Opposition to various energy forms in New England have helped increase energy prices in the region. Opposition to new natural gas pipelines has caused New England to need to import LNG from Russia rather than getting domestic natural gas from the Marcellus basin next door. Six of the last seven planned interstate pipeline projects planned to transport natural gas throughout the east have been paused or canceled. Opposition to high-voltage transmission lines has resulted in denial of a line to bring hydropower from Canada by Maine voters. The 146-mile transmission line’s future is hanging by a thread as the builder is appealing the constitutionality of the vote. These issues as well as others has forced wholesale power prices in New England to average $59.42 per megawatt-hour in December 2021, up 42.5 percent compared to the previous year. The average natural gas price during December was $8.38 per million British thermal units—up 96.7 percent from the December 2020 average Massachusetts natural gas price of $4.26 per million Btu.

Further affecting prices are goals that the New England states have of reducing reliance on fossil fuels. Each of the six states covered by the New England independent system operator has a carbon dioxide emissions reduction target, and all but New Hampshire’s are in statute. For example, in 2016, Massachusetts passed a law requiring the state to procure 9.45 million megawatt-hours of “clean energy” generation from hydro, solar, or wind, but not natural gas. As energy prices inched higher throughout the fall, early projections warned of some measure of trouble for New England, including the possibility of rolling blackouts, particularly if weather was severe. Several decarbonization studies show the region needs nuclear power and Canadian hydroelectric imports — in addition to vast amounts of wind and solar — to eliminate carbon dioxide emissions from its power plants. These states are members of the Greenhouse Gas Initiative, which is a cap and trade program to reduce power plant emissions by adding a tax to carbon intensive fuels. Europe has a similar system and is experiencing high energy prices and power shortage problems.

