An old joke says that if you laid all the world’s economists end to end, you wouldn’t reach a conclusion. We see that truth in the policy debates over a carbon tax. Just when NERA released its study documenting the tremendous harms a carbon tax would impose on the economy—a study that I praised in this blog post—the Brookings Institution touted a rival study extolling the wonders of a carbon tax.

What gives? How can two groups of smart economists come up with such diametrically opposed conclusions? Part of the answer is that the studies look at different criteria. The NERA study focused on the harmful impact of a carbon tax on U.S. GDP, worker income, and energy prices. The Brookings study looks at extra revenue for the government and reduced emissions. Furthermore, the Brookings study leaves out some crucial considerations, as I’ll explain below. In the real world, a carbon tax would be far more damaging to the economy than the Brookings study suggests.

Proposed Carbon Tax Won’t Dent Global Warming

As is typical in the pro-carbon tax literature, the Brookings study first paints an ominous picture of the dangers of unrestricted manmade climate change through the year 2100. The implication is that the proposed carbon tax would avert this catastrophe.

However, the study only recommends a modest tax, starting at $16/ton of carbon dioxide and rising at an inflation-adjusted 4 percent per year through 2050. This will hardly address the problem of global climate change.

Indeed, even if the US were to completely eliminate its carbon dioxide emissions through the end of the century, that would avert only about two-tenths of a degree Celsius of projected global warming, according to the mainstream models. And of course, the U.S. would still be pumping out plenty of carbon dioxide (as opposed to a complete cessation of emissions) with the modest tax proposed.

Thus we see the pattern that I noted in the context of the Boxer-Sanders carbon proposal: In order to keep down the projected costs of compliance, they recommend a modest carbon tax rate. (This would still hurt the conventional economy, to be sure, but it wouldn’t be devastating.) Yet according to the very models spitting out the alarming temperature predictions, such a modest rate wouldn’t avert the alleged problem.

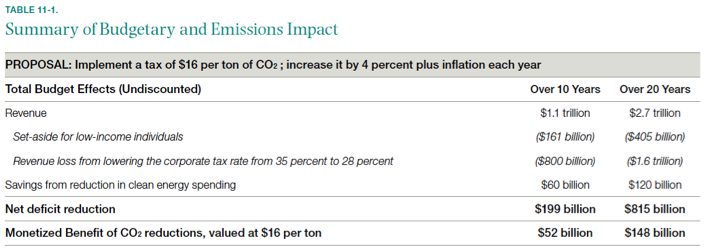

Returning to the Brookings study, look at the table summarizing the budgetary impact:

Keep in mind that “Revenue” means: This is how much the government is going to rake in from the proposed carbon tax. In the first decade alone, the study envisions a gross tax hike of $1.1 trillion. Far from being a benefit, this is a very alarming red flag of the policy.

Notice that $161 billion in the first ten years, and fully $405 billion in the first twenty, are devoted to “low-income individuals.” This refers to the fact that a carbon tax will have a hugely disproportionate impact on poorer households, because spiking gasoline, electricity, and heating costs will hurt them more than high energy prices hurts Bill Gates. The sizable numbers in the table indicate just how much the government would have to set aside—on paper—to make these people whole. That should first of all wake people up to the massive dislocations even this “modest” tax would cause, and it should also make the genuine friends of the downtrodden become very wary.

Can the federal government really be trusted to make sure nobody slips through the cracks? Does it really sound like a good idea to impose a trillion-plus dollar tax on the economy, only to give most of the money back in attempt to undo the damage? My “precautionary principle” says it’s safer to not impose the huge tax in the first place.

Similarly, does anybody really trust the government to permanently reduce corporate income taxes by $80 billion per year, even in a scenario with continued deficits and skyrocketing gasoline prices (caused by the carbon tax)? Surely in that context, the pressure would be for higher tax rates all around, especially on “the rich.” The government would not be able to permanently give a huge “handout for the rich” because of an alleged supply-side tax swap benefit.

Furthermore, the Brookings study is wrong for implicitly believing that a new carbon tax, coupled with a partial reduction in corporate taxes, would benefit the conventional economy. As I explain in this article, the economic literature on the “tax interaction effect” shows that even a totally revenue-neutral “carbon tax swap” deal would probably significantly hurt the conventional economy. When we factor in 15 percent of the carbon tax gross receipts being diverted as transfers back to poor individuals (leaving less on the table for income tax relief), the tradeoff becomes even worse.

Pass the Carbon Tax, So We Can Repeal Really Dumb Regulations

Later in the study, we find an argument for the carbon tax that is unintentionally hilarious:

A price on carbon will lower GHG emissions and spur innovation in low-GHG technology, and, therefore, a carbon tax will make many other, less-efficient energy and environmental regulations unnecessary. Indeed, an important component of the cap-and-trade bill passed by the U.S. House of Representatives in 2009 was the preemption of EPA CAA authority for some GHG emissions.

It is an odd situation indeed when we are touting the benefits of a carbon tax, by pointing to all the ways that the government currently screws things up. Rather than justifying a carbon tax, really such observations show why even more government regulations and taxes are dangerous. The same government that imposed “many other, less-efficient energy and environmental regulations” is going to be implementing the proposed carbon tax. Why would this same apparatus all of a sudden become a model of economic efficiency?

Conclusion

Economic studies can reach different conclusions—one decrying a carbon tax, the other praising it—by focusing on different attributes. As the NERA study showed, a carbon tax would significantly reduce GDP and real incomes, and would raise energy prices. This is especially true if the tax is punitive enough to significantly reduce US carbon dioxide emissions.

On the other hand, the new Brookings study embraces a carbon tax, because it treats trillions in government revenue as a good thing, and it unrealistically assumes (a) the government will devote the vast bulk of the new revenue to cutting taxes on corporations, and (b) a carbon tax hike in conjunction with an income tax cut will on net boost the economy. Finally, and quite hilariously, the study touts the carbon tax’s ability to rollback other government inefficiencies. As the old joke goes, the economist stranded on the tropical island tells his buddies, “Let’s assume a can opener.”