Charging electric vehicles using some forms of renewable power would qualify for credits under Environmental Protection Agency draft plans to expand a U.S. biofuel program. The measure is part of a proposal to set biofuel-blending requirements for gasoline and diesel that is planned to be released on November 16. If finalized, the measure could expand Renewable Fuel Standard (RFS) program benefits to electric vehicle makers and operators of EV charging networks and producers of biomass, biogas and waste-to-energy electricity. The inclusion of electric vehicles into the federal RFS would be one of the largest changes to the program since it began 17 years ago, originally meant to support blending ethanol, biodiesel and other plant-based alternatives into vehicle fuels. Congress included electricity from qualified fuels as part of the RFS when it was expanded in 2007 and EPA was tasked with approving new fuels for participation in the program.

Under the RFS, oil refiners must blend billions of gallons of biofuels into the nation’s fuel pool, or buy tradable credits, known as Renewable Identification Numbers (RINs), from those that do. The amount of renewable fuels that must enter into the U.S. fuel supply to increase biofuels use are annual targets, also called renewable volume obligations (RVOs), set by EPA. If EPA expands the RFS program to include electric cars, carmakers could gain access to a new type of credit, known as e-RINs, or electric RINS, to cover EV charging. The subsidy could spread to related industries too, such as car charging companies and landfills or manure ponds that supply renewable biogas to power plants. Electric vehicles would qualify for credits under the program’s “D3” mandate pool, which includes cellulosic biofuels that can be made from wood waste and other feedstocks. The new e-RIN program could begin as early as 2024.

The EPA is expected to provide annual biofuel blending mandates for multiple years instead of just one when it releases its proposal.

RIN Credit Prices Reach Record Levels

During the Biden administration, RIN credit prices hit record highs—another reason why gasoline and diesel prices increased and remain high for Americans. RINs generated by biomass-based diesel (biodiesel and renewable diesel) production, known as D4 RINs, peaked on April 28 at $1.91 per gallon. RINs generated by ethanol production (D6 RINs) peaked on June 7 at $1.68 per gallon—close to the high RIN prices in 2021.

