There are two prominent justifications for biofuel subsidies—to reduce gasoline consumption and carbon dioxide emissions. But how much does it cost to achieve these goals? According to the Congressional Budget Office (CBO)[i], subsidies for biofuels are costly to consumers and have high abatement costs for mitigating carbon dioxide emissions.

The ethanol subsidy and import tariff are set to expire at the end of the month, but there are representatives in Congress that want to extend them even though CBO findings indicate that taxpayers pay $1.78 to reduce gasoline consumption by one gallon from ethanol made from corn and $3.00 for cellulosic ethanol made from energy crops such as switch grass, poplars, corn stover, and woodchips. The analogous cost for biodiesel is $2.55, but its subsidy ran out the end of 2009.

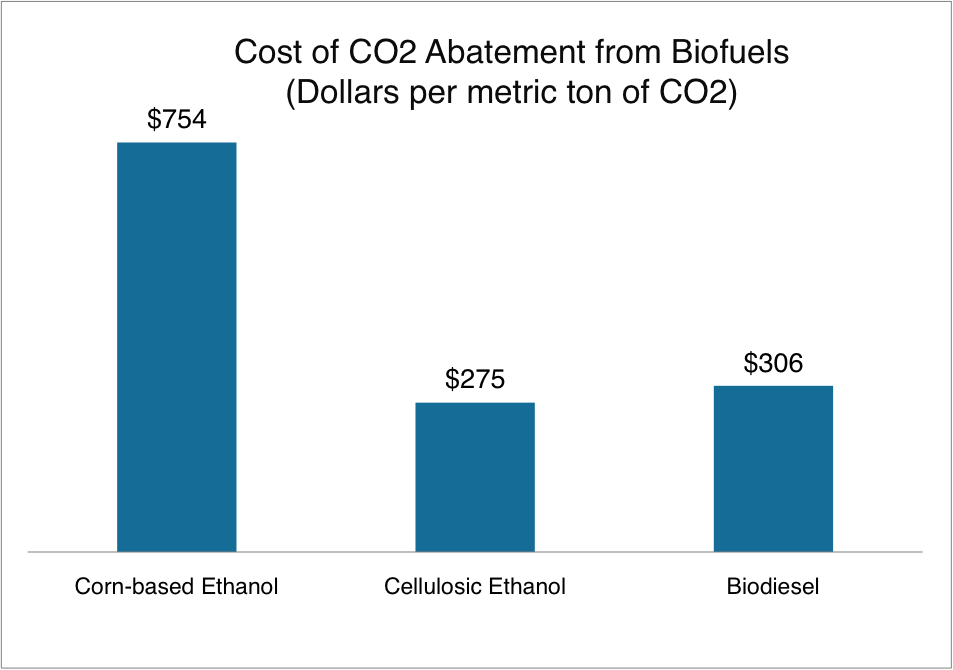

The cost to taxpayers for providing tax credits to biofuels to reduce carbon dioxide emissions is enormous: $754 per metric ton for corn-based ethanol, about $275 per metric ton for cellulosic ethanol, and $306 per metric for biodiesel. To put these numbers in perspective, it currently costs less than $15 a ton to purchase a certified carbon dioxide allowance traded on the European Climate Exchange.

Biofuels Production and Tax Subsidies

Biofuels are added to petroleum products in the transportation sector. In 2009, the United States produced 11.4 billion gallons of biofuels, of which 10.9 billion gallons was ethanol, produced mostly from corn, and 0.5 billion gallons was biodiesel, produced mostly from soybean oil[ii]. A tax credit of 45 cents per gallon of ethanol blended with gasoline is given to blenders of transportation fuels and is set to expire at the end of this month. Biodiesel produced from animal fats and recycled plant oils received a tax credit of one dollar per gallon before it expired in December 2009. Because tax credits for renewables are frequently reinstated, the CBO included the biodiesel tax credit in their analysis. All forms of cellulosic ethanol, made from energy crops that are grown specifically for fuel (switchgrass and poplars), corn stover, and woodchips, receive a tax credit of $1.01 per gallon if blended with gasoline. In fiscal year 2009, the biofuel tax credits reduced federal excise tax collections by about $6 billion.[iii]

Federal Renewable Fuel Mandate

The Energy Security and Independence Act passed in 2007 creates Federal renewable fuel mandates that require the production of specified volumes of renewable fuels to be blended with traditional transportation fuels, with targets increasing to 36 billion gallons by 2022.[iv] So far, corn-based ethanol has met its targets, but cellulosic ethanol has not since it is not yet a commercially viable technology. The Environmental Protection Agency recently lowered the mandate for cellulosic ethanol from the legislated target of 250 million gallons in 2011 to 3.94 million gallons, 1.6 percent of the original target.[v]

While some biofuels are imported to meet the mandates, Congress has imposed a tariff of 2.5 percent and 54 cents per gallon to discourage the importation of ethanol.[vi] The tariff is also set to expire at the end of this month.

