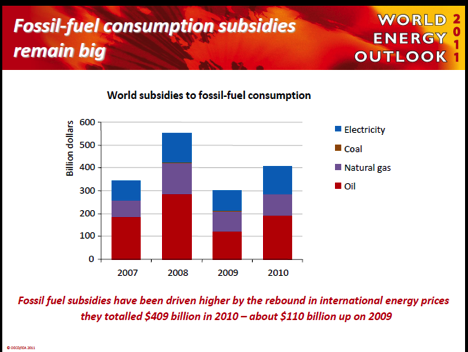

The International Energy Agency (IEA) recently released its 2010 estimate of global fossil-fuel consumption subsidies—$409 billion, 36 percent ($109 billion) higher than in 2009.[i] This increase, however, is almost entirely due to the increase in international energy prices. Under current trends, it could reach $660 billion by the end of the decade (0.7 percent of global GDP).[ii] Oil subsidies make up almost half the total fossil fuel consumption subsidies, with electricity making up 30 percent, natural gas 22 percent and coal less than 1 percent.

Fossil fuel consumption subsidies measure what developing countries spend to provide below-cost fuel to their citizens. That is, these countries artificially lower energy prices to their citizens, paying the difference from their government resources.[iii] Such welfare transfers are akin to the U.S.’s Low Income Home Energy Assistance Program (LIHEAP)[iv], and are differentiable from subsidies in the name of commercializing uneconomic energy sources such as on-grid wind or solar. The United States and other developed countries offer support to energy production in the form of tax credits or loan guarantees, which are not included in IEA’s fossil fuel consumption subsidy calculations since they are directed towards production rather than consumption of the fuel.

IEA’s estimate for global renewable subsidies (biofuels and renewable electricity) in 2010 was $66 billion, 10 percent higher than in 2009, with $44 billion subsidizing the cost of renewable-based electricity and $22 billion subsidizing biofuels. In contrast to fossil fuel consumption subsidies, renewable fuel subsidies often take the form of tax credits for investment or production, or premiums over market prices to cover the higher production costs compared to traditional fuels.

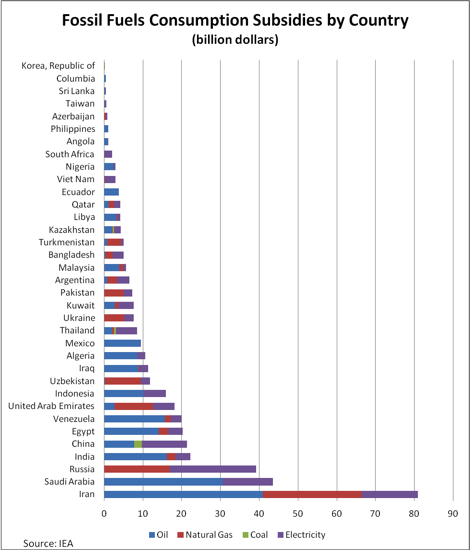

Fossil Fuel Consumption Subsidies by Country

Iran leads the world in fossil fuel consumption subsidies providing over $80 billion from its government resources in 2010 to lower the cost of fossil fuels to end-users in its country.[v] Of the $80.84 billion in fossil fuel consumption subsidies, over 50 percent covers oil, 32 percent funds natural gas, and the remainder (18 percent) goes towards electricity. Saudi Arabia is the second largest country subsidizing end-use fossil fuel prices, providing 70 percent of its over $43 billion in fossil fuel consumption subsidies to oil and 30 percent to electricity. Russia comes in third with over $39 billion in fossil fuel consumption subsidies, with natural gas getting 43 percent and electricity 57 percent of the total. India and China rank fourth and fifth, respectively, both funding over $20 billion in fossil fuel consumption subsidies. Over 70 percent of India’s fossil fuel consumption subsidies of $22.29 billion in 2010 fund lower oil prices in India. China is one of the few countries that subsidize coal consumption. Of its $21.32 billion in fossil fuel consumption subsidies in 2010, electricity receives the most (54 percent), then oil (36 percent), and coal at 9 percent.

Uzbekistan leads the world in the amount of its GDP that it subsidies; its $11.9 billion in fossil fuel consumption subsidies represents almost one-third of its economy. Iran’s subsidies for natural gas, oil and electricity represent 22.6 percent of its economy while Turkmenistan’s abundant natural gas supplies are subsidized to the level of 19.3 percent of its economy. China has the largest coal subsidies among the 5 countries that subsidize coal, but China’s fossil fuel consumption subsidies represent only 0.4 percent of its GDP.

On a per-person basis, fossil fuel consumption subsidies are highest for Kuwait at $2,798.6 per person, the United Arab Emirates at $2,489.6, and Saudi Arabia at $1,586.6.[vi]

Many of the countries providing fossil fuel consumption subsidies own state energy companies, including countries that comprise the Organization of Petroleum Exporting Countries, including Iran, Saudi Arabia, and Venezuela. Net exporting countries see these subsidies as an opportunity cost. For net exporting countries of oil and gas, fossil fuel consumption subsidies totaled $331 billion in 2010, compared to $78 billion for net importing countries. Since 2007, about 80 percent of fossil fuel consumption subsidies have been in net oil and gas exporting countries.

