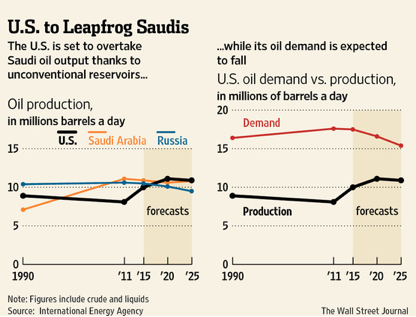

The International Energy Agency (IEA) is telling us what we already know[i]: the shale oil boom will make the global energy picture with the United States as the top oil and natural gas producer. According to the IEA, the United States will become the world’s largest producer of oil by 2017 overtaking both Saudi Arabia and Russia. By 2030, North America will become a net exporter of oil and, by 2035, the United States becomes almost self-sufficient in energy.[ii]

IER has long said that the United States has vast energy resources and we have emphasized that fact with publication of the North American Energy Inventory last December.[iii] What we needed was the policy and/or technology to make it happen. Because of the Obama Administration’s anti-fossil fuel policies, the growth that IEA is projecting is a result of technology. The IEA even hinted that this newly found U.S. energy independence could redefine military alliances, with Asian nations, instead of the United States, needing to secure oil shipping lanes.[iv]

The IEA also forecast that the United States will rely more on natural gas than either oil or coal by 2035 due to its cheap domestic supply and uses by industry and electricity generators. Electricity prices are expected to be about 50 percent cheaper in the United States than in Europe as a result of the increase in the number of power plants fueled by cheap natural gas.

Globally, the IEA indicates that fossil fuels will dominate the world’s energy picture as it has in the past. But, in the power sector, the agency believes that renewable energy (wind, solar, and hydroelectricity) use worldwide will be second to coal by 2035 due to technology improvements and continued subsidies. The IEA projects an increase in global renewable energy subsidies from $88 billion in 2011 to $240 billion in 2035.[v]

Source: http://professional.wsj.com/article/SB10001424127887323894704578114492856065064.html?mg=reno64-wsj

The IEA Forecast for the Oil Sector

According to the Energy Information Administration, the United States met 83 percent of its energy needs domestically in the first six months of this year. For the first nine months of the year, the U.S.’s net dependence on petroleum imports was 42 percent, with net petroleum imports averaging 7.75 million barrels per day. Gross petroleum imports average over 10 million barrels per day and the IEA expects them to drop to about 4 million barrels per day in 10 years because of new domestic oil production and reduced oil demand from stricter fuel efficiency standards. By 2035, the United States is expected to import less than 2 million barrels per day. The IEA expects the United States to produce 11.1 million barrels of oil per day in 2020 and 10.9 million barrels per day in 2025; 500,000 barrels a day and 100,000 barrels a day more, respectively for those years than Saudi Arabia is expected to produce.[vi]

But, according to the IEA, Saudi Arabia is expected to regain its ranking as the number one oil producer again by 2030, producing 11.4 million barrels per day compared to 10.2 million barrels per day for the United States. By 2035, the difference is expected to expand with Saudi Arabia producing 12.3 million barrels of oil per day compared to 9.2 million barrels per day for the United States. Thus, after 2025, the world is expected to rely increasingly on OPEC for oil and by 2035, almost 90 percent of oil from the Middle East is expected to be exported to Asia. OPEC’s share of world oil production is expected to increase from 42 percent to 48 percent.

Besides Saudi Arabia increasing oil production, Iraq is expected to account for 45 percent of the growth in global oil production. Iraq will increase its oil production from 3.4 million barrels per day today to 6 million barrels per day by 2020 and over 8 million barrels per day by 2035, becoming the second largest oil exporter, overtaking Russia. Russia’s oil production is expected to stay flat at over 10 million barrels per day until 2020, and decline thereafter to just above 9 million barrels per day by 2035. Russia is expected to continue to be the world’s largest energy exporter through 2035, with its revenue from fossil fuel exports increasing from $380 billion in 2011 to $410 billion in 2035.

