At the request of the Secretary of Energy, the Energy Information Administration (EIA), an independent agency of the U.S. Department of Energy, evaluated the subsidies that the federal government provided energy producers for fiscal year 2016, updating a study that it did for fiscal years 2013 and 2010. Federal subsidies to support renewable energy in fiscal year 2016 totaled $6.682 billion (2016 dollars), while those for fossil energy totaled $489 million—renewables subsidies were higher by almost a factor of 14. The EIA noted that those subsidies do not include state and local subsidies, mandates, or incentives that in many cases are quite substantial, especially for renewable energy sources.

EIA found that most federal subsidies in FY 2016 support renewable energy supplies (primarily biofuels, wind, and solar) and reducing energy consumption through energy efficiency. In FY 2016, 45 percent of federal energy subsidies were associated with renewable energy and 42 percent were associated with energy end uses (e.g., Low Income Heating Assistance and other such programs). Energy end-use and conservation subsidies declined from $7.7 billion in FY 2013 to $7.2 billion in FY 2016.

Despite renewable energy receiving almost half the federal subsidies, EIA reported that fossil energy in the form of coal, oil, natural gas and natural gas plant liquids made up 78.1 percent of primary energy production in FY 2016. Nuclear power contributed 10 percent, followed by biomass at 5.9 percent, hydroelectric at 2.9 percent, wind at 2.4 percent, solar at 0.6 percent, and geothermal at 0.2 percent.

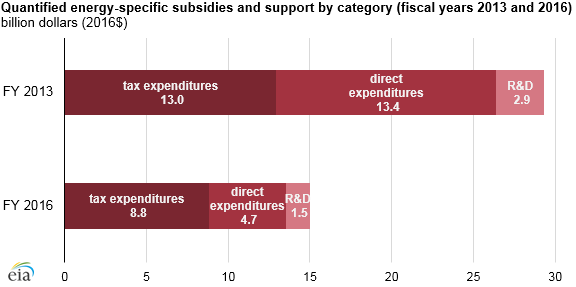

Total federal subsidies declined from $29.3 billion in FY 2013 to $15 billion in FY 2016. Federal renewable energy subsidies declined from $15.3 billion in FY 2013 to $6.7 billion in FY 2016. The decline in federal renewable energy subsidies was due mainly to a decrease in direct expenditures, which reflects an expired government program that allowed subsidy applicants to receive grants in lieu of tax credits. These grants (Section 1603 grants) were created by American Recovery and Reinvestment Act of 2009. While the application period for this temporary program ended, the outlays for some projects continued into FY 2016.

Source: EIA

The Section 1603 grants decreased by $7.7 billion between FY 2013 and FY 2016. Wind subsidies decreased the most, declining from $6.2 billion in FY 2013 to $1.3 billion in FY 2016. Solar subsidies also decreased, from $5.8 billion in FY 2013 to $2.2 billion in FY 2016. Both wind and solar continue to be eligible for tax credits—production tax credit for wind and the investment tax credit for solar.

Federal subsidies and support for fossil fuels decreased from about $3.9 billion in FY 2013 to $489 million in FY 2016. Subsidies for coal slightly increased, while subsidies for natural gas and petroleum liquids decreased. In FY 2016, certain tax provisions related to oil and natural gas yielded positive revenue flow for the government, resulting in a negative net subsidy of $773 million for oil and natural gas, based on estimates from the U.S. Department of Treasury.

Federal subsidies and support for nuclear energy also declined from $1.4 billion in FY 2013 to $0.4 billion in FY 2016.

Federal Subsidy and Support for Renewable Energy

Renewable energy (including biofuels) comprised 52 percent of total energy subsidies in FY 2013 and 45 percent in FY 2016. In FY 2016, tax expenditures accounted for 80 percent of total renewable energy subsidies. Direct expenditures for renewable energy decreased by 90 percent between FY 2013 and FY 2016 due mainly to the expiration of the Section 1603 grant program mentioned above. Renewable energy tax expenditures declined by $367 million between FY 2013 and FY 2016 due mostly to lower outlays for the production tax credit. In FY 2016, biofuels represented 42 percent of total subsidies for renewable energy while renewable energy used in electricity production represented the other 58 percent.

Among renewable technologies, biofuels received the only incremental increase in FY 2016 subsidy support because of greater U.S. biomass-based diesel production and foreign imports of these products that resulted in an approximately $1 billion increase in tax credits from FY 2013 levels.

Source: EIA

In fiscal year 2016, total federal electricity-related subsidies declined from their FY 2013 value. The amount of the decline is unknown because EIA did not provide a table of electricity related subsidies for FY 2016. However, the largest electricity-related federal energy subsidies were for renewable energy since subsidies for wind and solar each exceeded subsidies for coal and natural gas and petroleum. Wind and solar combined represented 90 percent of the federal renewable energy-related subsidies in FY 2016.

Source: IER based on EIA report

While EIA did not calculate the subsidies per unit of energy produced in FY 2016, the Institute for Energy Research calculated the federal subsidies and support per unit of electricity production from the information provided in EIA’s report for renewable technologies and nuclear power. Because EIA did not break out the electricity-related subsidies for coal, natural gas, and petroleum from their total subsidies, the subsidy per unit of energy produced could not be calculated for these sources of electricity. However, if one assumed that all of coal’s subsidies that EIA calculated were for electricity production, the subsidy cost per unit of production for coal would be $1.04 per megawatt hour. However, it is more likely to be about 80 percent of that value. The figure below provides the subsidy costs per unit of production for those technologies that EIA provided relevant data.

On a per dollar basis, government policies have led to solar generation being subsidized by over 95 times more than nuclear electricity production, and wind being subsidized over 12 times more than nuclear power on a unit of production basis.

Source: IER based on EIA report

Conclusion

EIA’s report shows that on a total dollar basis and on a unit of production basis, solar energy had the highest federal electricity-related subsidy in FY 2016. In terms of all subsidies and sources, renewable energy and end-uses had the largest subsidies. In general, total federal subsidies for energy declined by almost 50 percent between FY 2013 and FY 2016.