Coronavirus fears, closed office buildings, remote school instruction, travel restrictions, and closed destinations all combined to keep transportation fuel demand low this summer. In particular, demand for motor gasoline and jet fuel fell to their lowest level in years.

According to the Energy Information Administration, motor gasoline supplied by energy companies, a proxy for demand, remained at about 8.6 million barrels a day for two months through mid-August then increased to 9.2 million barrels a day during the week ended August 21. While that is an increase from a low in April of around 5 million barrels a day, it is well below the 9.7 million barrels a day from mid-March before lockdowns took place in much of the country. It also is below last summer’s driving-season peak of almost 10 million barrels a day.

Due to limited air travel, consumption of jet fuel remains weak. It fell to 0.5 million barrels per day in mid-April and increased to 1.1 million barrels per day during the week ended August 21—an increase of 147 percent. However, it remains below its 1.7 million barrel per day level in mid-march and 2.0 million barrel per day peak of last summer.

Jet Fuel

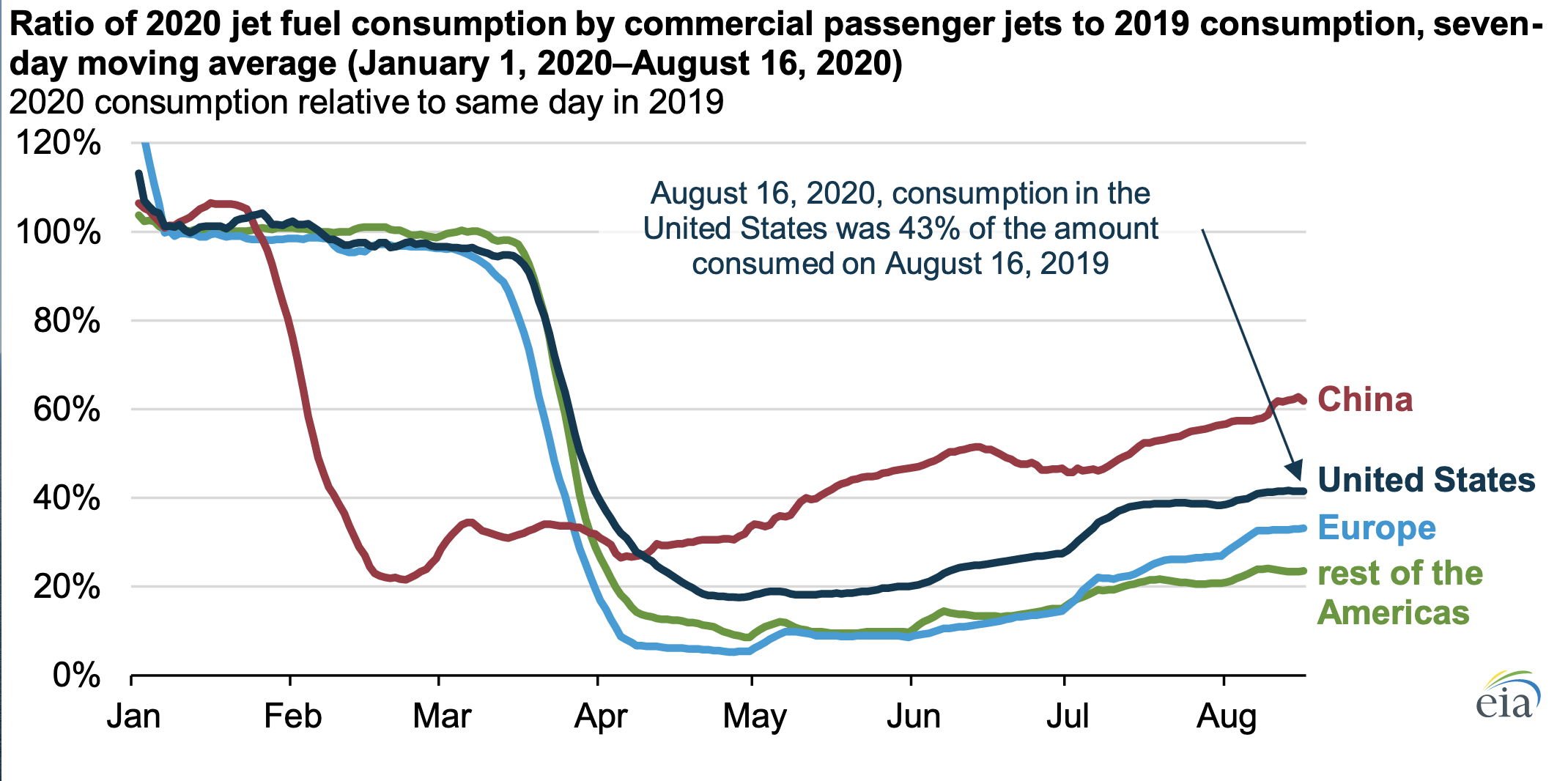

Despite the weakness in jet fuel consumption, according to the Energy Information Administration, U.S. jet fuel consumption has recovered faster than in other major aviation markets, except for China. The information is based on an analysis of flight-level data provided by Cirium on commercial passenger flights—a category of aircraft that accounted for 73 percent of total U.S. jet fuel consumption in January 2020.

In the United States, the decline in jet fuel consumption by commercial passenger flights was primarily driven by a decline in the number of flights. In January 2020, an average of 24,900 commercial passenger flights departed U.S. airports each day. By July 2020, flight volume declined to 13,700 per day—51 percent of the July 2019 level. Estimated U.S. jet fuel consumption by domestic commercial passenger flights declined by 47 declined between January 2020 and July 2020 compared with a decline of 70 percent for international flights during the same period.

