- The Biden Administration held the first wind lease sale in the Gulf of Mexico that resulted in only 1 winning bid; two other areas received no bids.

- Offshore wind is over 3 times as expensive as onshore wind.

- Atlantic Coast States saw much more interest as they force utilities to buy offshore wind power.

- The wind industry is having problems, with some of the world’s largest firms incurring billions of dollars of repair costs and having to renegotiate higher prices for power.

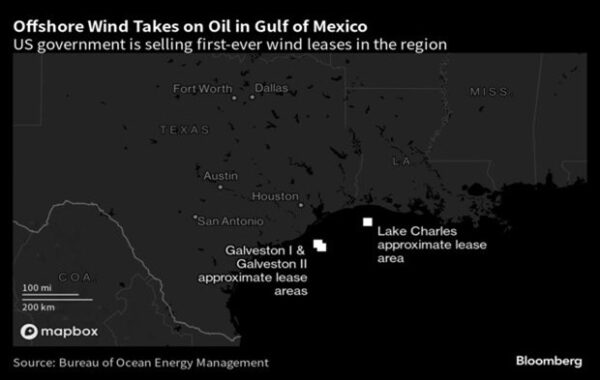

The first ever offshore wind lease sale in the Gulf of Mexico attracted only one bid, yet the Biden administration called it a victory. The auction of offshore wind development rights in the Gulf of Mexico ended with a single $5.6 million winning bid, reflecting meager demand despite the productivity of oil and gas production in the region. Germany’s RWE won rights to 102,480 acres off Louisiana, while the other two lease areas on offer off Texas received no bids, according to U.S. Bureau of Ocean Energy Management (BOEM). The resulting sale earned a fraction of the billions of dollars of bids ($4.37 billion) secured in an offshore wind lease sale off New York and New Jersey in February 2022, most likely because those states have passed laws that require utilities to buy power from offshore wind projects as the cost of offshore wind is over three times the cost of onshore wind and over double that of a dispatchable natural gas generating plant. More recent auctions for areas off the coasts of the Carolinas and California drew hundreds of millions of dollars.

The offshore wind industry faces challenges in the Gulf due to lower wind speeds, soft soils and hurricane activity, but benefits from infrastructure and logistical support built for the oil and gas industry. The Southeast also has low power prices that would make it harder for higher-cost offshore wind generation to compete for electricity contracts unless mandated as they are in the upper Northeast.

According to BOEM, fifteen companies were qualified to bid at the sale. They included offshore wind development arms of European energy companies Equinor, Shell, RWE and TotalEnergies, all of which are already developing U.S. offshore wind leases in other regions. Equinor and Shell also have significant oil and gas operations in the Gulf. European companies made their foray into offshore wind a number of years back because conditions were better suited in Northern Europe for its development with shallow waters, good wind resources and no hurricanes.

Past Interior Department auctions of wind leases along the U.S. East Coast have drawn much larger interest by developers due to near-guaranteed demand from states vowing to procure the power. No Gulf Coast state has established firm commitments to buy the power from offshore wind, despite Louisiana Governor John Bel Edwards setting a goal of five gigawatts of offshore wind power by 2035. That is likely due to the huge cost of offshore wind, which is over 3 times the cost of onshore wind and over twice the cost of a dispatchable natural gas generating plant. The cost of onshore and offshore wind does not include the cost of the back-up power needed when the intermittent and weather-driven technologies are not operating, a significant added cost.

Offshore wind is benefited on the U.S. East Coast by strong wind gusts, typically measuring around 8.5 meters to 10 meters per second (19 miles to 22 miles per hour). By contrast, the winds are less strong in the areas of the Gulf of Mexico that were auctioned for sale–about 7 to 9 meters per second. Further, in the Gulf, developers will have to design the structures to deal with seasonal hurricanes that are more prolific in the Gulf than the Atlantic Northeast.

Developing offshore wind off the Gulf coast does benefit, however, from existing infrastructure and industrial supply chains. There is a vast network of construction companies, shipyards, ports and engineering firms that have long supplied offshore oil and gas development in the Gulf. East Coast states, on the other hand, have had to invest a significant amount of funding to obtain the infrastructure that the Gulf already has. Texas and Louisiana have been involved with offshore oil and gas production for decades that could be leveraged to offshore wind with existing facilities, expertise and a skilled workforce.

Besides being more expensive than other generating technologies, offshore wind on the Atlantic seaboard has faced supply chain challenges and rising costs spurring delays and even project cancellations. In recent months, owners of several planned projects in the Northeast have sought to renegotiate or cancel power delivery contracts due to the soaring cost of inflation. Denmark’s Orsted, the world’s largest offshore wind farm developer, indicated it may see U.S. impairments of 16 billion Danish crowns ($2.3 billion) due to supply chain problems, soaring interest rates and a lack of new tax credits.

Orsted’s Ocean Wind 1, Sunrise Wind, and Revolution Wind projects are adversely impacted by several supplier delays, which may trigger impairments of up to 5 billion crowns ($.73 billion). And, the company’s discussions with “senior federal stakeholders” on obtaining more U.S. tax credits for its offshore wind projects had not progressed as expected, which in turn could lead to impairments of another 6 billion crowns ($.88 billion). Further, the increase in long-dated interest rates in the United States affected both offshore as well as some onshore wind projects and will cause impairments of around 5 billion crowns ($.73 billion).

Siemens Energy announced that quality problems at its wind turbine unit would take years to fix, wiping over a third off its market value and dealing a blow to one of the world’s biggest suppliers of wind turbines. Deeper-than-expected problems affected up to 15 to 30 percent of the more than 132 gigawatts worth of wind turbines worldwide. The repair bill for onshore turbines is expected at €1.6 billion ($1.75 billion) with extra costs leading to another €600 million ($655 million) for its offshore business to fix flaws in rotor blades and bearings that could cause damage ranging from small cracks to component failures that would need to be replaced. Serious problems would require the turbine to be removed and repaired onshore by sending in a massive ship, which can only be done in the summer due to safety reasons.

Biden’s Offshore Wind Goal

President Joe Biden set a goal of deploying 30 gigawatts of offshore wind by the end of the decade and development in the Gulf of Mexico is key to hitting that target as the three offered Gulf leases combined had the potential to account for more than 10 percent of that amount. The auctioned sites have the potential capacity of 3.7 gigawatts that the Biden administration says could be used to produce “green” hydrogen and provide power to Gulf Coast refineries, ports and shipyards. Hydrogen is made by electrolyzing water and it is considered “green” if produced with renewable energy, but is currently much more expensive than “grey hydrogen” produced using natural gas, which makes up almost all of the world’s hydrogen production.

Conclusion

Biden’s dream of 30 gigawatts of offshore wind is having problems as the recent lease sale in the Gulf of Mexico yielded only one bid off Louisiana, where the Governor has a goal of 5 gigawatts of offshore wind by 2035. Prior lease sales off the Atlantic coast have done much better as those states have mandates forcing utilities to purchase the power at agreed upon rates. Consumers in those areas will pay the price their elected officials are forcing on them. Offshore wind is very expensive—over 3 times the cost of onshore wind—and is intermittent, dependent on wind resources that are weather driven. Despite its huge costs, offshore wind must also have back-up power available to ensure that the lights do not go out when the wind stops blowing. The Gulf coast areas are less conducive to offshore wind than the Atlantic coasts due to lower wind speeds, greater propensity for seasonal hurricanes and soft soils. But even on the Atlantic coast, offshore wind developers are renegotiating contracts due to supply chain difficulties, increasing inflation and soaring interest rates. Some projects have even been canceled.