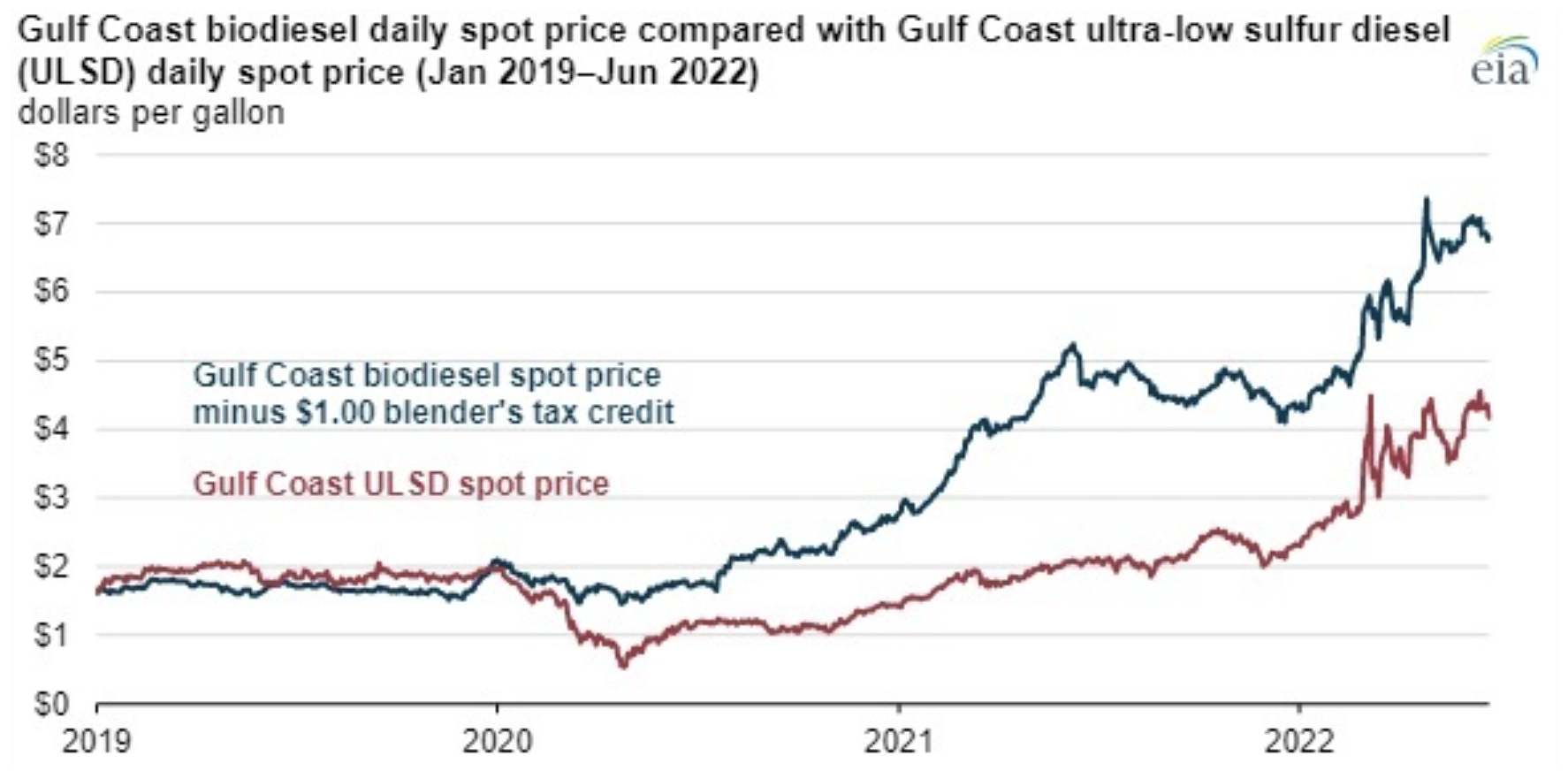

RIN prices increase when the cost of a biofuel is higher than the petroleum fuel it is blended into or if the RFS targets are set at a higher level than normal market-driven biofuel consumption can support. In the first case, RIN prices are set high enough to absorb the costs of the more expensive feedstock while still meeting the RFS program targets. Global demand for the agricultural feedstocks used to make biodiesel fuels has increased, making biodiesel more expensive than petroleum diesel and driving D4 RIN prices higher in 2022.

In the second case, when EPA sets the RFS target too high relative to the amount of demand from the market, the RIN price increases to encourage blending to the higher target level. The value of the higher RIN is an incentive for blenders and retailers to offer higher biofuel blends at discounted prices to encourage higher consumption of biofuels to meet the increased RFS targets. The increase in D6 RIN prices may be due to the RFS target announced by EPA on June 3, 2022 set at the statutory maximum of 15 billion RINs, the same as in 2019. The target is an increase from the 2020 and 2021 targets, which were lower because of reduced driving demand stemming from the COVID-19 lockdowns.

Biodiesel Example

The U.S. Gulf Coast spot price for biodiesel was $8.36 per gallon at its peak on April 28—$3.06 per gallon more than the $4.30 per gallon spot price for Gulf Coast ultra-low sulfur diesel. (Note that there is a $1.00 per gallon tax credit that blenders receive for blending biodiesel.) By July 11, the $3.06 difference had decreased to $2.52 per gallon but still remained large enough that high D4 RIN prices were needed to meet the RFS targets. This may help explain the conversion of refineries to biofuel production, as manufacturers receive much more per gallon producing biofuels.

Issues with E-RINS

The extension of the RFS program to award biofuel compliance credits for electric vehicles charged with renewable power would benefit the electric vehicle industry further—an industry that is already receiving lucrative tax credits as part of the Inflation Reduction Act—and will increase fuel costs for Americans. Exactly how the program would be set up and monitored is questionable as electricity that flows into chargers is non-distinguishable. Further, there was fraudulent activity in the original RFS program that could become a nightmare with the E-RINs program. And, the proposed program extension will just accentuate an already contentious program—currently among the oil and renewable fuels industries—possibly creating new disputes with renewable gas producers, charging station owners and automakers.

Conclusion

EPA wants to increase gasoline and diesel prices further by creating an extension to the RFS program to include electric vehicles charged by electricity generated from renewable fuels which will result in E-RIN prices that blenders will need to buy if they do not meet the EPA target. This proposal complements Biden’s “Green New Deal,” “Net Zero” and “Climate/Tax Bill” (so-called “Inflation Reduction Act.”) The program, which will be announced in mid-November, will be hard to design and monitor and could, at least initially, result in fraudulent E-RINs that will be costly to consumers and taxpayers.