PTC is the single most expensive energy subsidy in the federal tax code and is estimated to cost taxpayers about $40 billion from 2018 to 2027. The ITC and PTC also distort prices in the electricity market and that distortion is hurting nuclear, coal and natural gas generators. Since much of the material relating to wind and solar photovoltaic generation are imported, the shift to these sources means more dependence on foreign nations for our energy and less energy independence, which the United States reached in 2019 for the first time since 1957.

Conclusion

The PTC and ITC have been in place since 1992. Since 2010, the cost of onshore wind has dropped 40 percent and the cost of solar has dropped 80 percent. If neither industry can be economic without the ITC and PTC provided to them by the federal government – and thus the American taxpayer – it should be time to reevaluate them as viable energy sources. They have now been extended on 13 separate occasions despite the industries involved having argued that they are economic with non-renewable technologies without these tax credits. It appears that while wind and solar companies defend their industries by alleging that they can compete economically with other sources, their continued pursuit of taxpayer subsidies and laws mandating their use tells the true story. Congress seems as addicted to supporting them as the industries themselves appear addicted to taxpayer handouts.