The Swedish government recently announced the discovery of a huge rare earth deposit, heralded as the largest such discovery in Europe. It holds an estimated 1 million metric tons of rare earth oxides, a group of 17 elements, in the Kiruna area in the far north of the country, according to the government-owned mining firm, LKAB. Rare earth minerals are essential to many high-tech manufacturing processes such as electric vehicles, wind turbines, portable electronics, microphones and speakers. Rare earth elements are currently not mined in Europe, leaving the region dependent on imports. The vast majority of rare earths are currently mined and processed in China, meaning that Europe’s energy transition will make it dependent on another autocratic country—going from importing Russia’s oil, natural gas and coal to importing China’s rare earth elements. China’s dominant position gives the government leverage over pricing of the metals as well as the potential to restrict supplies to rivals. In 2010, China halted exports of rare earths to Japan for two months over a fishing dispute.

The Swedish discovery will not be fruitful soon. LKAB plans to submit an application for an exploitation concession in 2023 but added that it would be at least 10-15 years before it could potentially begin mining the deposit and shipping to market because of the lengthy environmental studies and other work required to open a mining facility in Europe. The process of approving new mines is lengthy because those operations often raise the risk of impacting water resources and biodiversity. According to Erik Jonsson, senior geologist at the Department of Mineral Resources at the Geological Survey of Sweden, Europe currently lacks full-scale capacity to process rare earth metals and to make intermediary products. The focus needs to be on the entire value chain to lessen dependency on autocracies for these metals and products such as high efficiency magnets that are needed for wind turbines or traction engines in electric vehicles.

Unless European permitting procedures could be shortened in a way that is acceptable to investors, the find is unlikely to make a big difference to the global supply picture anytime soon. There is no large-scale mining of rare earths in the European Union, partly because of the difficulty of creating new mines and facilities to refine the metal ores. Nonetheless, LKAB executives are planning a process intended to eventually provide Northern Europe both the ability to extract rare earths and to process them. LKAB recently became the largest shareholder in a Norwegian company, REEtec that specializes in separating out rare earths, like neodymium, which is used to make magnets. The plan would be to have REEtec, whose technology is said to be more environmentally friendly than older processes, build a plant in Sweden.

In northern Sweden, rare earths are found in iron ore deposits. The new find is near a large iron ore mine near Kiruna that has rare earths in quantities that are less concentrated than in the new find. The company plans to build a tunnel several miles long from the iron ore mine into the new rare earths deposit, to assess the resources. The economy in Kiruna has relied on mining for more than a century, but new extraction activity will need to be balanced with other activities including preserving nature and safeguarding reindeer herding in the region by the Sami people. Also, provision for adequate energy supplies is necessary because mining and processing requires substantial energy.

China Controls the Process from Mining to Magnets

China controls about 90 percent of the global market for the high-output magnets that are used in electric vehicles and wind turbines. China has a near-monopoly on the global supply chain for both the rare earths and the sintered magnets that are critical to electric vehicles and wind turbines. Both use high-output magnets that contain neodymium, one of the most important of the rare earths. Neodymium-iron-boron magnets are often combined with two other rare earths elements, praseodymium, and terbium, to perform better in high-temperature environments. The European Union imports 99 percent of its rare earth elements from China, according to a 2020 report.