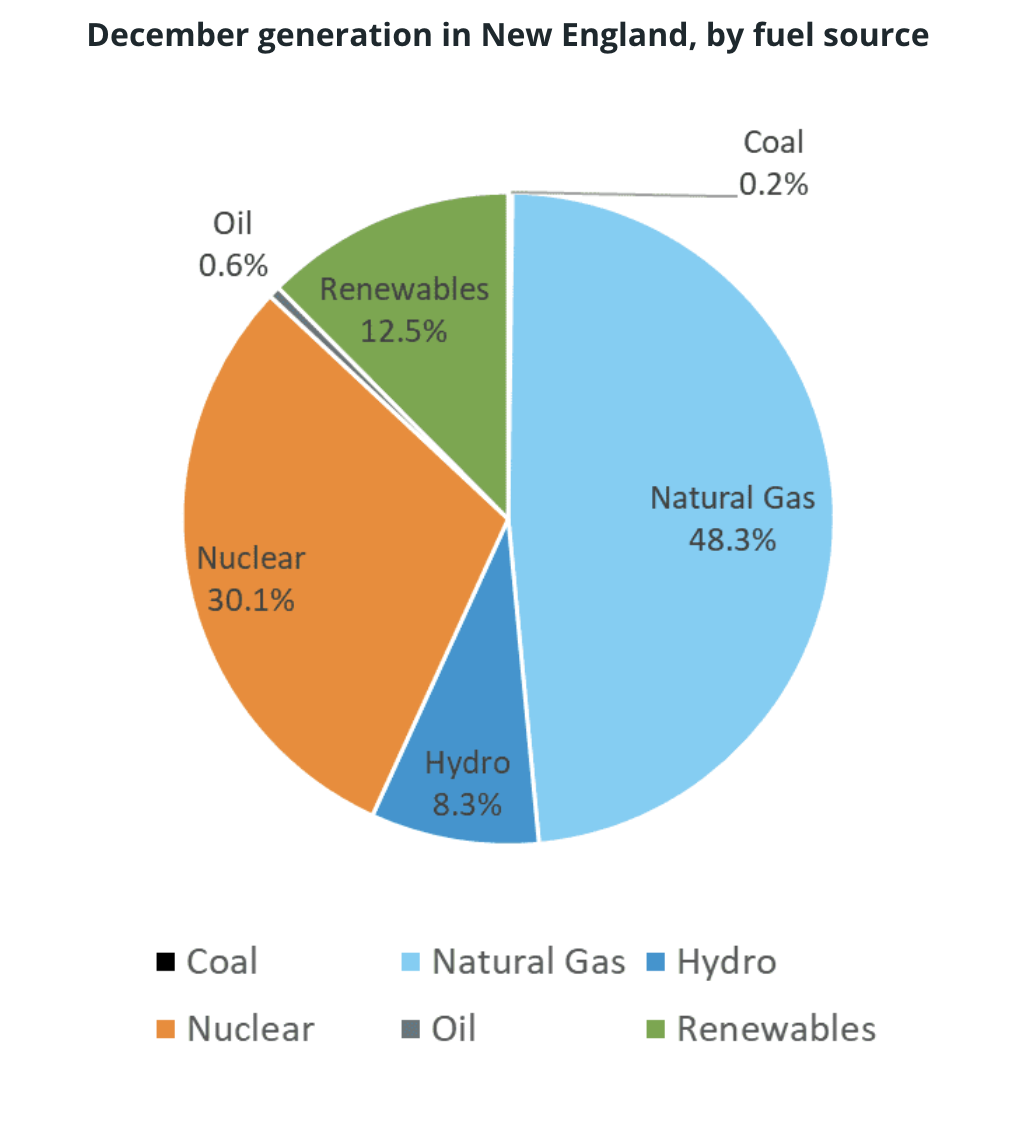

December Generation

Natural gas-fired and nuclear generation produced about 78 percent of the 8,258 gigawatt hours of electricity generated within New England during December, at about 48 percent and 30 percent, respectively. Coal resources generated 0.2 percent while oil-fired resources generated 0.6 percent—both fuels used when other sources are not available. New Hampshire maintains the 459 megawatt Merrimack Station in Bow, the last coal-burning power plant in New England. While it is seldom used, it is able to stay online because of capacity payments received as it provides backup power for the electric grid whose increasingly renewables-fueled system requires it for reliability.

Renewable resources generated about 12 percent of the energy produced within New England, including 6.3 percent from wood, refuse, and landfill gas; 4.8 percent from wind; and 1.2 percent from solar resources. Hydroelectric resources generated 8.3 percent. The region also received net imports of about 2,176 gigawatt-hours of electricity from neighboring regions.

N.E. Fuel Supply Issues

Fuel supply issues have been a concern in New England for the past two decades due to constraints on the natural gas pipeline system, which limits the availability of fuel for natural gas-fired power plants. Heating customers are served first through firm service contracts. When natural gas is not available or is higher priced than alternate fuels, the wholesale markets goes to other sources, including LNG, coal, or oil. But, since 2013, about 7,000 megawatts of these fuels have retired or announced plans for retirement in the coming years, with nearly 2,000 megawatts having retired since winter 2017/2018. Government policies are driving the backup sources out of the market.

Russian LNG

As New England has been shuttering its coal-fired power plants, back-up power has mostly been supplied by natural gas, raising the price of electricity as cold weather forces different sectors to compete for natural gas. When domestic natural gas supplies are short, the region purchases Russian LNG to supply the Everest LNG import terminal a few miles north of Boston. The Russian LNG comes from a new $27 billion terminal on the Yamal Peninsula in the Arctic Circle operated by Yamal LNG—a joint venture among Russia’s gas company Novatek, France’s Total, and China’s CNPC. LNG is both more expensive than domestic natural gas and more carbon intensive. Liquefied natural gas results in greater emissions than pipeline gas because cooling the gas to minus 260 degrees Fahrenheit and then shipping and regasifying it requires more energy than pumping natural gas through domestic pipelines. Generally, LNG produces 5 to 10 percent more emissions over its entire life cycle than piped gas. Because New England has denied permits for natural gas pipelines, the region ends up using more carbon intensive and expensive energy than it needs to.

Conclusion

A tight global natural gas market and existing pipeline constraints put New England in a “precarious position” this winter, as backup supplies are scarce in the region should cold weather be colder than expected or if another polar vortex should hit. The independent system operator New England, which oversees the wholesale electricity market in Maine, Massachusetts, New Hampshire, Rhode Island, Connecticut, and Vermont, see those conditions increasing the likelihood of operators having to employ planned outages to manage power demand in the event of extreme winter weather. Add to this energy situation decarbonization efforts within the states, mostly in statute, and tools to get there, such as the Regional Greenhouse Gas Initiative, and it is easy to see why electricity and natural gas prices are high in the region. While this does not get much coverage in the press, substantial price increases such as these are bound to catch the attention of the consumers in the region.