President Joe Biden’s Interior Department’s reports indicate that there may be no offshore lease sale in the Gulf of Mexico until fiscal 2024, which will further Biden’s ban on oil drilling on federal lands and waters. Instead, Biden will release a million barrels of oil per day from the Strategic Petroleum Reserve (SPR) for 6 months. That amount of U.S. oil release is equivalent to about two days of global demand. It would mark the third time that Biden has tapped U.S. strategic reserves in the past six months, and would be the largest release in the near 50-year history of the Reserve. The U.S. SPR currently holds 568.3 million barrels–its lowest level since May 2002. (SPR has a total capacity of 714 million barrels.) The oil release would increase supplies by 1 million barrels per day for six months and help the market rebalance, but it does not resolve the structural supply deficit. The Biden administration is also considering temporarily removing curbs on summer sales of higher-ethanol gasoline blends to lower fuel costs.

The SPR Draws

In November, Biden released 50 million barrels from the petroleum reserve and on March 1, Biden announced the release of a further 30 million barrels, in coordination with a release of an additional 30 million barrels from other countries around the world. The International Energy Agency (IEA) is still in the early stages of coordinating the 60-million-barrel release of oil, announced on March 1, from about two dozen other countries. With Biden’s latest announcement of a SPR draw, IEA member countries are again to meet to decide on another collective oil release.

Mr. Biden’s release of 50 million barrels in November barely dented oil prices on the global market as the world consumes 100 million barrels per day. The November release was well before the war in Ukraine, which began on February 24, 2022, but Biden was trying to offset the political damage of some of his anti-oil policies that had increased gasoline prices by $1 a gallon last year. Biden’s prior releases from SPR were to consist of exchanges that would have to be replaced by oil companies at a later date. It was not clear whether the more recent announcement of a 180 million barrel draw would consist of exchanges from the reserve, outright sales, or a combination of the two.

The latest Biden SPR release is not big enough to offset the potential loss of Russian oil exports, which is about 3 million barrels per day. While the release will lower the oil prices a little in the short term, lower prices generally encourage more demand. Further, a large discharge from SPR could cause “congestion” on the Gulf Coast, keeping new oil production from fields in West Texas out of pipelines and storage tanks. The move could also discourage Saudi Arabia and other global producers from increasing supply to reduce prices, which it appears they decided upon today.

OPEC+ Decision

The Organization of the Petroleum Exporting Countries and allies including Russia (OPEC+) agreed to stick to its existing agreement and raise its May production target by 432,000 barrels per day—a target amount already built into the market price. Saudi Arabia claims it has the ability to produce about 12.5 million barrels a day–over two million barrels a day above current production. Most members of OPEC+ have already run out of the ability to increase production, as countries like Nigeria and Angola have been unable to keep up with recent targets. The group is likely to add only a small fraction of the output increase it announced, and clearly, Russia will not be able to increase production because it is already running out of storage tanks for unsold oil. Later this year, OPEC+ is to unwind the steep production cuts of early 2020 that bolstered the market when demand and prices plummeted in the early days of the COVID pandemic.

With the extreme volatility in oil prices—from below $100 a barrel to about $130 a barrel—Saudi Arabia and UAE may figure that they should hold onto their resources until markets calm. Oil consumption may be higher during the summer driving season and output may potentially be lower. OPEC believes that geopolitics rather than shortfalls are adding a premium to the price, which allows them to rake in huge volumes of cash. “Current volatility is not caused by changes in market fundamentals but by current geopolitical developments,” the group said after its meeting on March 2. Also, continued impediments to domestic production by the Biden Administration — especially on federal lands and waters and pipeline permitting strengthens their market position.

EPA Considering Ethanol Blend Change

The Biden administration is considering temporarily removing restrictions on summer sales of higher-ethanol gasoline blends. The ethanol industry would like to increase sales of the fuel blend, E15, and lift summertime restrictions on it. E15 contains up to 15 percent ethanol, while most gasoline contains 10 percent ethanol. The summertime ban on E15 was imposed due to concerns that it contributes to smog in hot weather due to high volatility. Since U.S. ethanol is made from corn, increasing the ethanol content in gasoline may increase food prices. Food prices have already escalated and globally higher food prices are expected as Russia and Ukraine are major exporters of wheat and other crops, as well as fertilizers of various kinds.