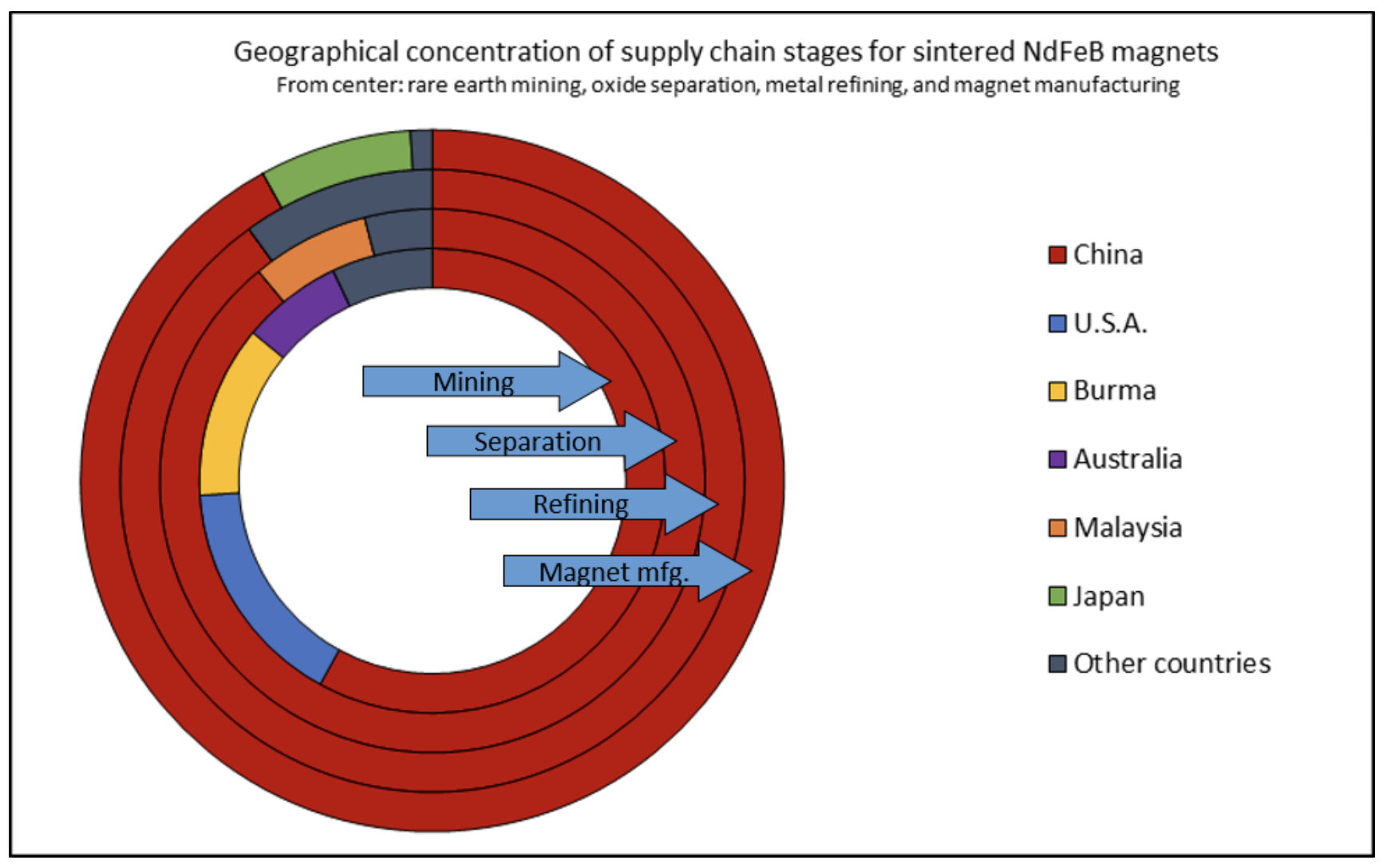

According to a U.S. Department of Energy Report: While the mine production of rare earth elements has diversified since 2012, China accounts for an estimated 89 percent of total rare earth separation capacity, an estimated 90 percent of total metal refining capacity, and approximately 92 percent of global sintered magnet manufacturing. The United States, by comparison, accounted for about 16 percent of total rare earth mine production in 2020 (up from less than 1 percent in 2012), but does not separate rare earths or refine them into metals, and produces less than 1 percent of the world’s magnets. There are plans to add domestic capacity in each of these areas in the United States, but permitting reform would be needed.

The following figure shows how the supply chain for magnets is highly concentrated in China, especially as it moves further down the supply chain from mining, to separation, to metal refining, and to magnet manufacturing.

Greenland

Deposits of rare earths exist on Greenland, which is legally an autonomous part of Denmark, and have attracted interest from the mining industry. However, a Chinese company has been blocked from opening a mine on the island because of contamination fears. President Trump wanted to purchase Greenland from Denmark when he was in office because of their substantial natural resource wealth. During WWI, the United States purchased the Virgin Islands from Denmark.

Conclusion

Sweden’s large rare earths’ find is a positive step, but without permitting reform, it is likely to take 10 to 15 years before mining can occur. But, mining is only one step in the process of producing magnets needed for electric vehicles and wind turbines. Meanwhile, China has currently almost a complete monopoly on the supply chain from mining to producing magnets and is in the position to control their pricing and availability. It will be difficult for the United States and Europe to move quickly on China’s monopoly due to environmental laws and permitting issues and the push by politicians to transition to renewable energy and electric vehicles quickly. The result will be dependency on an autocratic ruler or sheer chaos with insufficient energy as politicians are shuttering fossil fuel plants and facilities while they push for renewable energy, which is controlled more by China than the world’s oil supplies were ever controlled by OPEC.