As of August 16, 2020, consumption of jet fuel by U.S. commercial passenger flights was approximately 612,000 barrels per day, 42 percent of the estimated amount consumed on the same date one year earlier. That compares with year-ago levels from Europe (36 percent), the rest of Africa (31 percent), the Middle East and North Africa (30 percent), the rest of Asia (28 percent), and in the rest of the Americas (24 percent). Relative jet fuel consumption in China (including its Special Administrative Regions Hong Kong and Macau) was higher than in the United States—60 percent of the amount consumed in the previous year.

Source: U.S. Energy Information Administration

Distillate Fuel

Due to the drop in the demand for gasoline and jet fuel, refiners reduced their operations and made other changes that resulted in proportionately less production of motor gasoline and jet fuel and more production of distillate fuel oil. Beginning in April, refiners decreased overall refinery runs. They were 22 percent lower in April 2020 compared with the 2019 average of 17.0 million barrels per day.

Refinery yield for motor gasoline fell from its 2019 average of 46 percent to 41 percent in April and the refinery yield for jet fuel fell from its 2019 average of 10 percent to 5 percent in April as refiners produced less gasoline and jet fuel and more distillate. Distillate fuel increased its refinery yield from its 2019 average of 30 percent to 38 percent in April—its highest value on record. The refinery yields for gasoline and jet fuel were the lowest in the U.S. Energy Information Administration’s (EIA) monthly data series for refinery yields, which dates back to 1993. Refinery yields reflect the volumetric ratio of a finished product to refineries’ total inputs of crude oil and net inputs of unfinished oils. Refinery yields are zero-sum, meaning a decline in one product’s yield will mean an increase in another product’s or group of products’ yields.

Conclusion

The coronavirus pandemic hit the transportation fuels industry hard with a large downturn in demand for motor gasoline and jet fuel. As a result, refiners had to make adjustments and they both decreased their total production of petroleum products and changed their slate of products to produce more distillate fuel due to increasing demand from farmers and transporters as spring and summer approach. Compared to other countries, the United States had the second greatest improvement in jet fuel demand after the lockdowns—second only to China, the original source of the virus.