It is apparently not enough for Barack Obama to shutter coal-fired power plants throughout the nation due to EPA’s so-called Clean Power Plan and other measures like the Mercury and Air Toxics Standards. These and other policies have already caused several coal companies to declare bankruptcy with thousands of coal miners losing their jobs, but now the President is going to make coal on federal lands outrageously costly to lease. The Obama administration announced a moratorium on new coal leases on federal lands last Friday.[i] The moratorium will last for 3 years while the Department of Interior (DOI) undertakes a review of the fees charged to mining companies to see if they provide a “fair return to American taxpayers and reflect coal’s impact on the environment”.[ii]

Despite the PR campaign by the White House and the Department of Interior that implies their moratorium will give them time to arrive at the truth, President Obama telegraphed his intention in his State of the Union Speech, when he said: “That’s why I’m going to push to change the way we manage our oil and coal resources, so that they better reflect the costs they impose on taxpayers and our planet.”[iii] The clear translation is that their minds are made up and coal and oil must be made more costly, which just happens to coincide with the wishes of the “keep it in the ground” movement, which has much sway with the White House.

The reality is that this move is not about making sure the American taxpayer gets a “fair return” but rather to reduce coal mining. The administration’s “keep it in the ground allies” do not want any royalties from coal production and will almost certainly push for an exorbitant royalty rate. This will make it uneconomic to mine coal on federal lands and as such it could cost the U.S. Treasury more in lost revenue than it would gain in projected increased royalty and rent fees.

According to a study performed for the Institute for Energy Research, the long term effects of opening federal lands in the Powder River Basin (where most coal on federal lands is mined), to coal leasing would generate $87.9 billion annually for the U.S. economy, producing over 260,000 jobs each year with over $16 billion in additional annual wages. The federal government would receive an additional $16.7 billion annually in federal tax revenues, while state and local tax revenues would rise by $6.2 billion in Wyoming and by $0.5 billion in Montana.[iv]

Thus, the real reason for the moratorium and review is to leave coal in the ground, ensuring that it releases less carbon dioxide emissions in the future, regardless of the impact this policy will have on the nation’s energy reliability and the increased cost to consumers. While this may sound harsh, it is consistent with the president’s promise back in 2008 that under his plan, “electricity prices will necessarily skyrocket.” All of the president’s energy initiatives insofar as we can determine are consistent with this stated goal.

DOI’s Review of the Coal Lease Program

According to DOI, the review will look at issues related to the Bureau of Land Management’s (BLM) administration of the federal coal program, including:

- Determining the appropriate leasing mechanisms to decide how, when and where to lease;

- Accounting for the environmental and public health impacts of the coal program;

- Ensuring that the sale of these public resources results in a fair return to the American taxpayers;

- Determining whether U.S. coal exports should factor into leasing or other program decisions; and

- Evaluating how the management, availability and pricing of federal coal impacts domestic and foreign markets and energy portfolios.

While the 3-year review is being undertaken, a moratorium is placed on new coal leases by the DOI. During that time, coal companies will continue to be able to mine the coal reserves already under lease. The royalty payment levied on coal production is set at 12.5 percent–the same rate as the royalty for onshore oil and gas.

The Interior Department has also tasked the U.S. Geological Survey to establish and maintain a public database to account for the annual carbon emissions from fossil fuels developed on federal lands. The Interior Department’s fact sheet notes that carbon dioxide emissions from the use of natural gas, oil, and coal on federal lands could amount to 28 percent of the nation’s annual total energy-related emissions based on an “independent analysis” that is not referenced in the fact sheet.[v]

Coal Mined On Federal Lands

Most of the nation’s low-sulfur, sub-bituminous coal used in producing electricity is located on federal lands in the Powder River Basin, where President Obama’s new leasing rules will have great impact.

