Wind turbine costs are expected to increase 10 percent over the next 12 to 18 months due to rising raw-material costs and the costs and complexities of transporting the huge machines. Despite companies facing increased manufacturing costs and problems moving the increasingly large turbines, whose blades can span more than a football field, the demand for wind turbines this decade is expected to double the demand in the previous 10 years as the world transitions to renewable energy. A quadrupling of transportation costs and increases in steel, copper, aluminum and carbon fiber prices are expected to increase wind-turbine prices by 10 percent over the next year to 18 months. Prices for raw materials used in wind turbines started rising in mid-2020 and those higher costs are expected to continue. Higher oil prices this year have raised the cost of the fuels used to move wind-turbine supplies and equipment.

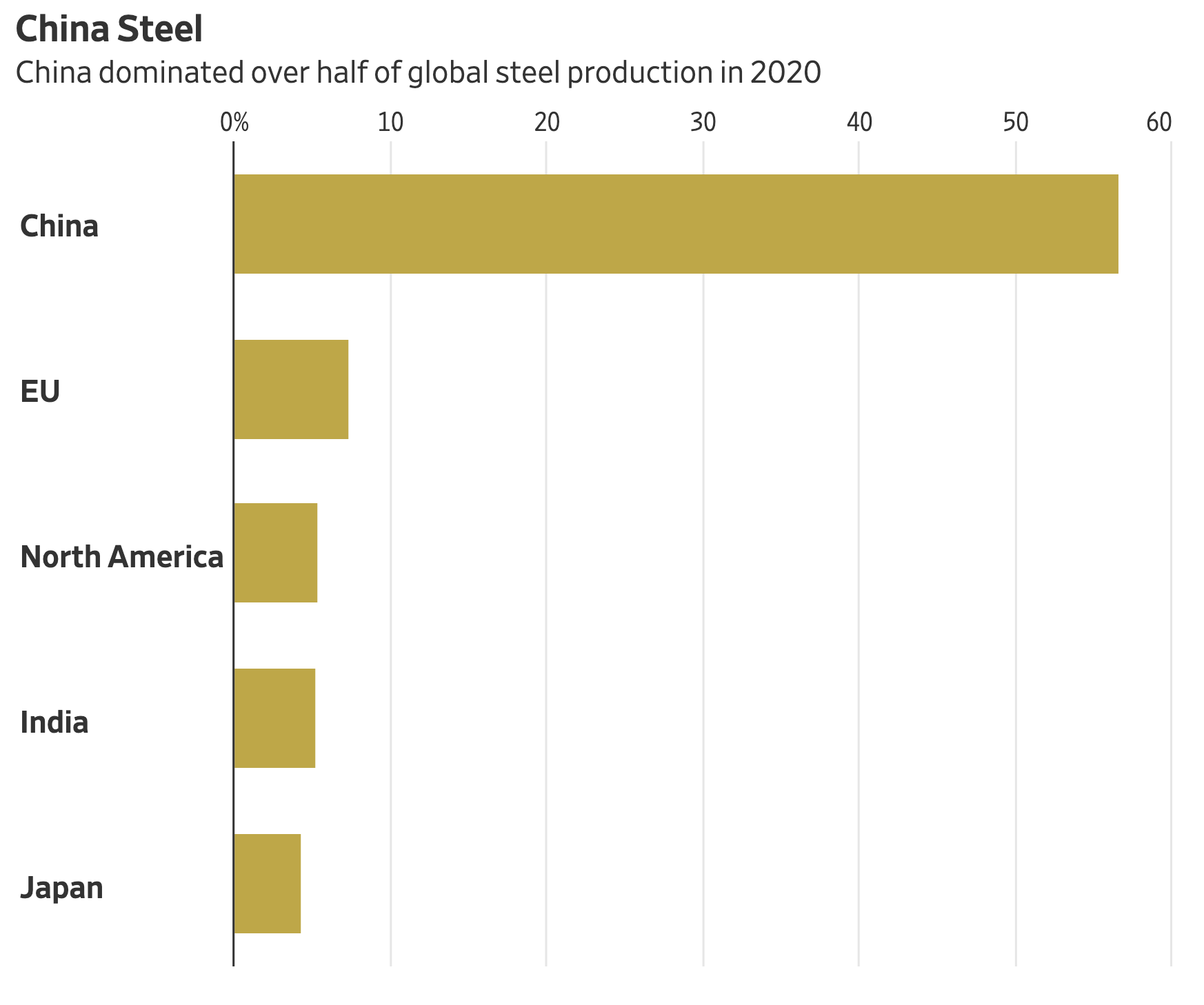

According to a report from the National Renewable Energy Laboratory, wind turbines are predominantly made of steel (71 to 79 percent of total turbine mass); fiberglass, resin or plastic make up 11 to 16 percent; iron or cast iron make up 5 to 17 percent; copper (1 percent); and aluminum (0 to 2 percent). China produces 57 percent of the world’s steel and has temporarily curbed steel supply, which is one reason steel prices have sky-rocketed in 2021. China’s steel furnaces are relatively new, with an average age of 12 years, compared with 53 and 45 years in North America and Europe, respectively. In the first half of 2021, 18 new blast furnace projects were announced in China. About 90 percent of China’s steel is made using blast furnaces that are less carbon efficient than electric arc furnaces.

Steel generates 7 percent of global carbon-dioxide emissions related to energy consumption—more than any other industrial sector. According to the World Steel Association, over 70 percent of steel is produced using the blast furnace process, in which coal is burned at high temperatures to reduce the oxygen in iron ore, turning it into steel. To reduce emissions, some companies are melting scrap metal to make new steel, or employing direct reduced iron, where oxygen is taken out without it being melted in a furnace.

In the United States, 70 percent of steel production is made using electric arc furnaces to melt scrap metal–a process that uses only about an eighth of the energy used in steel produced from iron ore. According to the American Iron and Steel Institute, the United States recycles enough steel scrap to build 25 Eiffel Towers every day. But, only about 13 percent of global steel production comes from the European Union, United Kingdom and North America combined, according to the World Steel Association. China produces over 4 times as much steel.

