Despite renewable energy investment more than tripling globally during the current decade compared to the last 10-year period, most of the power delivered to the world’s electric grids during the recent decade was from coal. In fact, coal is still the world’s largest source of electricity, providing 38% of world electrical generation in 2018, about the same as 1997. The world spent about $2.6 trillion on renewable energy projects during the decade, over three times the amount spent from 2000 to 2009. Solar photovoltaic investments totaled around $1.3 trillion, and onshore and offshore wind investment totaled around $1 trillion. Globally, solar energy capacity increased by 638 gigawatts between 2009 and 2019, while coal-fired capacity increased by 529 gigawatts, wind capacity increased 487 gigawatts, and natural gas capacity increased 436 gigawatts. Last year, $41 billion was invested in coal worldwide.

Solar capacity additions have taken off because its costs have decreased as technological advances have made solar panels smaller, cheaper to manufacture, and more efficient. According to the U.S. Energy Information Administration, the average construction cost for solar in the United States decreased by 37 percent between 2013 and 2017.

China’s spending on renewable electricity was the highest in the world at $758 billion from 2000 to the first half of 2019. The United States was second with $356 billion, followed by Japan at $202 billion. The European nations spent around $698 billion on wind, solar, and other renewable energy sources, with Germany and the United Kingdom spending the most. It is expected that 330 gigawatts of new wind power capacity will come online over the next five years, driven primarily by onshore wind power projects in the United States and China.

Investments in renewable power capacity last year, however, dropped 38 percent in China and by 6 percent in the United States, while rising in Europe by 45 percent.

Nuclear

Despite the International Energy Agency warning that the loss of emissions-free nuclear power would derail efforts to tackle greenhouse gas emissions, the net capacity for nuclear power declined by 7 percent over the decade as reactor shutdowns and decommissioning outpaced construction of new reactors. Nuclear power net capacity fell more than any other electricity source—oil declined by only 2 percent. Those concerned about sustaining carbon-free electrical generation should be concerned about the decrease in nuclear generation.

China

According to the “Global Trends in Renewable Energy Investment 2019” report, compiled by the Frankfurt School, Bloomberg New Energy Finance and the U.N. Environment Programme, China led the world in both renewable capacity investments and in coal-fired generation construction. Despite its lead, renewable power investment in China has fallen sharply because of cuts to subsidies by the government. China installed by far the largest amount of new renewable capacity excluding large hydro over the 10-year period, at around 451 gigawatts (36 percent of the world total). China has been the largest participant in the construction of both solar and coal, adding over 200 gigawatts of each during the 2010 decade.

The Brussels-based Global Wind Energy Council predicts a rush of new wind power projects in China, which may be more pronounced for 2019 and 2020 due to a new regulation released by the Chinese National Development and Reform Commission on the 21st of May. In order to qualify for a relatively higher feed in tariff for both onshore and offshore wind, the projects must be grid-connected in the near future. For onshore wind, the feed in tariff will expire starting in 2021. The belief is that by expediting the effective date of the subsidies, it may in turn expedite the deployment of useful renewable energy.

United States

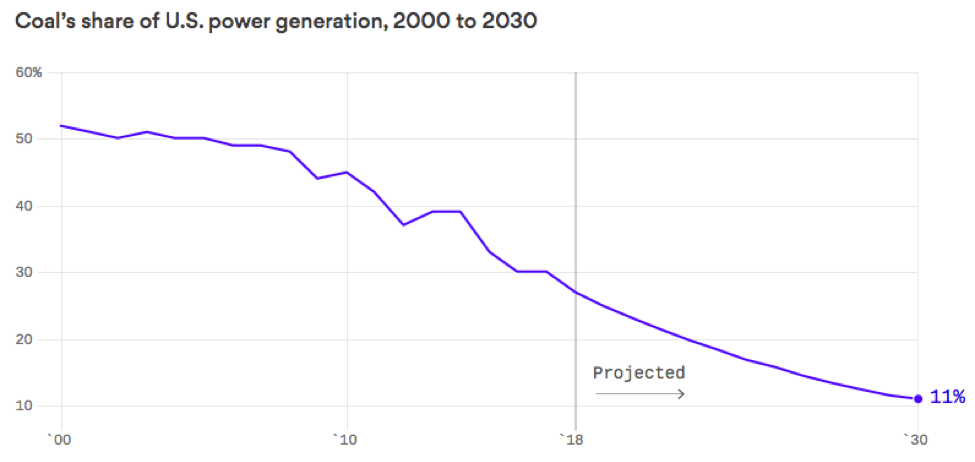

Forecasts are predicting a large drop in coal generation in United States. The Energy Information Administration, in its latest Annual Energy Outlook, is predicting that electric power demand for coal will fall to 17 percent of total generation by 2050. Moody’s Investors Service predicts coal will represent 11 percent of total U.S. power generation by 2030—down from 27 percent in 2018. (See graph below.) The over 50 percent drop in coal demand from utilities by 2030 implies that coal demand would decline by about 7 percent per year on average over the next 10 years. Coal’s U.S. decline results from low cost natural gas generation, mandates and subsidies for renewable electricity, and tougher environmental regulations put in place during the Obama administration.

The impact of the Moody’s coal forecast on the rail industry is severe, slashing revenue for U.S. railroads by about $5 billion by 2030—5.5 percent of the railroad industry’s 2018 revenue. Railroads that rely on domestic coal from the Powder River Basin in Montana and Wyoming will be affected the most by a smaller demand for thermal coal used by electric utilities. Union Pacific and BNSF Railway Co. are two railroads that have the greatest exposure to coal that originates from that region.

Coal constitutes 13 percent of total freight volume and remains the largest single freight commodity moved by rail. According to the Association of American Railroads, trains haul nearly 70 percent of U.S. coal to its destination, with the majority of coal being used to generate electricity.

As coal demand from U.S. utilities declines, railroads will become increasingly reliant on export coal—a more volatile source of revenue. About 8 percent of U.S. coal is exported to Europe, China, and India. Some of the lost coal rail shipments may be supplanted by growth of intermodal freight–the transportation of shipping containers and truck trailers by rail. Over the last decade, intermodal freight growth has largely offset lost coal carloads.

Conclusion

Internationally, coal is still the dominant electricity generation fuel despite large investments in renewable energy. While more renewable capacity has been added over the last decade than coal capacity, coal is able to run at higher capacity factors. Solar and wind are both intermittent technologies that need traditional generation sources to meet demand when the sun is not shining and the wind is not blowing. Coal can be dispatched at any time to meet demand and many countries are taking advantage of it, particularly in Asia.