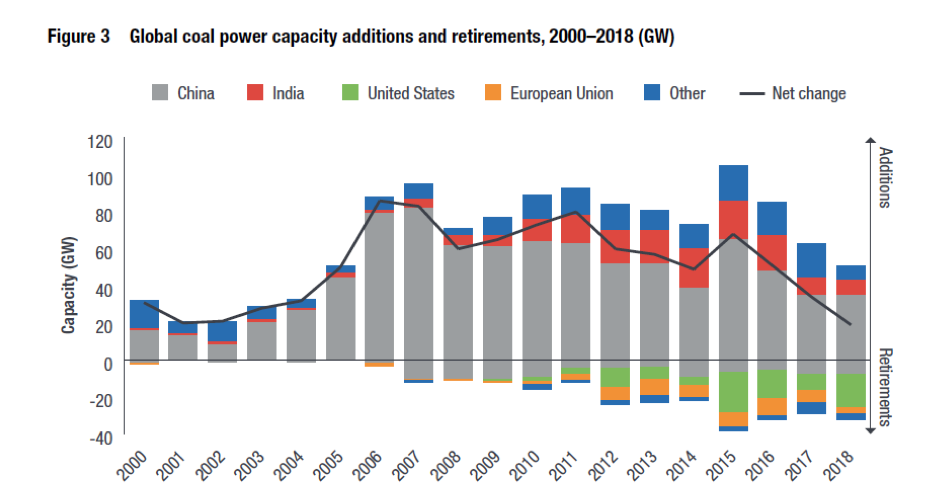

U.S. coal plants are closing due to low natural gas prices, state mandates, and federal subsidies for renewable energy, mainly solar power and wind energy. Two coal-fired plants to close by the end of this year are The Navajo Generating Station in Arizona and the Bruce Mansfield coal plant in Pennsylvania—both large coal plants that have been producing power for decades. The third unit to the Paradise coal plant in western Kentucky is expected to close next year. The Tennessee Valley Authority closed two of Paradise’s three units in 2017. Previously, smaller coal fired plants were retired. In 2015, the United States closed 15 gigawatts of coal-fired capacity—about 5 percent of the coal fleet—which remains a record on coal capacity retirements in one year. In 2018, 14 gigawatts of U.S. coal capacity were retired.

This is in sharp contrast to the capacity plans of developing countries, particularly in Asia, that are viewing coal, because of its affordability and reliability, as their main option in powering their countries to provide electricity to their population and to improve their economies. India, for example, is building a new large (1,600 megawatt) coal-fired power plant costing nearly $2 billion. Coal to fuel the plant will be imported from Australia’s Carmichael project and the electricity will be exported to nearby Bangladesh. The project has been approved for two loans—a $700 million loan from the state-owned lender that funds power plants and for another $700 million loan from a second state-owned company designed to help electrify Indian villages.

Further, subsidies for coal-fired power plants have almost tripled from just over $17.2 billion per year (average for 2013–2014) to nearly $47.3 billion per year (average for 2016–2017) in the Group of 20 countries, according to a study by the Overseas Development Institute and two other groups (Natural Resources Defense Council and the International Institute for Sustainable Development). The report finds that they have furthered increased to at least $63.9 billion per year in government support to the production and consumption of coal, with almost three-quarters of the support identified being directed to coal-fired power production. G20 governments support coal through $27.6 billion in domestic and international public finance, $15.4 billion in fiscal support, and $20.9 billion in state-owned enterprise investments per year (e.g., China investing almost $8.8 billion and India investing over $6.4 billion annually). These subsidies include support for facilitating the transition away from coal.

G20 Coal Subsidies Report

The subsidies consist of:

- Public Finance. For example, Japan provides public finance for coal overseas ($5.2 billion per year) and China, which is the world’s largest consumer of coal for power generation and industry, also provides international public finance for coal mining and coal-fired power overseas ($9.5 billion per year).

- India’s banking system is dominated by domestic public institutions that together provide about $10.6 billion per year of public finance for coal mining and coal-fired power domestically.

- Canada, China, and Germany are among countries whose governments have been providing support for rehabilitation of mining sites and for helping workers and communities. There is limited information as to the beneficiaries of this support and the conditions regarding phase-out commitments and deadlines.

- G20 governments provide subsidies for energy transitions that continue to support coal-fired power. These include subsidies for capacity mechanisms (designed to guarantee security of power supply) in France, Germany, Italy, Russia, South Korea, Turkey, and the United Kingdom, the allocation of free allowances to industry under the European Union Emissions Trading Scheme, research and development support for coal-fired power generation with carbon capture and storage, and for co-firing of biomass with coal.

- Several countries provide subsidies to the consumption of coal-fired power. For example, Indonesia, provides over $2.3 billion in fiscal support per year to compensate electricity generators for the increase in coal prices and for having to sell electricity to domestic consumers under regulated prices. Similar subsidies relating to below-market prices for electricity consumers exist in China, Mexico, Russia and South Africa, with much of the consumption coming from coal-fired generation.

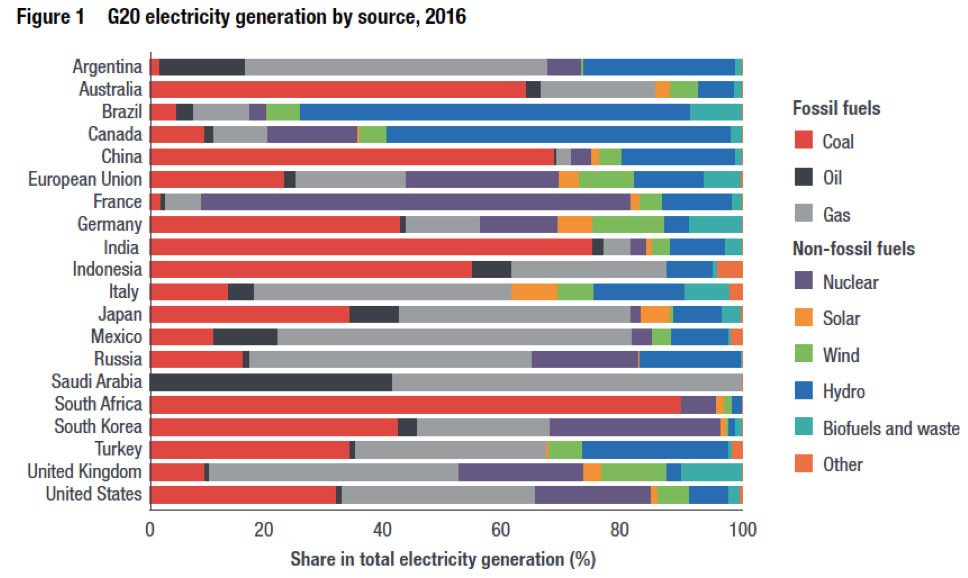

Below is a graph depicting the G20 countries and their generation fuel shares in 2016. Note that some countries (e.g., the United States) have changed their shares considerably in the last two years. The United States now gets 27 percent of its generation from coal, 17 percent from renewable energy including hydropower, and 35 percent from natural gas.

Conclusion

While the United States is retiring coal-fired power plants, developing Asia (particularly China and India) is building them due to their affordability and reliability. Further, many G20 countries, both developing and developed, are subsidizing the construction of coal-fired plants through domestic and international public finance, fiscal support, and state-owned enterprises. They apparently see coal plants as long term investments for stable and affordable electrical generation.