The Government Accounting Office (GAO) just released a report entitled: Actions Needed for Interior to Better Ensure a Fair Return regarding the nation’s oil and gas resources.[i] GAO has determined that the Department of Interior does not have the procedures in place to ensure that the American taxpayer is getting a fair return for access to the nation’s oil and gas resources. In particular, the GAO recommends that the Interior Department implement procedures to make adjustments to onshore royalty rates. (The Department of Interior increased royalty rates for offshore production in 2007 and 2008.) Further, GAO recommends that procedures be put in place to make periodic assessments of the fiscal system and for adjusting lease terms for new offshore leases. But, what the GAO did not analyze is whether these changes would make any difference in total revenues from oil and gas production on public lands—a big hole in its analysis. GAO failed to consider the lost revenue from the lands the federal government does not lease and GAO also failed to consider why oil and gas production is increasing on private and state lands, but decreasing on federal land.

According to the GAO:

“The federal government seeks a fair return on its share of revenue from leasing and production activities on federal lands and waters through the federal oil and gas fiscal system. Under the fiscal system, companies pay royalties, rents, and other payments—payments generally specified in lease terms—and taxes on profits from the sale of oil and gas produced from federal leases.”

GAO found Interior’s procedures lacking and recommends:

- Take steps, within existing authority, to revise BLM’s regulations to provide for flexibility to the bureau to make changes to onshore royalty rates, similar to that which is already available for offshore leases, to enhance Interior’s ability to make timely adjustments to the terms for federal onshore leases.

- Establish documented procedures for determining when to conduct periodic assessments of the overall fiscal system. Such procedures should identify generally when such an assessment should be done or what changes in the market or industry would signal that such an assessment should be done. …

- Establish documented procedures for determining whether and how to adjust lease terms for new offshore leases, including documenting the justification and analysis supporting any adjustments.

Narrow Focus of GAO Report

If a narrow review of Interior’s procedures is what is warranted, GAO’s recommendations would be what one would expect. However, the GAO study is too narrowly focused on process and royalty rate increases without examining the bigger picture of development of oil and gas resources on private and state lands vs. public lands.

While oil and gas companies are developing resources on private and federal lands at a rapid pace, resource development on federal lands is slowing due to the significant amount of red tape to process permits that has increased under the Obama Administration. Although royalty rates on federal lands are lower than those on private and state lands[1], oil and gas companies are paying the higher rates to produce on those lands because the delays in federal permitting result in cost increases for oil and gas companies.

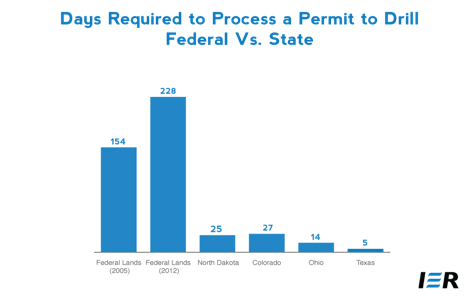

A comparison of the time it takes to process a permit by states vs. the federal government is given in the chart below. While it took the Obama Administration over 7 months to process a permit in 2012, states are taking less than a month. Also note that the time it takes for the Obama Administration to process a permit has increased by almost 50 percent from the time it took under the Bush Administration to process a permit in 2005.

Besides taking an enormously long time to process permits, the number of leases on federal lands is down dramatically under the Obama Administration as the chart below shows. The average number of onshore leases that the Bureau of Land Management issued during the Obama Administration is more than 50 percent less than the average number issued by the Clinton Administration and over a third less than those issued by the Bush Administration.

These actions by the Obama Administration result in lower production on federal lands compared to those on private and state lands. The graph below shows the share of oil and natural gas production that came from federal lands. The share of oil production from federal lands peaked in fiscal year 2010 at 36.4 percent, but has declined by 10 percentage points to just 26.2 percent in fiscal year 2012. Natural gas production on federal lands peaked at 35.7 percent in fiscal year 2003, the first year that the Energy Information Administration reports the data, and has declined ever since reaching half that share in fiscal year 2012 at 17.8 percent.[ii]

GAO failed to consider why, in the middle of a massive increase of oil and natural gas production on private and state lands, production on federal lands is lagging. Royalty rates are frequently higher on private and state lands than on federal lands, but production is falling on federal lands.

