The Environmental Protection Agency (EPA) recently denied almost all of the outstanding requests from oil refiners for biofuel waivers. EPA denied 26 petitions from 15 small refineries that applied for waivers for the 2016-2018 and 2021-2023 compliance years. The Renewable Fuel Standard (RFS) requires refiners to blend billions of gallons of biofuels into the nation’s fuel mix or buy tradable credits (known as RINs). The EPA can award exemptions to some small refiners if they prove that the obligations cause them undue harm. The EPA under Biden has not extended any waivers to any refineries, reversing the policy of former President Donald Trump, whose administration granted 34 exemptions to oil refiners for the 2017 compliance year. Renewable fuel credits for the 2023 compliance year are around $1.50 per gallon. There are still two pending petitions.

A group of refiners plan to file a lawsuit challenging the EPA rejection of the waivers, which has left some refiners on the hook for hundreds of millions of dollars. The costs that refiners must pay serve to increase the prices of gasoline and diesel for consumers. The small refiners believe EPA’s decision is arbitrary, capricious, and contrary to law that allows for the exemptions in such cases. Two refiners, Par Pacific and CVR Energy, have some of the largest outstanding obligations. Par Pacific’s gross RINs and environmental credit obligations stood at $347 million at the end of the first quarter 2023, based on market pricing then. CVR Energy’s outstanding liability was about $582 million at the end of the first quarter. These additional costs make it more difficult and expensive to produce energy for consumers.

Bipartisan Legislation to Lower Compliance Costs

To help small refiners remain in business, a bipartisan group of U.S. lawmakers introduced legislation directing the Biden administration to allow oil refiners to purchase compliance credits for biofuel blending at a lower, fixed cost compared to the open market. The proposal would reduce compliance costs associated with the RFS and help refineries stay afloat at a time of instability in global energy markets. The rising compliance costs are driven by fuel mandates that are out of step with domestic fuel demand. Under the proposed bill, refiners could buy credits around conventional biofuel blending, which includes corn-based ethanol blending, at the fixed price if they are not able to obtain them in the market at cost-effective levels.

EPA Sets RFS Fuel Mandates

The RFS program was established in 2005 and vastly expanded under the Energy Independence and Security Act of 2007, which specified mandatory volumes of renewable liquid fuel use through 2022 and required EPA to set levels after that. When determining renewable volume obligations for years after 2022, EPA must consider a variety of factors specified in the statute, including costs, air quality, climate change, implementation of the program to date, energy security, infrastructure issues, commodity prices, water quality and supply.