[table id=46 /]

Fossil fuel consumption subsidies are often used to alleviate energy poverty, but are an inefficient means for doing so, creating market distortions that result in wasteful energy consumption. In 2010, only 8 percent of the $409 billion spent was distributed to the 20 percent of the poorest population, demonstrating inefficiencies in assisting the poor.

Renewable Energy Subsidies

Renewable energy subsidies cover biofuel production and renewable electricity generation. They are production type subsidies in contrast to fossil fuel consumption subsidies and are generally tax credits, grants or premiums on the electric generation they produce to pay for their cost compared to traditional electric generating sources.[vii]

The European Union and the United States were responsible for almost 80 percent of the $66 billion in renewable energy subsidies in 2010, with the European Union spending $35 billion, almost twice the amount spent by the United States. According to the IEA, production mandates for biofuels in the United States are expected to raise those subsidies to $70 billion in 2035.

Subsidies for global electricity-based renewable energy totaled $44 billion in 2010, 12 percent higher than in 2009. Non-hydro renewable capacity increased by 22 percent, with wind and solar representing 90 percent of that increase. Wind subsidies were the highest at $18 billion, receiving on average $53 per megawatt hour of electricity generation. Solar photovoltaic technology received 28 percent of the renewable energy electricity-based subsidies, receiving $425 per megawatt hour of electricity output, accounting for only 4 percent of subsidized renewable generation.

Subsidies to biofuels totaled $22 billion in 2010, 6 percent higher than in 2009. According to the IEA, the cumulative cost of biofuels between 2011 and 2035 is expected to total $1.4 trillion to meet mandates for blending and other biofuel targets and to cover tax credits to the industry. Except in Brazil, biofuels are not cost competitive with oil-based conventional fuels and subsidies are required to meet legislative targets.

Conclusion

Many Americans are confused by the large amount of global fossil fuel consumption subsidies that the IEA calculates, not realizing that these subsidies have nothing to do with tax policy, research and development or loan guarantees, where most U.S. programs are directed. In fact, most liberalized countries do not offer fossil fuel consumption subsidies that artificially lower the end-use price of the fuel. Such subsidies are common and even pervasive, however, in the developing world, particularly in economies with state-owned energy companies.

The IEA has been advocating for years that fossil fuel consumption subsidies should be eliminated since they encourage wasteful consumption. According to the IEA, if fossil fuel consumption subsidies were completely phased out by 2020, 4.4 million barrels of oil per day would be saved in 2035, global primary energy demand would be reduced by nearly 5 percent, and carbon dioxide emissions would be reduced by 5.8 percent.[viii]

While eliminating fossil fuel consumption subsidies would help reduce wasteful consumption of fossil fuels, it would need to be accomplished gradually so citizens of those countries that subsidize fossil fuel consumption can more easily make the necessary adjustments. Peru, for example, was able to zero out these subsidies. In 2008, Peru provided $.62 billion in fossil fuel consumption subsidies to oil, natural gas and electricity, but zeroed them out by 2009.[ix] Iran is trying to reduce fossil fuel consumption subsidies. In December 2010, the country started a 5-year program to bring fossil fuel consumption subsidies for oil, natural gas, and electricity in line with international market prices.[x]

These welfare transfers can be differentiated from subsidies in the name of commercializing or sustaining uneconomic energy sources such as on-grid wind or solar, which the United States and other industrialized countries have been heavily subsidizing. These forms of energy subsidies that help promote production of uneconomic energy sources can be abolished without detrimental affects to the U.S. economy or its citizens, and in fact would increase economic efficiency since by their very nature, they are more expensive than competing forms of energy.

[i] International Energy Agency, World Energy Outlook 2011, Energy Subsidies, http://www.iea.org/weo/subsidies.asp

[ii] New York Times, Cost of Subsidizing Fossil Fuels Is High, but Cutting Them Is Tough, October 23, 2011, http://www.nytimes.com/2011/10/24/business/global/cost-of-subsidizing-fossil-fuels-is-high-but-cutting-them-is-tough.html?scp=1&sq=IEA%20fossi%20fuel%20subsidy&st=cse

[iii] International Energy Agency, Fossil Fuel Subsidies—Methodology and Assumptions, http://www.worldenergyoutlook.org/docs/weo2010/Subsidy_Methodology_WEO2010.pdf

[iv] Department of Health and Human Services, Low Income Home Energy Assistance Program, http://www.acf.hhs.gov/programs/ocs/liheap/

[v] International Energy Agency, Fossil-fuel consumption subsidy rates as a proportion of the full cost of supply, 2010, http://www.iea.org/subsidy/index.html

[vi] Ibid.

[vii] International Energy Agency, Methodology for calculating subsidies to renewables, http://www.worldenergyoutlook.org/docs/weo2011/other/WEO_methodology/RenewablesSubsidies_W EO2011.pdf

[viii] International Energy Agency , World Energy Outlook 2011

[ix]International Energy Agency, Fossil-fuel consumption subsidy rates as a proportion of the full cost of supply, 2010, http://www.iea.org/subsidy/index.html.

[x] International Energy outlook, World energy Outlook, Recent Developments in Energy Subsidies, http://www.worldenergyoutlook.org/Files/ann_plans_phaseout.pdf