“If we want to wean ourselves from foreign oil, why would we allow a pipeline to be built for 1,700 miles to manufacture petroleum products to be shipped overseas?” Reid told reporters after the weekly Senate Democratic policy lunch. “That’s the purpose of this.”[i]

What Harry Reid seems to be referring to is that in 2011, for the first time in 62 years, the United States was a net exporter of petroleum products[ii], exporting about 15 percent of the petroleum products the U.S. produced. Unfortunately, his statements show that he understands little about the U.S. petroleum industry and consumer petroleum demand.

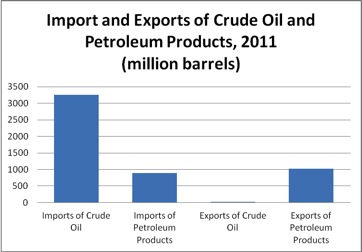

What Harry Reid is not telling the public is that the United States remains a net importer of crude oil and petroleum products. Total imports of crude oil and petroleum products in 2011 were 4 times more than the petroleum products that were exported. In fact, the United States spent more than $433 billion on crude oil and petroleum imports in 2011, over $100 billion more than the $333 billion spent in 2010 and over 4 times the value of the petroleum we exported. Nevertheless, Senator Harry Reid suggests the purpose of importing Canadian oil via the proposed Keystone Pipeline is to export it in the form of petroleum products.

Source: Energy Information Administration, Monthly Energy Review, Table 3.3b, http://www.eia.gov/totalenergy/data/monthly/pdf/sec3_9.pdf

Source: Energy Information Administration, Monthly Energy Review, Table 1.5,

U.S. Petroleum Demand, Production, and Imports

U.S. petroleum demand took a nose dive beginning in 2008 primarily due to the recession. The petroleum industry has not been able to recoup that demand mainly due to a poor economy and high national unemployment. For example, one reason that gasoline demand is down is because Americans are driving less. According to a USA Today analysis of data from the Federal Highway Administration, Americans have been driving fewer miles every month since March, 2011.[iii] “With the number of Americans unemployed or underemployed, you have a reduction in disposable income, fewer commutes, fewer shopping trips and leisure trips,” says Troy Green of AAA.[iv]

The demand for gasoline in the United States dropped by almost 6 percent from a peak of 9.3 million barrels a day in 2007 to 8.8 million barrels a day in 2011.[v] While the recession is the major factor in the lower gasoline demand, other factors are the increase in vehicle fuel efficiency, higher gasoline prices, and the use of ethanol blended in gasoline.[vi]

While oil production is up in the United States, it is not enough to preclude the need for imported crude oil. In fact, in 2011, the United States imported 4.1 billion barrels of crude oil and petroleum products, four times the amount it exported. But, we now get almost half of our net crude oil and petroleum imports from the Western Hemisphere, and half of that (or more than a quarter of the total) is from Canada. In 2010, just 12 percent of our net imports came from Saudi Arabia, down from almost 19 percent in 1993.[vii]

Why is the United States exporting some of the petroleum products it is producing? Because without those exports, the U.S. refining industry would not be able to survive the current slump in petroleum product demand and remain solvent to produce refined products in the future. In December 2011, the Energy Information Administration (EIA) calculated that a mere 5 percent of the price of a gallon of diesel went to refineries and an amazing -2 percent of the price of a gallon of gasoline. Yes, that is a minus 2 percent! Of course these are only estimates of the four cost components of gasoline and diesel. But the majority of the price of gasoline (80 percent) and diesel (68 percent) is attributed to the cost of crude oil.

Source: Energy Information Administration, http://www.eia.gov/petroleum/gasdiesel/

U.S. refineries need to be prepared in case the U.S. economy rebounds, raising the demand for petroleum products and the demand for crude oil imports. Currently, the United States has a market for its petroleum products due to the economic growth of emerging economies. If these economies were to slip, the United States could lose those markets and be forced to remain solvent based solely on U.S. demand and prices.

U.S. Refinery Closures

U.S. refiners are closing plants that have become uneconomic. These closures have dire implications for users of petroleum products in the United States. In recent years, refineries closed in Westville, New Jersey, and Yorktown, Virginia and this past December a large refinery in southeastern Pennsylvania and one in New Jersey were shuttered.[viii] In Pennsylvania, Sunoco is trying to sell its Marcus Hook and South Philadelphia refineries, whose combined output is 500,000 barrels a day, or it will shutter the plants by July. Since 2009, those plants have lost $772 million. Conoco Phillips is also planning to shutter a refinery that produces 185,000 barrels a day in Trainer, Pennsylvania if it cannot find a buyer.[ix]

These refiners have been hit by weak demand because of slow economic growth, increased use of ethanol, and higher vehicle fuel efficiency. Between 2004 and 2011, demand for refined products in the Northeast and Mid-Atlantic states declined by 12 percent, with the largest decline in distillates, according to a study by Kevin Lindemar, a petroleum refining expert. According to Lindemar, east coast refinery closures together with one in the U.S. Virgin Islands (Hovensa) will reduce their output of refined products by about 1 million barrels a day between 2009 and 2012.[x]

The rated capacities of the refineries being closed total about 1.5 million barrels per day, but since these refineries are not running at capacity, the lost output is around 800,000 barrels per day. Besides closures of U.S. refineries, several European refineries, another source of gasoline to the United States, have recently closed or have been put on the market for sale. According to Lindemar, 11 European refineries have closed since 2009.