By suggesting that Interior increase the federal royalty rate, GAO is suggesting increasing the price the government charges for something that people evidently do not want to buy even at a lower cost than its rival. What the GAO should have looked at is why production is falling on public lands when federal government prices are lower than the competition?

GAO is concerned that Interior’s policies “by themselves, provide a long-lasting assurance that federal resources will provide a fair return.” This is a valid concern. But a fair return would consider the fact that Interior fails to lease millions of acres for oil and natural gas development. This means that the federal government’s return on those acres is zero—regardless of the royalty rate.

It may be that GAO understands little about economic growth or policies that allow for investment to occur. GAO is part of the legislative branch–the branch of government that has passed myriad laws and authorized the very regulatory efforts that has led to making federal lands production uneconomic despite lower royalties than private and state lands. Like Washington and its terribly misguided policies, agents of Washington like GAO tend to suffer from the same tragic group thinking that perpetuates bad policies that hurt Americans.

With these abysmal statistics, it is not surprising that revenues are not where they should be. But raising the royalty rates on onshore production is not what is currently needed to get the American taxpayer its proper revenues from oil and gas resources on public lands as one can see from the study described below.

Opening Federal Lands to Oil and Gas Development

IER commissioned a groundbreaking paper that highlights the large economic effects, including economic growth, wages, jobs, and federal and state and local tax revenues, of opening federal lands and waters to oil and gas leasing. The study finds that if the federal government opened up certain federal lands and waters to exploration and production, the federal treasury would receive $24 billion annual federal tax revenue over the next seven years and $86 billion annually thereafter. State and local governments would receive $10.3 billion annual state and local tax revenue over the next seven years and $35.5 billion annually thereafter. Over 37 years, federal and state and local tax revenues would increase to the tune of $2.7 trillion in federal revenues and $1.1 trillion in state and local revenues.

Further, the increase to GDP would be $127 billion annually for the next seven years, and $450 billion annually in the long run. Most impressively, the opening of federal lands could have a cumulative increase in economic activity of up to $14.4 trillion over a period of 37 years. And the ripple effect of that boom would be 552,000 in job gains annually over the next 7 years with annual wage increases of up to $32 billion over that time period and an increase of 1.9 million jobs annually in the long run with annual wage increases of $115 billion.[iii]

Conclusion

While the GAO study provided recommendations that are obvious, it did not get at the real issues of why the American taxpayer is not getting his or her adequate return from the public’s natural resources. The narrow focus of the GAO report did not indicate to the American public that federal bureaucratic red tape is causing the oil and gas industry to look elsewhere for its large investments in oil and gas production infrastructure. Raising the royalty rates on onshore production would not necessarily mean more revenues, at least not as much additional revenues as opening federal lands to oil and gas production would accomplish for the American taxpayer. But, even without the additional leasing, much could be accomplished by the federal government speeding up permit processing times comparable to oil and gas-producing states, whose ability to adequately regulate production has been demonstrated for over a century.

[i] Government Accounting Office, Oil and Gas Resources: Actions Needed for Interior to Better Ensure a Fair Return, December 2013, http://gao.gov/assets/660/659515.pdf

[ii] Energy Information Administration, Sales of Fossil Fuels Produced from Federal and Indian Lands, FY 2003 through FY 2012, May 30, 2013, http://www.eia.gov/analysis/requests/federallands/

[iii] Institute for Energy Research, Economic Effects of Immediately Opening Federal Lands to Oil and Gas Leasing: A Response to the Congressional Budget Office, February 2013, https://www.instituteforenergyresearch.org/wp-content/uploads/2013/02/IER_Mason_Report_NoEMB.pdf