President Biden believes he can get Senator Manchin to agree to a spending bill that will promote the Democrat’s progressive agenda and aid his goal of reducing greenhouse gas emissions by 50 percent from 2005 levels by 2030. But, were Biden to succeed in getting Congress to pass such a bill, energy prices would escalate much more than they already have due to Biden’s onerous policies on fossil fuels. For example, the proposed bill contains a methane tax that could increase natural gas heating costs by 17 percent amid an already expected increase of 30 percent, and other costs and restrictions on oil and gas development would send gasoline prices even higher.

Methane Tax

The Build Back Better bill contains an escalating tax on methane emissions by oil and gas producers that will reach $1,500 per ton by 2025. The fee helps to meet President Biden’s vow at COP26 to reduce global methane emissions 30 percent by 2030. This is something he alone has imposed on the U.S. economy, and is not written into law. The methane tax is estimated to raise $8 billion over 10 years—costs that producers will pass along to customers. About 180 million Americans use natural gas to heat homes and run appliances and about 5.5 million businesses use it to run their workplaces and manufacturing facilities. It is also the #1 source of electrical generation in the United States, which has allowed the United States to lead the world in reducing carbon dioxide emissions.

The Energy Information Administration (EIA) expects the U.S. households that primarily heat with natural gas (about 50 percent of all U.S. households) to pay 30 percent more this winter than they did a year ago and 50 percent more if this winter is cold. The American Gas Association estimates that the methane tax, if passed, could add another 17 percent to an average customer’s bill. The methane tax is regressive in that it hurts lower income families more than higher income families that have more discretionary income. It would also contribute to rising electricity prices for homes and businesses.

Other Oil and Gas Provisions

The House passed Build Back Better bill contains a long list of increases in federal royalties and fees, new fees and taxes, as well as barriers to leasing in the Arctic National Wildlife Refuge, the Pacific, Atlantic, and eastern Gulf of Mexico. The arbitrary new fees would add millions of dollars in operating costs, which will lower U.S. oil and gas production and turn the United States into an energy importing country, reversing the energy independence achieved under President Trump. This bill taxes American energy, restricts access to resources owned by Americans and advances ‘import-more-oil’ strategy that the Biden administration has been promoting—all of which will cost Americans more to heat their homes and fill their tanks with gasoline.

It was clear from the onset that the Senate would make changes to the bill. Some of the purported changes include lowering the rate increases for onshore federal oil and gas leasing fees from the increases in the House bill, eliminating a ban on new leases off the Atlantic, Pacific and East Gulf coasts and dropping new annual pipeline fees.

The Senate version would increase the minimum rate for royalties from onshore production from 12.5 percent to 16.7 percent— about 2 percentage points less than the 18.75 percent in the House bill. Offshore royalties would remain the same as with the House bill, with rates raised to no less than 14 percent, compared to 12.5 percent currently. The Senate version also keeps a provision charging royalties on all natural gas that a company produces, including gas that is consumed or lost by venting and flaring.