According to the Energy Information Administration (EIA), 402 million short tons of coal were mined on federal lands (40.6 percent of total coal mined) and 19 million short tons were mined on Indian lands in fiscal year 2014. Most (80 percent) of these 421 million short tons were mined on federal and Indian lands in Wyoming—the main location of the Powder River Basin–that contains low-sulfur, sub-bituminous coal that helps meet environmental standards in electric generation.[1] [vi]

According to a study performed for the Institute for Energy Research, the long term effects of opening federal lands in the Powder River Basin to coal leasing would generate $87.9 billion annually for the U.S. economy, producing over 260,000 jobs each year with over $16 billion in additional annual wages. The federal government would receive an additional $16.7 billion annually in federal tax revenues, while state and local tax revenues would rise by $6.2 billion in Wyoming and by $0.5 billion in Montana.[vii]

According to the study, coal resources on federal lands (excluding Alaska) amount to approximately 957 billion short tons, and approximately 57.5 percent of those coal resources are located in the Powder River Basin (PRB). Of that, 84.3 percent (464 billion short tons) were estimated to be available for future lease until the DOI instituted the moratorium. Because the Clean Energy Action in October 2013 produced a report that indicated less than 20 percent of the coal resources available can be economically recovered, the 464 billion short tons in the PRB was reduced by 80 percent, resulting in economically recoverable reserves of roughly 93 billion short tons (about 86 billion short tons in Wyoming and 6.5 billion in Montana).

Applying EIA’s economic recovery estimate of 90.2 percent to exclude coal reserves on land unsuitable for mining, the study assumed roughly 85 billion short tons were available to be leased in the PRB, with just under 80 billion short tons located in Wyoming and just under 6 billion short tons in Montana. Using $18.66 per short ton for the price of Wyoming, PRB low sulfur sub-bituminous coal, the reserve estimates were converted to dollar equivalents to get the above estimates of economic output, wages and tax revenues.

Coal Production Already Declining

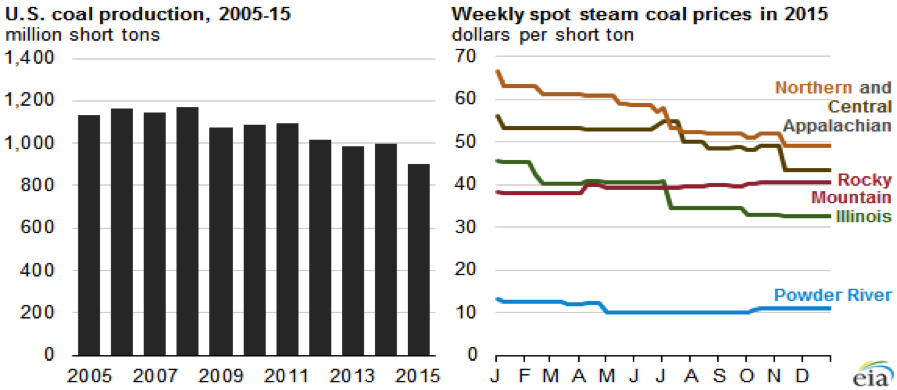

Due to low natural gas prices and onerous regulations by President Obama’s Environmental Protection Agency (EPA), U.S. coal production in 2015 is expected to be 10 percent lower than in 2014–the lowest level in 30 years. Since reaching its highest production level of almost 1.2 billion short tons in 2008, the year before President Obama took office, coal production in the United States has continued to decline. U.S. coal production in 2015 is expected to be about 900 million short tons–the lowest level since 1986. (See graph below.)[viii]

Source: EIA, http://www.eia.gov/todayinenergy/detail.cfm?id=24472

The majority of coal in the United States is used to generate electricity. While coal had traditionally generated the majority of electricity in the United States, that changed in April of 2015, when natural gas-fired generation surpassed coal-fired generation on a monthly basis for the first time in history, as the average daily natural gas spot price at the Henry Hub fell from $4.38 per million British thermal units in 2014 to $2.61 per million British thermal units in 2015. Natural gas generation also surpassed coal generation in July through October 2015, the most recent month with available data. EIA’s Short-Term Energy Outlook estimates that power sector coal consumption in 2015 will be 764 million short tons–the lowest level since 1988.

U.S. coal exports also declined in 2015. Based on U.S. Census Bureau data through September 2015 and estimates for the remainder of the year, the United States is expected to export 77 million short tons of coal in 2015, a 21 percent decline from 2014. China, the world’s largest coal consumer, imported 8.3 million short tons from the United States in 2013 (7 percent of total U.S. coal exports), but decreased its coal imports from the United States to 1.8 million short tons in 2014, and less than 0.5 million short tons in 2015 is expected to be imported by China.