China’s Carbon Reduction Commitment

China’s commitment to the Paris climate accord is to cap its carbon dioxide emissions by 2030, and to become carbon neutral by 2060. To do so, it must curb its steel making sector, whose demand is high due to China’s housing and construction industry, and it must use less carbon intensive energy. The iron and steel sector is the largest industrial energy consuming sector in China—accounting for 13 percent of the nation’s energy use in 2018. China’s other heavy industrial sectors like nonferrous metals, cement, glass and chemicals together account for around a quarter of its energy consumption.

Coal represents 57 percent of the nation’s energy supply. To achieve peak emissions in 2030, China would need both enormous investments in clean power and dramatically curb growth in the housing-related heavy industrial sectors that account for close to 40 percent of total energy demand. While the overall energy efficiency of China’s economy continues to improve, the pace of reducing its carbon intensity has slowed dramatically since 2016—partly because property investment has increased since the real-estate crash of 2014 and 2015.

The output from its industrial and energy sectors and its building program point to China missing its commitment to the Paris climate agreement. Of course, that does not stop President Joe Biden from forcing “green technology,” encouraged by high subsidies paid by taxpayers into the U.S. economy to meet his goal of reducing greenhouse gas emissions by 50 to 52 percent by 2030. While the United States buckles under the Paris accord Biden committed the United States to, China will continue to emit greenhouse gases and remain the highest emitting country in the world.

Conclusion

President Biden intends for the United States to have a zero-carbon generating sector by 2035. To do so, the grid’s carbon-producing electric technologies that generate over 50 percent of the country’s electricity must be replaced with wind and solar energy. Wind turbine costs are estimated to increase by 10 percent over the next 12 to 18 months as the costs for the materials needed to make turbines and the costs for transporting them increase. One of the major components of a wind turbine is steel and China makes 57 percent of the world’s supply. Steel production is very carbon-intensive, so China would need to scale it back to meet its commitments to the Paris climate accord. But, China shows no signs of doing so as it is building additional blast furnace facilities that last 5 decades or more. China also uses coal for over 50 percent of its energy needs—the most carbon intensive energy fuel. It is unlikely that China will meet its Paris climate commitments, but President Biden is ignoring that issue and forcing Americans to comply with his goals. Sound familiar?