The CBO Study Results

The CBO calculated the costs to taxpayers of using ethanol to reduce gasoline consumption by one gallon to be $1.78 for ethanol made from corn and $3.00 for cellulosic ethanol. Based on the tax policy in place through last year, the cost of reducing an equivalent amount of diesel fuel using biodiesel is $2.55.

According to the CBO, using biofuels to reduce greenhouse gas emissions by using tax credits would cost taxpayers $754 per metric ton of CO2 for ethanol, about $275 per metric ton of CO2 for cellulosic ethanol, and $306 per metric ton of CO2 for biodiesel. The estimates exclude emissions of carbon dioxide that occur when the production of biofuels results in forests or grasslands being converted to farmland to grow the fuel. According to the CBO, taking those emissions into account could raise the cost of reducing emissions substantially.

Source: Congressional Budget Office, Using Biofuel Tax Credits to Achieve Energy and Environmental Policy Goals, July 2010, http://www.cbo.gov/doc.cfm?index=11477&zzz=40959

Conclusion

Apparently, some of our Congressmen have not read the CBO study. For example, Senator Tom Harkin from Iowa recently said, “The 45 cents per gallon comes back to consumers in cheaper gasoline prices. Consumers are better off. If we do away with that, gasoline prices are going to go up and they are going to pay for it at the pump, and the oil companies will get the profit, not American farmers, not American producers, not American shippers.”[vii] Senate Finance Committee Chairman Max Baucus has a plan to extend the tax credit for ethanol through 2011, but to reduce it from 45 cents to 36 cents per gallon. He would also extend the 54 cent per gallon tariff on imported ethanol through next year.[viii]

Our politicians when they passed the renewable fuel mandates in 2007 failed to recognize the shortcomings of biofuels, including their lower efficiency resulting in less miles per gallon than traditional transportation fuels, the resultant increase in food prices from diverting corn to the transportation fuel market, and the unlikeliness of cellulosic ethanol to be commercially viable to meet its increasing mandates. We need to recognize that tax subsidies and federal mandates cost the American public both directly and through secondary effects.

[i] Congressional Budget Office, Using Biofuel Tax Credits to Achieve Energy and Environmental Policy Goals, July 2010, http://www.cbo.gov/doc.cfm?index=11477&zzz=40959

[ii] Energy Information Administration, Monthly Energy Review, http://www.eia.gov/mer/pdf/pages/sec3_3.pdf, http://www.eia.gov/mer/pdf/pages/sec10_8.pdf and http://www.eia.gov/mer/pdf/pages/sec10_7.pdf .

[iii] Congressional Budget Office, Using Biofuel Tax Credits to Achieve Energy and Environmental Policy Goals, July 2010, http://www.cbo.gov/doc.cfm?index=11477&zzz=40959

[iv] http://energy.senate.gov/public/_files/RL342941.pdf

[v] Open Market, Ethanol Mandates Meet Reality, November 4, 2010, http://www.openmarket.org/2010/11/04/ethanol-mandates-meet-reality/

[vi] Congressional Budget Office, Using Biofuel Tax Credits to Achieve Energy and Environmental Policy Goals, July 2010, http://www.cbo.gov/doc.cfm?index=11477&zzz=40959

[vii] The Hill, Harkin: Ethanol tax credits could move in the Omnibus package, December 2, 2010, http://thehill.com/blogs/e2-wire/677-e2-wire/131743-harkin-ethanol-tax-credits-could-move-in-omnibus?page=2#comments

[viii] E2 Wire, Energy Roundup: Baucus floats energy subsidy compromise, December 3, 2010, http://thehill.com/blogs/e2-wire/677-e2-wire/131809-e2-morning-roundup-baucus-floats-ethanol-compromise-renewable-power-grant-extensions-plus-big-hurdles-for-offshore-inspectors-bingaman-laments-obamas-drilling-retreat-and-more