Depending on the scenario, IEA expects real oil prices in 2011 dollars in 2035 to be either $125 or $145 per barrel.

Global Energy Demand

The IEA expects global energy demand to grow between 35 and 46 percent from 2010 to 2035, depending on whether policies that have been proposed are put in place. Most of that growth will come from China, India, and the Middle East, where demand is growing rapidly. IEA expects fossil fuels to dominate the energy mix through 2035 and coal’s share of primary energy demand is expected to decrease only slightly by 2035. The U.S.’ reduced reliance on coal in the generation sector due to inexpensive natural gas means that coal will be used in other places, according to the IEA. The IEA expects China’s coal demand to peak around 2020 and then stay flat until 2035, and in 2025, it expects India to overtake the United States as the world’s second-largest coal user.[vii]

The IEA predicts that the Chinese real gross domestic product will increase by 5.7 percent per year between 2011 and 2035. The Chinese economy is expected to overtake that of the United States in terms of purchasing power parity soon after 2015 and in terms of market exchange rates by 2020.

The IEA also expects the world’s population to increase by 1.8 billion to 8.6 billion, increasing world oil demand to 99.7 million barrels per day in 2035 from 87.4 million barrels per day in 2011.

Renewable Energy

IEA expects wind installations, solar facilities, and hydroelectric dams to become the second biggest power generator in 2015 and rise to almost a third of all generation in 2035, rivaling coal. The rise in renewable energy is due to subsidies, falling technology costs, rising fossil-fuel prices and carbon pricing. The Global Wind Energy Council expects installed wind turbines to more than double to 493 gigawatts in 2016 from 2011 levels and the European Photovoltaic Industry Association expects cumulative solar panel installations to triple to 208 megawatts in 2016 from about 70 megawatts in 2011, even though manufacturers of wind turbines and solar panels struggle with over capacity. To achieve this, the IEA expects global renewable energy subsidies to increase from $88 billion in 2011 to $240 billion in 2035.

Conclusion

The IEA in its World Energy Outlook 2012 is predicting that fossil fuels will dominate the energy sector through 2035 and that the United States will become the world’s largest oil producer by 2017, overtaking both Saudi Arabia and Russia. The IEA is not the only agency with this prediction; Citigroup Inc. indicated that the United States will achieve this goal before the end of this decade. The IEA also expects that the United States will become almost energy independent by 2035 and that OPEC will be exporting 90 percent of its oil to Asia, changing the security dynamics in the Middle East.

[i] International Energy Agency, World Energy Outlook 2012, November 2012, http://www.iea.org/publications/freepublications/publication/English.pdf

[ii] Reuters, U.S. to overtake Saudi as top oil producer: IEA, November 12, 2012, http://www.reuters.com/article/2012/11/12/us-iea-oil-report-idUSBRE8AB0IQ20121112

[iii] Institute for Energy research, North American Energy Inventory, December 2011, http://www.energyforamerica.org/wp-content/uploads/2012/06/Energy-InventoryFINAL.pdf

[iv] Wall Street Journal, Shale Boom to Turn U.S. Into World’s Largest Energy Producer, Watchdog Says, November 12, 2012, http://professional.wsj.com/article/SB10001424127887323894704578114492856065064.html?mg=reno64-wsj

[v] Bloomberg, Renewables to Rival Coal for Power Generation in 2035, November 12, 2012, http://www.bloomberg.com/news/2012-11-12/renewables-to-rival-coal-for-power-generation-in-2035.html

[vi] Bloomberg, U.S. Oil Output to Overtake Saudi Arabia’s by 2020, November 12, 2012, http://www.bloomberg.com/news/2012-11-12/u-s-to-overtake-saudi-arabia-s-oil-production-by-2020-iea-says.html

[vii] New York Times, U.S. to be World’s Top Oil Producer in 5 Years, Report Says, November 12, 2012, http://www.nytimes.com/2012/11/13/business/energy-environment/report-sees-us-as-top-oil-producer-in-5-years.html?nl=todaysheadlines&emc=edit_th_20121113