In a previous article, I explained that the federal gasoline tax was a very crude way to fund highways, because there is only a tenuous link between gasoline consumption and highway usage. Privatization, not tax hikes, would be a much better solution to fund infrastructure.

In this article, I’ll point out another problem with hiking the federal gas tax: Once you factor in state-level taxes on gasoline, you realize the fuel is already taxed far too much. Indeed, for the highest tax states, the proposal to raise the federal tax by 25 cents would mean the combined taxes would amount to almost a dollar per gallon (indeed it would be $1.02 for Pennsylvania!).

The fact that so many of our nation’s highways and local roads are in disrepair is evidence of government mismanagement, not of inadequate taxes. Indeed, the combined gas tax rate in is already at or well above the level one would set, using the “social cost of carbon” as reported by the EPA. It would be quite revealing if Republicans supported an unjustified tax on transportation that hits middle and lower income groups the hardest, so soon after they voted for an enormous reduction in corporate income taxes.

Gas Price Components

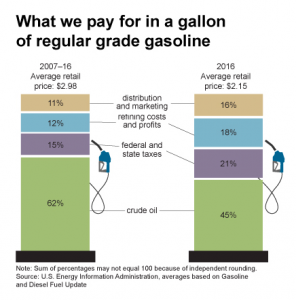

The Energy Information Administration (EIA) provides a handy graphic showing the components of the price of conventional gasoline:

As the figure shows, after crude oil, “federal and state taxes” are the largest component of the price at the pump—larger than distribution and marketing, and also larger than refining and profit margins.

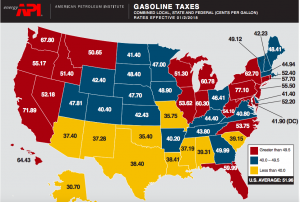

This might surprise some readers, who keep hearing about how allegedly paltry the federal gas tax is—currently 18.4 cents per gallon. The explanation is that the states and local governments have supplemented the federal tax with a taking of their own, which in some cases is enormous. The following chart from API illustrates the latest numbers:

Because gasoline taxes are built right into the price at the pump, most Americans don’t realize just how much money governments are various levels are collecting with every gallon sold.

What About Climate Change?

Interestingly, to the extent that one wants to justify gasoline taxes on climate change grounds, we are already above the “correct” level, according to the government’s own figures. Specifically, the so-called “social cost of carbon” right now is about $40/ton of CO2 (using the 3% discount rate which is considered standard in policy discussions). Using a standard calculator, that translates into about a 36 cents per gallon tax on gasoline.

As API’s map above indicates, the total taxes on gasoline in just about every state in the Union are already above that level, and hiking them an additional 25 cents would of course make gasoline that much more “overtaxed” on climate change grounds.

Now in fairness, we should acknowledge that the theory of carbon taxes is supposed to be levied purely on the “negative externality” aspect, above and beyond the “normal” costs. Proponents of gas taxes could argue that the taxes are serving two separate functions: a portion for highway funding and a portion to account for negative externalities. My modest point in this section was to show that simply invoking “climate change” isn’t a trump card (no pun intended) that justifies any and all tax hikes. On their own terms, proponents of a gas tax for climate change reasons have some ‘splaining to do.

Conclusion

Despite claims to the contrary, gasoline is not “undertaxed.” Taxes are currently 21 percent of the total price at the pump, and combined taxes on gasoline are already higher than the “proper” amount for climate change reasons according to the government’s own numbers. Yes, there are many highways, local roads, and other forms of infrastructure that could use improvement, but this just shows that governments at all levels are the wrong entities to provide these products.