Off Shore Oil Lease Sales

In the most recent budget released by the Interior Department, its projected revenues suggest that there is not going to be any lease sales in 2023, so fiscal year 2024 would be the soonest for a potential next lease sale. The Outer Continental Shelf Lands Act requires the Department of Interior to prepare a five-year offshore oil and gas lease sale program that indicates the size, timing and location of proposed leasing activity. The current 2017-2022 lease program is set to expire on June 30, which means the next five-year plan should be in place by July 1 to avoid a lapse in the program. Historically, a new five-year plan is approved prior to the current plan’s expiration, allowing for continuous lease sales.

While the Department of Interior says one is in the works, a draft has been not been released. The process of developing a new 5-year plan requires issuance of a draft proposed rule and a draft environmental impact statement, then a proposed rule (possibly narrower in scope than the draft proposed rule), then a final rule, and the first two stages need to include the gathering and consideration of public comments before the subsequent stage can be triggered. It appears the Department is dragging its feet despite surging energy prices.

Only one offshore lease sale was held during the Biden Administration as part of the 2017-2022 program—the largest lease sale in the Gulf of Mexico (GOM) to date. However, a federal court nullified the results, citing flawed analysis of greenhouse gas emissions. The Biden Administration has not appealed that decision. Earlier this year, the administration blamed a delay in holding lease sales on a federal court decision that blocked the administration from using a contested social cost of carbon in weighing drilling impacts. But a federal appeals court has since allowed the Interior Department to continue using the metric.

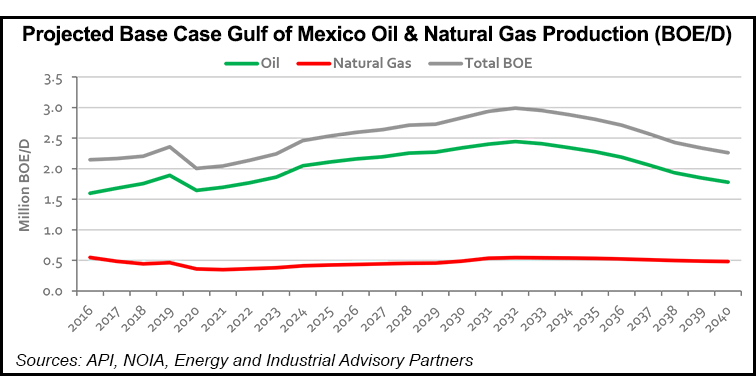

A new analysis recently released indicates that a new five-year lease program in the GOM would produce an average of 2.6 million barrels of oil and gas equivalent per day from 2022 to 2040. A delay in the program could mean 480,000 barrels per day less production over that period. By 2036, the lost production could total 885,000 barrels of oil equivalent per day–a 33 percent decrease from the production that could arise with a five-year program in place. Without a five-year program, almost 60,000 of the 370,000 U.S. jobs supported by GOM production could be lost, along with an estimated $1.5 billion per year loss in government revenue. That loss in revenue would jeopardize funds for programs supported by offshore oil dollars, such as the Land and Water Conservation Fund which pays for maintenance and repairs on public lands, as well as eliminating millions of dollars for local governments and historic preservation budgets. The analysis also found that no new leasing until 2028 could lead to average annual reductions of capital investment and spending by $5.3 billion and of GDP contributions by $5 billion.

Conclusion

President Biden’s Administration is looking for all sorts of ways to lower oil prices except the ones that would actually work. Had Biden allowed the Keystone XL pipeline to be completed, it could already be shipping more oil from North Dakota and neighboring Canada, where the U.S. gets most of its oil imports, and alleviate some of the oil supply shortages. If Biden would remove his ban on new drilling on federal lands and water, it would encourage new investment in oil and gas development. If Biden would allow ANWR and the Naval Petroleum Reserve-Alaska to be developed, Alaska could support its pipeline that barely has enough oil flow to keep it operational. Rather than grabbing at straws, Biden needs to hold U.S. lease sales for oil and gas onshore and offshore and to approve the over 4,000 drilling permits that his Administration is sitting on. Those are the root causes of rising energy prices, despite the rhetoric coming from the Biden Administration.