Recently, the Democratic National Committee’s Platform Committee approved changes to the Democratic platform that include a commitment to “end subsidies for fossil fuels.” But what the DNC Platform Committee sees as “subsidies” for fossil fuels are actually commonplace business tax deductions that are in this case available to small independent oil and natural gas producers. According to the Independent Petroleum Association of America, independents produce 83 percent of our domestic oil and 90 percent of our domestic natural gas. One of the tax deductions is provided to all U.S. manufacturing firms, not just oil and gas producers, while many of the others are for typical business deductions in the tax code akin to research and development costs available to all industries.

Comparison of Federal Tax Expenditures

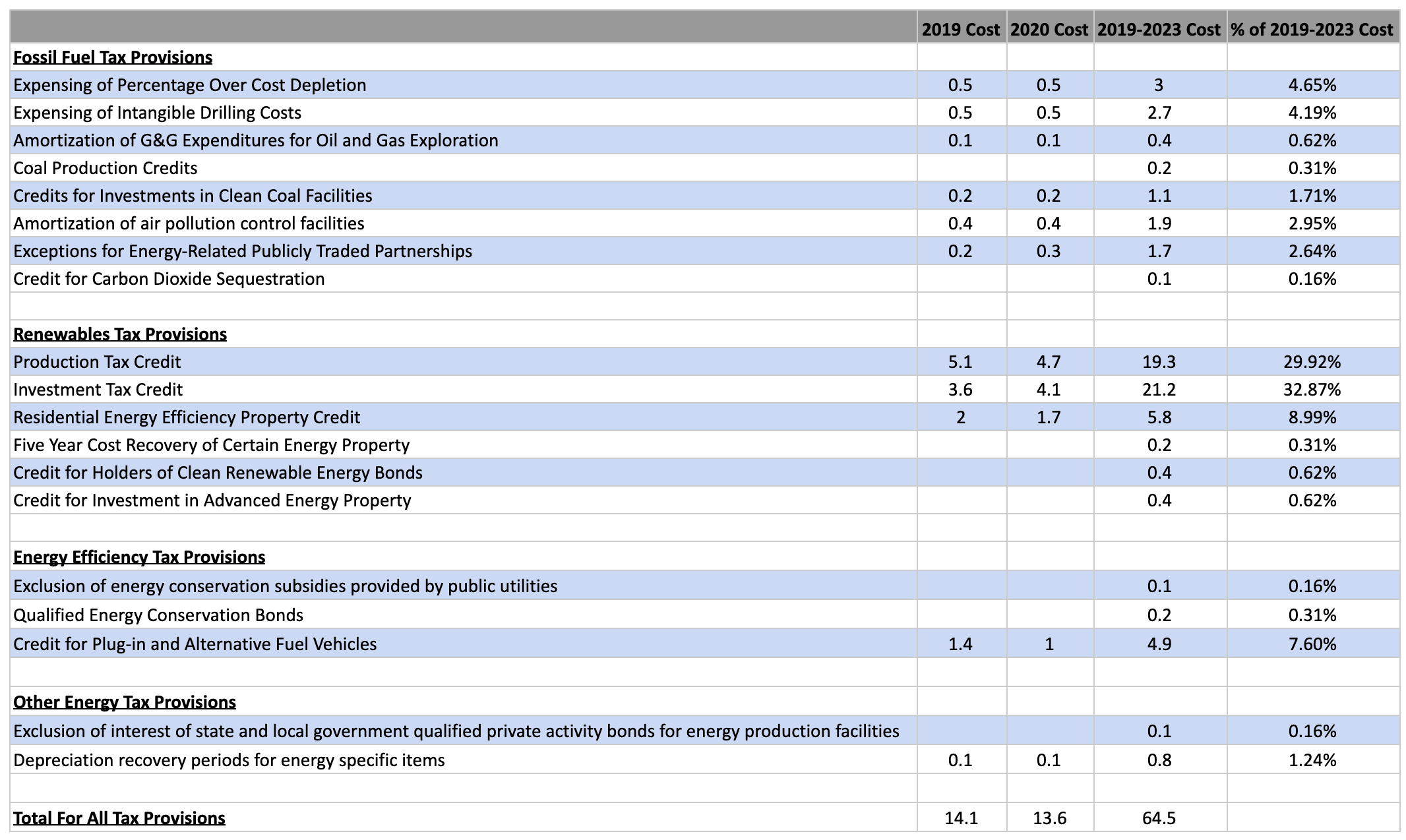

The Joint Committee on Taxation provides estimates of federal tax expenditures (how much the tax code helps various industries) with the most recent estimates covering fiscal years 2019 to 2023. In the table below, we have compiled the tax provisions into the following four categories: fossil fuels, renewables, energy efficiency, and other energy tax provisions. By far the largest category is for renewables, which total $47.3 billion over the 5-year period or 73 percent of all the energy tax provisions, which total $64.5 billion. The fossil fuel tax provisions total $11.1 billion over 5 years or 17 percent of the total for the energy tax provisions. Note that fossil fuels supply 80 percent of our energy while renewable fuels supply only 11 percent, despite receiving 73 percent of the federal energy tax provisions.