Replacing the lost supply of gasoline is a lesser problem than replacing distillates — diesel and heating oil. Europe, who relies more on diesel than gasoline usually has a surplus of gasoline to sell to the United States, but because diesel is in tight supply in Europe, very little is imported into the United States. Most diesel imports come to the United States from dedicated refineries in Canada. Attracting adequate supplies of diesel and heating oil to East Coast markets in the future may require a hefty price premium or shortages will result. The impact from the shuttered refineries will be felt first through increases in gas prices along the East Coast, particularly north of Washington DC. Some forecasters are predicting prices in the $4 to $5 a gallon price range.[xi]

These refinery closures will mean higher prices and a loss of American jobs in a tough economy. Refiners must find additional markets if they are to survive. One way to keep those refineries operating is to export petroleum products.

Who Benefits from U.S. Petroleum Product Exports

In November 2011, Mexico and Canada imported a combined 33 percent of U.S. petroleum product exports: the United States exported 21.6 percent to Mexico and 11.5 percent to Canada. Over the past 5 years, Mexico’s net petroleum imports from the United States rose by about two-thirds. Because Mexican refineries are having a tough time keeping pace with gasoline demand, the country buys over 60 percent of the gasoline that the United States exports.[xii]

Brazil is also a major purchaser of U.S. petroleum product exports. In 2006, the United States was a net importer of petroleum products from Brazil, but last year a net 106,000 barrels a day were sent from the United States to Brazil. Argentina and Peru are also net importers of petroleum products from the United States.[xiii]

Outside of North and South America, China, Japan, Singapore, and various European countries are also buyers of U.S. petroleum products.

Conventional gasoline, low-sulfur diesel, petroleum coke, and residual fuel are the largest components of petroleum product exports from the United States. Petroleum coke is used in making steel.

Source: Energy Information Administration, http://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=MTTEXUS2&f=M and http://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=MTTIMUS2&f=M

U.S. Import/Export History

The United States is not new to exporting petroleum products. The United States was a net exporter of petroleum products for decades through World War II, with sales reaching a high of 126 million barrels in 1944. In 1950, the United States became a net importer with net imports peaking at about a billion barrels in 1973, the year of the Arab oil embargo. Net imports fell off in the 1980s and 1990s and spiked in the middle of the last decade.[xiv]

Conclusion

The United States has become a net exporter of petroleum products for the first time in 62 years due to lower U.S. petroleum demand and thriving markets in emerging nations, many of which are in North and South America. The markets for petroleum products could shift at any time due to economic changes in the United States and/or in emerging economies. Regardless, U.S. refineries need to be in operation and ready to fulfill those demands. Closures of refineries due to lack of U.S. demand will only mean higher prices in the future and fewer jobs for Americans.

Some politicians want the public to believe that the Keystone pipeline is to make refiners rich from exporting petroleum products, but that is a far cry from the truth, when their price share of a gallon of gasoline, according to EIA, is in the negative. Refinery exports are currently keeping the lights on at refineries in the United States so they can survive until a time when the economy recovers and demand here increases.

The Keystone pipeline could keep some U.S. refineries in business. While those refiners might export some of the products they produce, they would be remaining solvent to supply future U.S. demand. What U.S. refineries need is access to a stable supply of oil, which Canada and Keystone can provide.

[i] Politico, Keystone pipeline talks curtailed by Harry Reid, January 24, 2012, http://www.politico.com/news/stories/0112/71907.html#ixzz1lcLzqMZK

[ii] Times Tribune, Specter of abundance, January 2, 2012, http://thetimes-tribune.com/opinion/editorials-columns/national-columnists/specter-of-abundance-1.1251413#ixzz1jHXCsH9C

[iii] USA Today, Oil boomlet sweeps U.S. as exports rise, December 16, 2011, http://www.usatoday.com/money/industries/energy/story/2011-12-16/us-oil-boom/52053236/1

[iv] USA Today, Economy, gas prices make Americans drive less, December 8, 2011, http://www.usatoday.com/news/nation/story/2011-12-07/americans-driving-less/51716466/1

[v] Energy Information Administration, Monthly Energy Review, http://www.eia.gov/totalenergy/data/monthly/pdf/sec3_15.pdf

[vi] CNN Money, Gasoline: The next big U.S. export, December 5, 2011, http://money.cnn.com/2011/12/05/news/economy/gasoline_export/

[vii] USA Today, Oil boomlet sweeps U.S. as exports rise, December 16, 2011, http://www.usatoday.com/money/industries/energy/story/2011-12-16/us-oil-boom/52053236/1

[viii] Oil Price, Peak Oil Crisis Being Compounded by Refinery Closures, January 26, 2012, http://oilprice.com/Energy/Oil-Prices/Peak-Oil-Crisis-Being-Compounded-by-Refinery-Closures.html

[ix] AOL Energy, Refinery Closures Would Disrupt Supply Chain, Marketers Say, February 7, 2012, http://energy.aol.com/2012/02/07/refinery-closures-would-disrupt-supply-chain-marketers-say/

[x] Ibid.

[xi]Oil Price, Peak Oil Crisis Being Compounded by Refinery Closures, January 26, 2012, http://oilprice.com/Energy/Oil-Prices/Peak-Oil-Crisis-Being-Compounded-by-Refinery-Closures.html

[xii] Wall Street Journal, U.S. Nears milestone: Net Fuel Exporter, November 30, 2011, http://online.wsj.com/article/SB10001424052970203441704577068670488306242.html?mod=WSJ_hp_LEFTTopStories

[xiii] Wall Street Journal, U.S. Nears milestone: Net Fuel Exporter, November 30, 2011, http://online.wsj.com/article/SB10001424052970203441704577068670488306242.html?mod=WSJ_hp_LEFTTopStories

[xiv] Ibid.