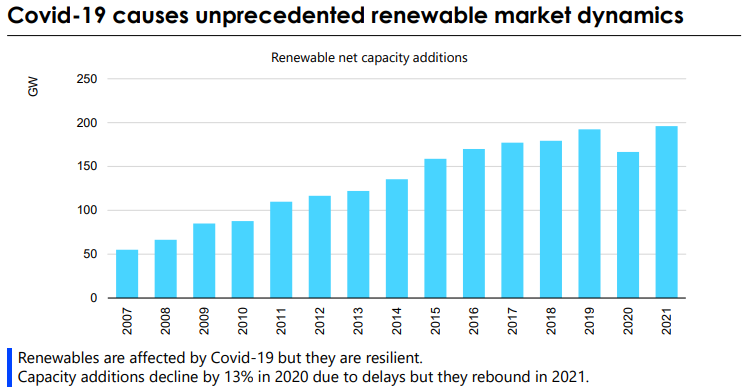

According to the International Energy Agency (IEA), 167 gigawatts of renewable capacity are expected to be added in 2020—a decline of 13 percent compared to 2019 additions and the first decline in growth in 20 years. The decline is a result of delays in construction activity due to supply chain disruption, lockdown measures, social-distancing guidelines, and emerging financing challenges. Despite the coronavirus pandemic, global installed renewable power capacity in 2020 is expected to increase by 6 percent and surpass the total power capacity of North America and Europe combined. Solar PV and wind are expected to account for 86 percent of global renewable capacity additions this year, despite a decline of 18 percent and 12 percent, respectively, compared to 2019.

According to IEA, in 2021, renewable power additions are expected to bounce back to 2019 levels, as most of the delayed projects come online and assuming a continuation of supportive government policies. But, the forecast is still 10 percent lower than projected before the pandemic. The 2020 and 2021 renewable forecasts are aided by the commissioning of two mega hydropower projects in China.

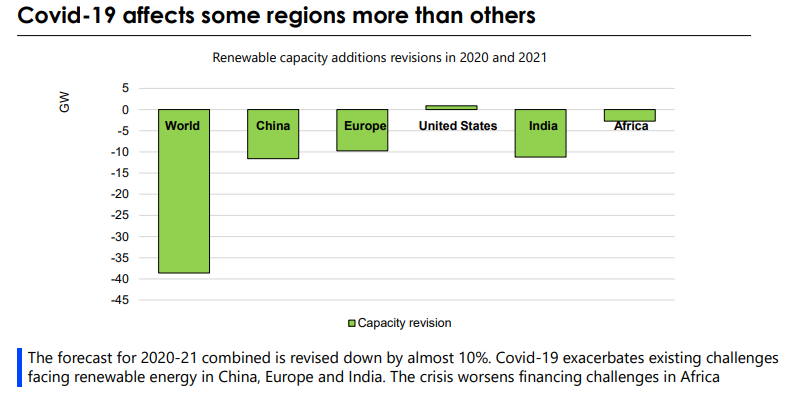

Almost all renewable mature markets are affected by downward revisions, except the United States where investors are pushing to finish projects before federal tax credits expire. Europe’s renewable capacity additions are expected to decline by one-third in 2020—their largest annual decline since 1996—and are expected to recover partially in 2021. The graph below shows the change in renewable capacity additions by region.

Solar

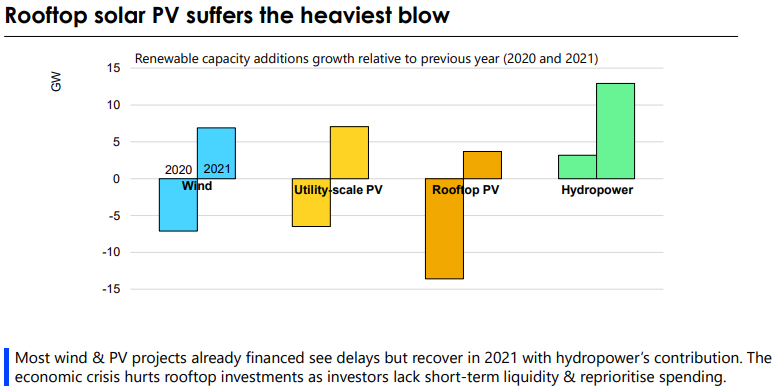

Solar PV is expected to account for over half of the renewable expansion in 2020 and 2021, but its additions are expected to decline from 110 gigawatts in 2019 to just over 90 gigawatts in 2020. Large-scale solar PV projects are expected to rebound in 2021, but overall installations are unlikely to surpass 2019 levels due to a significantly slower recovery of distributed solar PV as households and small businesses review investment plans.

Wind

Commissioning delays caused by the coronavirus have slowed the pace of onshore wind installations in 2020, but they should resume in 2021, as the majority of projects in the pipeline are already financed and under construction. Global offshore wind deployment is not expected to be as affected during this 2-year period because offshore projects have longer construction timelines than onshore projects.

Biofuels

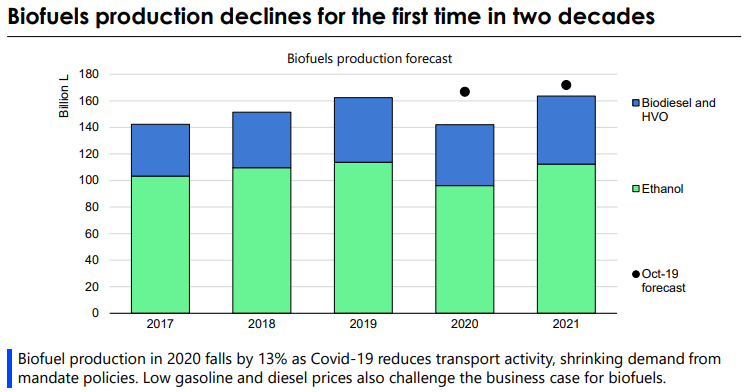

The coronavirus pandemic has radically changed the market for transport fuels and thus the global context for biofuels, which is driven by policies requiring suppliers to blend a set volume of biofuels with fossil transport fuels. Global biofuel production is expected to decline by 13 percent in 2020—the first decrease in output in two decades. Global gasoline demand is forecast to fall by 9 percent in 2020 and diesel demand by around 6 percent, limiting biofuel consumption from mandates. If transport fuel demand rebounds in 2021, biofuel production could return to 2019 levels, which would be 5 percent lower than the previous forecast for 2021 before the coronavirus pandemic.

Renewable Heat Consumption

The global consumption of renewables for heating is expected to decline in 2020. The dip in oil and natural gas prices is affecting the cost-competitiveness of renewable fuels and technologies that provide heating. Many planned investments to switch from fossil-fuel heating to renewable or electric alternatives are expected to be postponed or cancelled. The industrial sector is expected to consume less renewable heat as lower commercial, industrial and construction activity during lockdown results in a demand loss for most heat-intensive industries.

Conclusion

The IEA expects global renewable capacity and production to increase in 2020 despite the coronavirus pandemic—the only fuel to see an increase in output. According to IEA, the coronavirus pandemic exacerbated existing challenges for renewable energy deployment, with rooftop solar PV, transport biofuels and renewable heat expected to be hit the hardest. Even with IEA’s rebound projected for renewable energy in 2021, the forecast is revised down by 10 percent compared with the previous IEA projection.