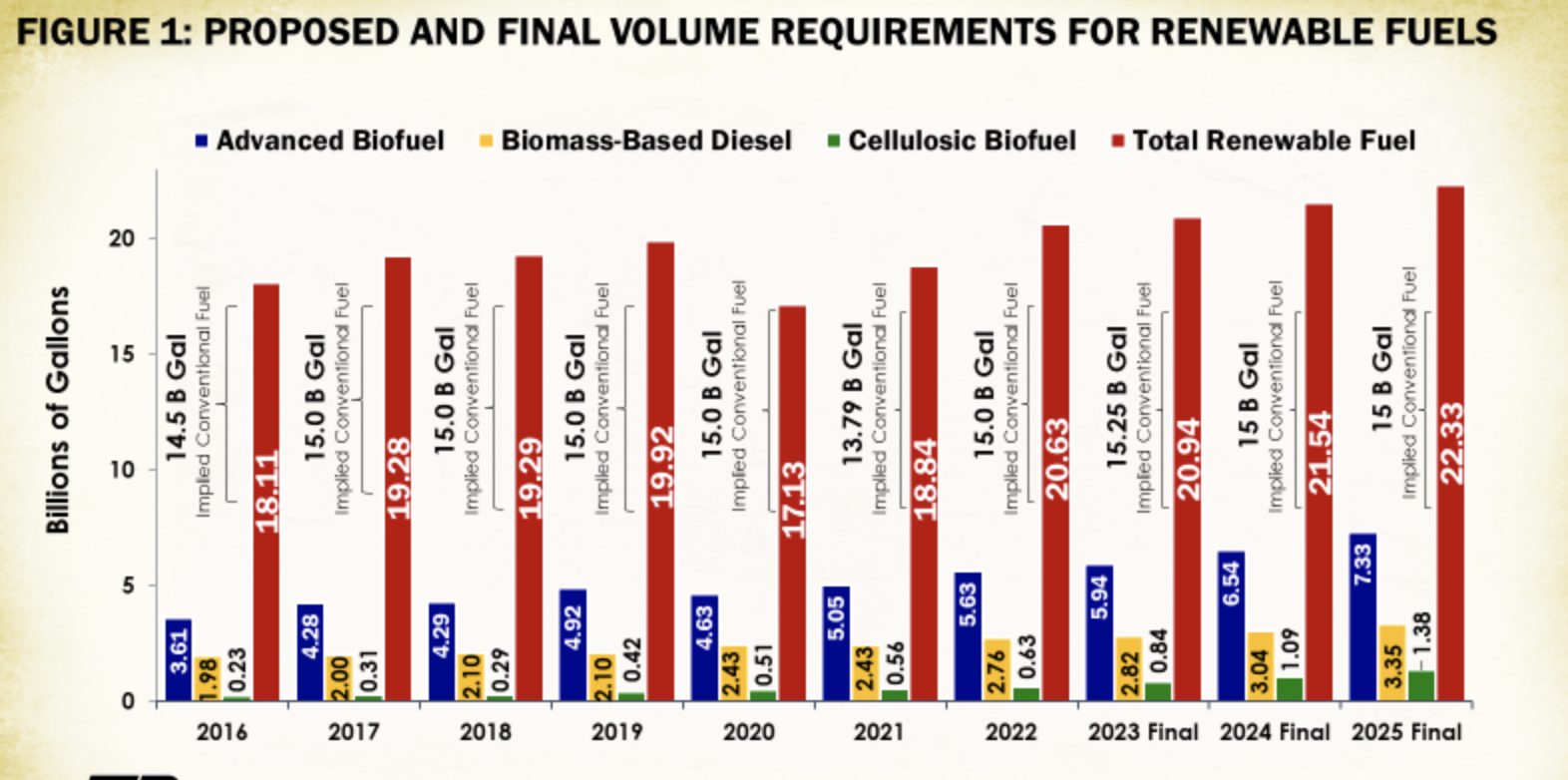

The Biden administration increased the amount of biofuels that must be blended into the nation’s fuel supplies over the next three years, holding production totals steady for corn-based ethanol. A plan finalized by the Environmental Protection Agency sets biofuel blending volumes at 20.94 billion gallons in 2023, 21.54 billion gallons in 2024 and 22.33 billion gallons in 2025 covering cellulosic biofuel, biomass-based diesel, advanced biofuel, and total renewable fuel. The totals are higher than levels set for 2022 and earlier years, and include 15 billion gallons of corn-based ethanol in all three years. The final rule increases total renewable fuel volumes in 2025 by 1.7 billion gallons, or 8 percent, from 2022, including an increase of 310 million gallons in 2023, another 600-million-gallon increase in 2024, and an increase of 790 million gallons in 2025. The proposal also includes new incentives to encourage use of biogas from farms and landfills, and renewable biomass such as wood.

According to EPA’s cost analysis, “The biofuel costs are higher than the costs of the gasoline, diesel, and natural gas that they displace,” and thus the mandated usage of such fuels leads to higher overall fuel costs. EPA estimates that, over the three-year period, the rule will cost consumers about $23 billion. Oil refiners call the mandates pricey, while biofuel proponents such as ethanol producers and corn farmers like the obligations because they increase the market for their products.

Most gasoline sold in the United States contains 10 percent ethanol, mostly produced from corn. About 40 percent of corn produced in the United States is used to make ethanol. The EPA in May proposed raising the percentage of ethanol in gasoline to 15 percent for certain states beginning in 2024.

Conclusion

Biden’s EPA has denied almost all waivers requested by small refiners regarding biofuel blending requirements, forcing them to purchase market based renewable credits that will increase the cost of gasoline and diesel for consumers. Renewable credits are currently costing around $1.50 per gallon. The United States has been losing petroleum refining capacity as operators convert refineries to produce biofuels, which are mandated and heavily subsidized in places like California, or simply close them due to onerous regulation.

Further, the EPA is increasing the biofuel blending requirements for 2023, 2024, and 2025, increasing 2025 levels to 8 percent above 2022 levels. The increased biofuel requirements will also increase fuel costs to consumers as the price of biofuels is higher than the petroleum-based gasoline and diesel they displace. Bipartisan legislation is afoot to help the small refiners by allowing a lower renewable credit price, but it is unclear whether it will get passed and signed into law by President Biden as he has stated that he wants to kill fossil fuels and a weaker refinery industry is a step in that direction.