As of this writing, the debt ceiling crisis is still up in the air. Both parties are telling the voters that this is going to be painful, with Democrats gearing for tax hikes and Republicans emphasizing the need for budget cuts.

Things would not look so bleak if the federal government allowed more freedom in the development of American energy resources. Energy freedom would boost economic growth and lower oil prices. The fiscal crisis would be eased as more revenues flowed into the Treasury, and fewer people needed unemployment benefits and food stamps.

The Fiscal Crisis

The United States government truly does face a fiscal crisis. In addition to the more than one trillion dollars annually that Uncle Sam has been racking up in official, legally binding debt, there is the even more alarming accumulation of liabilities such as future Social Security and Medicare payments. An article in the USA Today from June quoted an estimate of these unfunded liabilities at some $62 trillion. The official debt limit currently under dispute—standing at a whopping $14.3 trillion—is nowhere near the full extent of the problem.

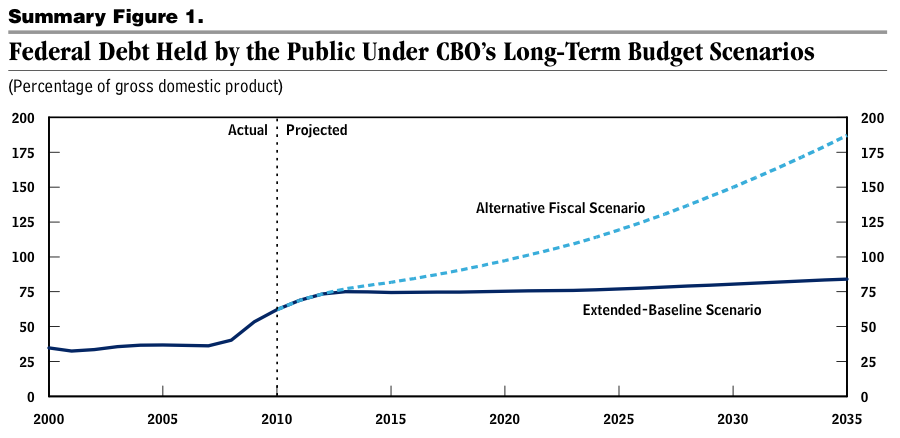

The following diagram is taken from the Congressional Budget Office’s most recent long-term projection:

Source: CBO’s 2011 Long Term Budget Outlook

Here’s what CBO means by “Alternative Fiscal Scenario” in the above chart:

The budget outlook is much bleaker under the alternative fiscal scenario, which incorporates several changes to current law that are widely expected to occur or that would modify some provisions of law that might be difficult to sustain for a long period. Most important are the assumptions about revenues: that the tax cuts enacted since 2001 and extended most recently in 2010 will be extended; that the reach of the alternative minimum tax will be restrained to stay close to its historical extent; and that over the longer run, tax law will evolve further so that revenues remain near their historical average of 18 percent of GDP. This scenario also incorporates assumptions that Medicare’s payment rates for physicians will remain at current levels (rather than declining by about a third, as under current law) and that some policies enacted in the March 2010 health care legislation to restrain growth in federal health care spending will not continue in effect after 2021.

In other words, the CBO modelers plug into the “Alternative Fiscal Scenario” what the policymakers historically have done time and again, rather than what they say they are going to do, under current law.

The Conventional Two-Party Response

In light of the sobering facts above, we can see why even the notoriously shortsighted policymakers in DC are starting to take this whole debt thing seriously. Yet the way the debate is unfolding leaves Americans feeling hopeless. The typical left-wing liberal recommendation is to soak the rich with higher taxes.

The problem with this suggestion is that there isn’t all that much revenue to tap among the “super rich.” Moreover, the “super rich” are highly mobile (and therefore highly capable of simply moving to a lower tax country where their talents are appreciated) as well as highly motivated to reduce any increased tax burden by changing their investment and income strategies. Therefore, in order to bring in meaningful revenue over the coming years, double income working couples will need to suffer as well. In any event, raising taxes in the midst of a recession will not spur job creation and bring down the unemployment rate under any economic theory.

If the left-liberal recommendation won’t work, the right-wing conservative line is a bitter pill for many Americans to swallow. They have done little to rebut the President’s claim that if the debt ceiling isn’t raised, he can’t continue making Social Security payments, making the oceans recede or healing the sick.

Sugar-Coating the Pill Through Energy Freedom

We don’t mean to suggest that hard choices will not have to be made. Ultimately, the only long-term solution to recurring budget emergencies is to wean the American people from their over-dependence on the federal government. Citizens need to stop looking to Washington D.C. whenever they encounter trouble in their lives, and they must reject politicians who promise them something for nothing because we have nothing with which to pay for those things. Otherwise, no matter how much new revenue is raised (whether through tax hikes, asset sales, or pro-growth policy reforms), officeholders will manage to fritter it away on new spending programs.

Even so, things are not as bleak as the current debate suggests. If the government implemented the types of policy reforms that IER has been advocating all along, the pill of budget austerity would not be so bitter.

A recent paper [.pdf] by LSU economist Joseph Mason argued that federal efforts to expedite the development of offshore oil and natural gas resources would achieve several goals simultaneously: It would create jobs, boost economic growth, lower energy prices, and increase government revenue (in the form of leases but also general tax receipts).

Mason’s paper made a crucial distinction that is often lost in the debate: There is a huge difference between raising tax rates versus raising tax revenues. Just because policymakers claim that they are getting tough on the deficit by jacking up “taxes on the rich,” doesn’t mean they will actually accomplish this objective. Because people respond to tax incentives, they will reduce the taxable base and partially offset the effect of higher rates. In practice total revenue might go up or down, but the point is that “raising taxes” is an ambiguous phrase.

Conclusion

The federal government has spent itself into an enormous hole by promising voters things they could not afford in return for votes. It cannot possibly meet the promises it has made to current and future beneficiaries of various government programs. No one denies that serious and painful reform is needed.

Yet one obvious step to help climb out of the hole is to untie the hands of entrepreneurs to develop American energy resources. This means allowing more activity to take place as well as lessening the regulatory burden which is a tax on productivity and which continues to grow exponentially, stifling growth, investment and revenue production potential. Such reforms would bring in more revenue while reducing the applications for government assistance. The situation is not as bleak as the media portray it.