Federal Energy Tax Provisions and Their Budgetary Impact, Actual 2019 and Projected 2019-2023 Cost

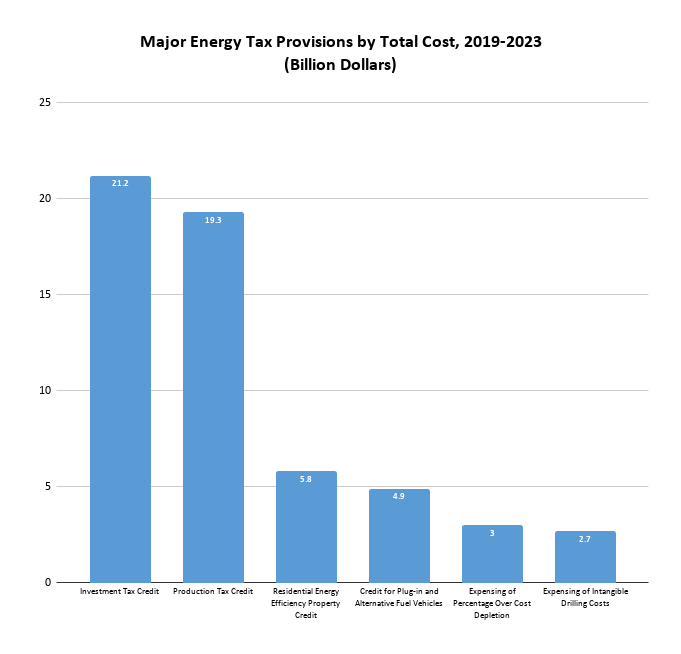

As the table above indicates, of the tax provisions that the Joint Committee on Taxation provides, by far those with the largest cost (in the sense of tax expenditures) are the Investment Tax Credit (ITC) at $21.2 billion and the Production Tax Credit (PTC) at $19.3 billion, both targeted to renewable energy, with solar ($20.8 billion) and wind ($17.9 billion) receiving the largest shares. They are followed by the residential efficiency property credit at $5.8 billion and the credit for plug-in and alternative fuel vehicles at $4.9 billion. The two costliest measures catering to oil and natural gas, namely the expensing of intangible drilling costs (IDCs) at $2.7 billion and percentage vs. cost depletion at $3.0 billion, constituted a much smaller budgetary impact. The figure below charts the six costliest items.

The two tax deductions that primarily affect small independent producers are the percentage depletion allowance and expensing of intangible drilling costs. As the oil and gas in a well is depleted, independent producers are allowed a percentage depletion allowance to be deducted from their taxes. While the percentage depletion allowance sounds complicated, it is similar to the treatment given other businesses for depreciation of an asset. The tax code essentially treats the value of a well as it does the value of a newly constructed factory, allowing a percentage of the value to be depreciated each year. This allowance was first instituted in 1926 to compensate for the decreasing value of the resource, and was eliminated for major oil companies in 1975. This tax deduction is estimated to save the independent oil and gas producers about $2.4 billion over the 5-year period.

Independent producers are also allowed to count certain costs associated with the drilling and development of wells as business expenses. The law allows the small producers to expense the full value of these costs, known as intangible drilling costs, every year to encourage them to explore for new oil. The major companies get a portion of this deduction—they can expense a third of intangible drilling costs, but they must spread the deductions across a five-year period. This tax treatment is also similar to that of other businesses for such investments as research and development. This tax deduction is estimated to save the independent oil and gas producers about $2.4 billion over the 5-year period.

Renewable Tax Credits

Tax credits are significantly different—and much more valuable, than tax deductions. Tax credits are essentially a dollar-for-dollar reduction in a company’s tax obligation (or even a government check in the event of “refundable tax credits” now being sought by some renewable energy businesses). Tax deductions reduce how much of one’s income is subject to taxes. The tax deductions of business expensing by fossil fuel businesses allows certain deductions against income, which are taxed at the corporate rate of 21 percent. A tax credit can be worth almost 5 times as much to a business as a tax deduction.

While tax credits are typically supposed to be temporary to allow for a young industry to get on its feet, the production tax credit for wind has been in place for 28 years and the increased investment tax credit for solar has been in place for 15 years, which should have been more than enough time for each industry to reach adulthood. This is especially true given that wind energy supporters were predicting nearly 40 years ago it would be able to compete without subsidies by 1990. Further, the investment tax credit for solar is permanent at the lower ten percent level for commercial installations.

The wind production tax credit has been extended a dozen times since 1999 and the House of Representatives voted to extend it again under the guise of coronavirus relief. Only this time, they want to allow for the option of direct payments rather than a credit on investors’ taxes, which they believe will encourage investment for businesses not making enough to pay any taxes. These are the aforementioned “refundable tax credits.” Currently, someone with a tax obligation to the government gets that obligation reduced on a direct dollar basis; this would allow companies that do not pay taxes to receive federal aid.

If elected, Democratic Party presidential candidate Joe Biden will extend these credits again in order to attain his ‘clean energy’ standard, despite their being—by far—the most expensive tax credits under current law. They are also the “least bang for the buck” in terms of energy received by taxpayers.

Conclusion

Politicians routinely call for removing subsidies from oil companies, which are tax deductions that are targeted to small and independent oil and gas producers. Fossil fuel tax expenditures total just 11 percent of total energy tax provisions over the 2019 to 2023 period, while supplying 80 percent of the nation’s energy. The lion’s share of subsidies are provided to renewable energy and energy efficiency, which produce little energy. Fear of climate change and the resulting Paris Accord has prompted countries to invest heavily in wind and solar energy. Countries are heavily subsidizing these technologies, but their investment has resulted in increased electricity prices and massive grid expansions with resultant costs, while costing government budgets and consumers billions in subsidies. If wind and solar truly make sense, the free market will support them without the need for subsidies and mandates. It is time to take the training wheels off.