Coal Company Bankruptcies

Decreased demand for coal has caused a wave of bankruptcies by the nation’s largest coal companies, most recently with the bankruptcy filing of Arch Coal, the nation’s second-largest coal company, which needs to cut $4.5 billion in debt. Arch joins competitors Walter Energy Inc., Alpha Natural Resources Inc., and Patriot Coal Corp.—companies that filed for court protection last year. Over a quarter of U.S. coal production is now in bankruptcy, trying to reorganize to deal with prices that have fallen 50 percent since 2011. Employment in the coal sector has fallen to its lowest level since the 1980s. With thousands of coal miners out of work, starting wages in West Virginia, for example, have fallen to around $20/hour, half of that what they were at the start of the decade.[ix]

Conclusion

The Obama Administration is continuing its war on energy production on federal lands—this time with coal production. It has placed a moratorium on federal coal leases while a 3-year review is undertaken by the DOI. Roughly 40 percent of the coal produced in the United States comes from federal lands—a larger percentage than for oil and natural gas. Thus, this review could have devastating results on future coal prices and production, making a depressed industry hurt even more. While the Obama Administration wants to pose this undertaking as a way to ensure a fair price for American resources on public lands, in actuality it is for the fulfillment of his desire to drive up energy prices and force people to use less natural gas, oil, and coal. The economic and employment impact to be gained by further opening federal lands to coal production makes his motives even clearer.

If it were concerned about revenue, the Obama Administration would not oppose opening ANWR, would not be proposing the most anemic 5 year plan in the history of the offshore oil and gas leasing program, and energy production would not be declining on federal lands consistently while it is breaking records in growth on non-federal lands. It is not believable that the administration is concerned about revenues, since everything they have done has been to reduce production of publicly owned assets from federal lands, and in turn, reduce federal revenue streams. This latest move, along with others regarding conventional energy, are part of a program more reflective of the president’s promise to make energy prices skyrocket, thus forcing suffering Americans to choose the energy sources the White House prefers, which just happen to be marketed for sale by some of their largest financial contributors.

[1] Other states where coal is mined on federal lands are Arizona, Colorado, Montana, New Mexico, Oklahoma, and Utah.

[i] New York Times, Putting an Environmental Price Tag on Coal, January 15, 2016, http://www.nytimes.com/2016/01/16/opinion/putting-an-environmental-price-tag-on-coal.html?emc=edit_th_20160116&nl=todaysheadlines&nlid=63692790&_r=0

[ii] Department of Interior, Fact Sheet: Modernizing the Federal Coal Program, January 16, 2016, http://www.blm.gov/style/medialib/blm/wo/Communications_Directorate/public_affairs/news_release_attachments.Par.47489.File.dat/Coal%20Reform%20Fact%20Sheet%20Final.pdf

[iii] White House, Remarks of President Barack Obama—State of the Union Address As Delivered, January 13, 2016, https://www.whitehouse.gov/the-press-office/2016/01/12/remarks-president-barack-obama-%E2%80%93-prepared-delivery-state-union-address

[iv] Institute for Energy Research, The Economic Effects of Immediately Opening Federal Lands to Oil, Gas, and Coal Leasing, December 2015, https://www.instituteforenergyresearch.org/wp-content/uploads/2016/01/IER-Mason-Study.pdf

[v] Department of Interior, Fact Sheet: Modernizing the Federal Coal Program, January 16, 2016, http://www.blm.gov/style/medialib/blm/wo/Communications_Directorate/public_affairs/news_release_attachments.Par.47489.File.dat/Coal%20Reform%20Fact%20Sheet%20Final.pdf

[vi] Energy Information Administration, Sales of Fossil Fuels Produced from Federal and Indian Lands, FY 2003 through FY 2014, July 2015, http://www.eia.gov/analysis/requests/federallands/pdf/eia-federallandsales.pdf

[vii] Institute for Energy Research, The Economic Effects of Immediately Opening Federal Lands to Oil, Gas, and Coal Leasing, December 2015, https://www.instituteforenergyresearch.org/wp-content/uploads/2016/01/IER-Mason-Study.pdf

[viii] Energy Information Administration, Coal production and prices decline in 2015, January 8, 2016, http://www.eia.gov/todayinenergy/detail.cfm?id=24472

[ix] Wall Street Journal, Arch Coal File for Bankruptcy, January 11, 2016, http://www.wsj.com/articles/arch-coal-files-for-bankruptcy-1452500976?cb=logged0.28593429861069136