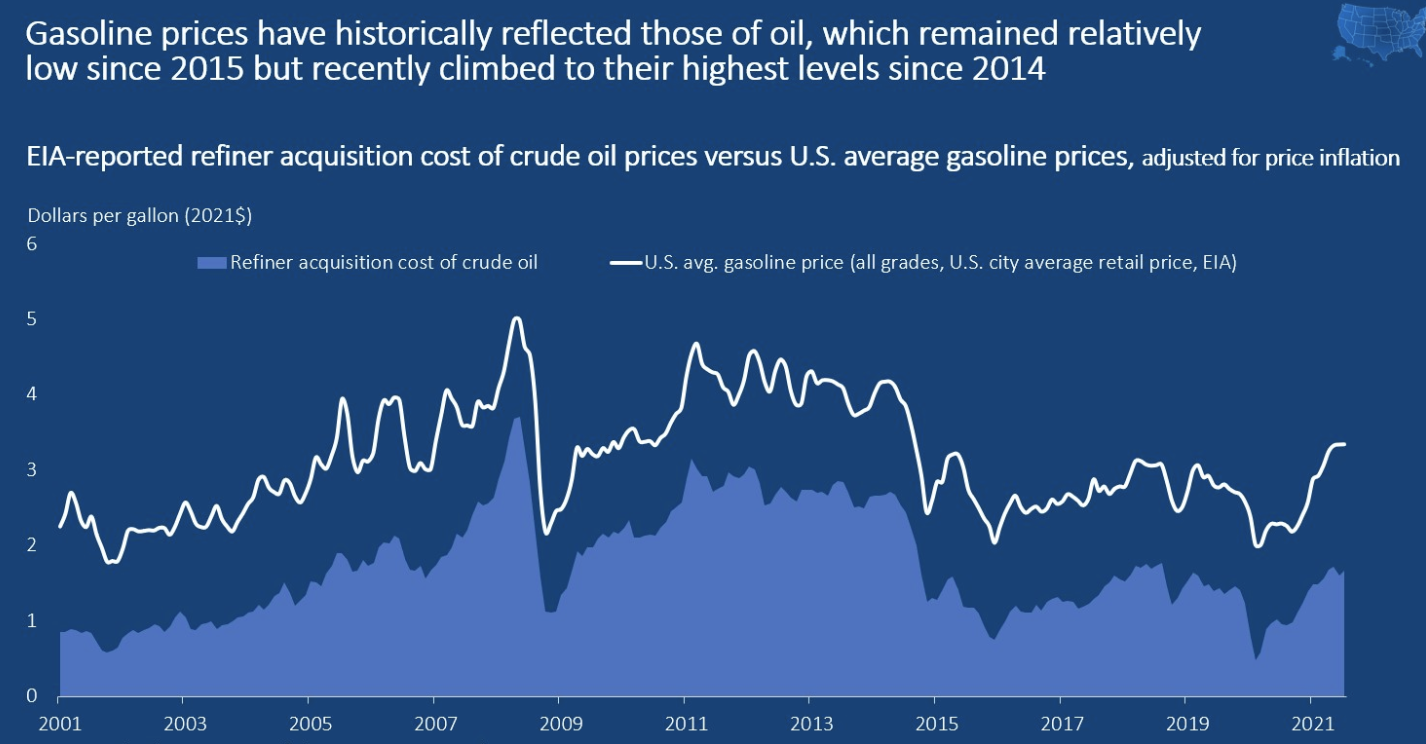

These new fees on domestic oil and gas production will benefit foreign producers, particularly OPEC and Russia, to the detriment of American consumers and workers, and increase gasoline prices further that have already increased over $1 a gallon since Biden took over the Presidency. They are now at the highest level since 2014 when the U.S. energy renaissance from hydraulic fracturing and horizontal drilling lowered oil prices and made the United States the largest oil and gas producer in the world.

Gasoline Prices Align with Oil Prices

According to the Energy Information Administration, crude oil accounted for 55 percent of the cost of a gallon of gasoline in November—the major component of gasoline prices. Over the past five to 10 years, the United States had abundant domestic oil production that led oil and refined product prices to run lower than international prices. But, after the COVID lockdowns were reversed, U.S. oil supply lagged demand, resulting in increased import-dependence and oil prices at their highest levels in seven years. Added to the supply demand imbalance were the onerous policies by the Biden Administration that canceled the Keystone pipeline, banned new leases on federal lands until overturned by the courts, and threatened higher royalty payments. Oil companies are reluctant to invest in new production when their products have come under attack from the Biden Administration on multiple fronts. Currently, U.S. crude oil production is down more than 1.5 million barrels per day compared with its highest levels in late 2019 and early 2020.

Conclusion

Despite high gasoline prices stressing the U.S. consumer and home heating prices expected to soar this winter, Congress and President Biden want to raise fees and increase red tape on the U.S. oil industry. The House Build Back Better bill provides oil and gas provisions that are punitive measures, including arbitrary new fees that would add millions of dollars in annual operating costs, pricing out U.S. production on federal lands and waters and taxing methane emissions from all production, even on private lands. These provisions benefit higher-emitting producers like Russia and China that wield their energy resources as a geopolitical tool, as is currently being done in Europe by Russia controlling their natural gas imports. The best remedy for lower energy prices would be a return to domestic production, and not begging an oil cartel to increase its output, as President Biden is doing. Biden wants to make fossil fuels more expensive to reduce their production and use and force people to use his preferred energy sources, but does not want the public to believe he is causing the energy price increases.