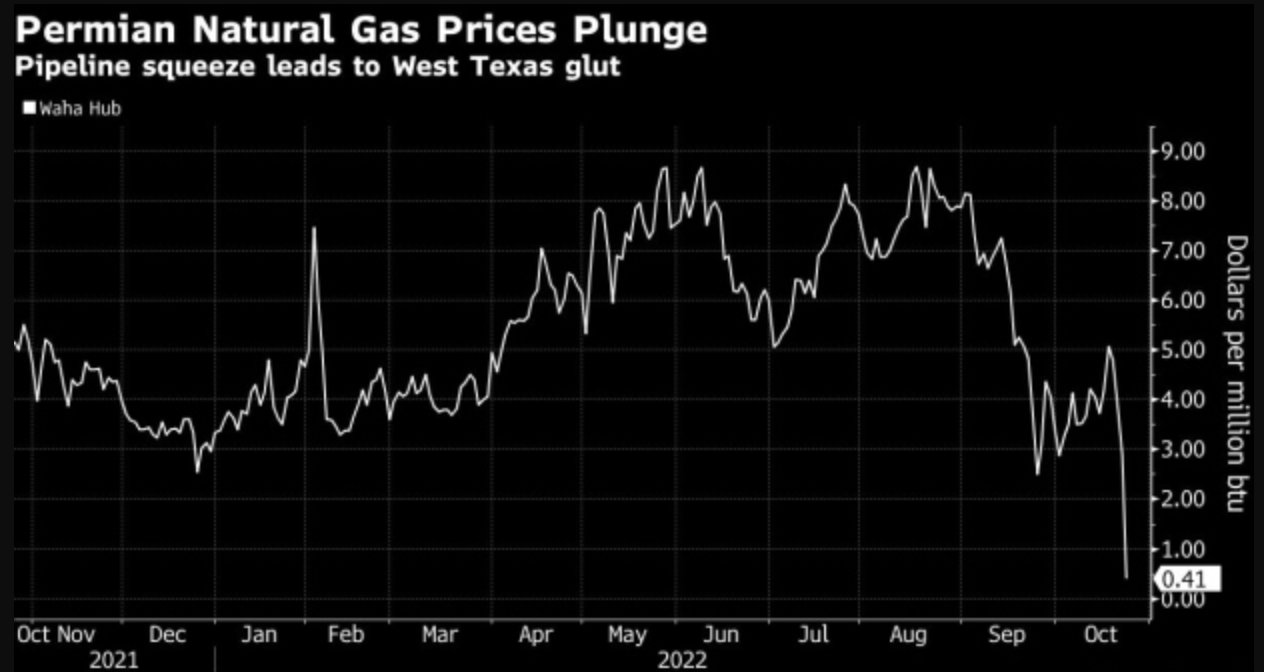

Just as the world needs energy desperately, and particularly energy in the form of natural gas, takeaway capacity has been proven to be insufficient in the Permian basin of Texas. Natural gas production in the Permian basin overwhelmingly uses pipeline networks, the safest and most efficient means of transport. Recently, natural gas in the area of the Permian known as Waha traded for just 20 cents to 70 cents per million British thermal units—a price much lower than the U.S. benchmark futures contract of around $5 per million BTUs and European prices of around $28 per million BTUs. The following day they fell into negative territory—around negative $2 per million BTUs. Insufficient pipeline capacity has been a problem for years as obtaining approval and the necessary permits to build natural gas pipelines from the Federal Energy Regulatory Commission has been getting more difficult. The bottleneck situation worsens when pipeline operators perform necessary repairs and preventative maintenance that forces a temporary reduction in pressure or halts to shipping, as has recently occurred.

Kinder Morgan’s Gulf Coast Express and El Paso Natural Gas pipeline systems are currently undergoing scheduled maintenance. Kinder Morgan is conducting maintenance at its Gulf Coast Express Pipeline beginning October 25 at its Rankin, Devils River, and Big Wells Compressor Station with volumes expected to be reduced throughout the week. The EL Paso Natural Gas pipeline system has had a number of maintenance activities performed on multiple lines since the beginning of October.

FERC’s Jurisdiction and Biden’s Edict

During the first days of his Presidency, President Biden embarked on his environmental goals to “end fossil fuels,” pushing FERC to consider changes to the way it reviews applications to approve and construct new natural gas infrastructure projects by addressing greenhouse gas emissions and environmental justice concerns in its decisions. In other words, increasing delays and costs on natural gas projects. Despite being an “independent agency,” FERC began a review of its policies for their compliance with Biden’s edict. Some have noted a particularly cozy relationship between FERC Chair Richard Glick and the White House.

In February, FERC released a new certificate policy statement, which governs the process for approving new natural gas infrastructure projects. It also released an “interim” policy statement on how it will consider greenhouse gas emissions and climate change impacts from new natural gas infrastructure. FERC stated that it would apply the policy statements to both pending and new applications. The rules were made effective immediately without a comment period or transition schedule. However, after receiving backlash from Congress, FERC changed its issuances to “draft” policy statements rather than “interim” policy statements just over one month after their issuance and after Biden promised more U.S. LNG to Europe, which is starved for natural gas because of the Russian invasion of Ukraine. Further, FERC made the policy change apply only to new proposed projects, and not to affect any pending projects. This occurred after bipartisan Senate criticism of this initiative, and pending Mr. Glick’s nomination for another term.

The proposed revisions to the certificate policy statement are significant, having the potential to pause or stop the development of greenfield projects and major expansions. The draft certificate policy statement creates a great deal of uncertainty for developers, thereby delaying potential projects.

For instance, FERC indicated that precedent agreements, which typically form the critical financial support for a new project, are not the sole factor and may not provide sufficient evidence to demonstrate the “need” for a new project. Instead, FERC intends to look for examples of the end-use of the natural gas as a major determining factor of whether the project is needed. In essence, FERC will decide whether they approve of the uses of the natural gas. They can second-guess whether a project is warranted, regardless of the demand for the natural gas.

The burden to provide specific end-user examples falls to the project applicant to show how the gas will be used to support a “public interest determination.” If the applicant does not include the information, or if FERC deems the information to be insufficient to demonstrate project need, FERC could deny certification of the project. This enormous increase in discretionary authority proposed by FERC, while good for lawyers and lobbyists specializing in FERC cases, promises a much more costly regulatory framework, which will inevitably increase the costs of pipeline construction. It also puts FERC in the position of “industrial policy czar,” deciding who and what should receive energy.

Thus, FERC may deny an application as a result of any type of adverse interest. Applicants may also need to propose mitigation measures for any determined adverse impacts, which includes engaging with interested landowners and for developers to continue to evaluate landowner input during the life of a project.

There is no timeline by which FERC must act, leaving some developers to question the viability of any new natural gas infrastructure projects. Investors are hesitant to propose projects in the absence of reasonable certainty about permitting. Without certainty in pipeline infrastructure and reasonable natural gas prices, potential energy-intensive industries may decide to off-shore new projects rather than invest in America.

While the comment period has expired, FERC has not released final actions regarding this policy.

Worldwide Pipeline Project Status

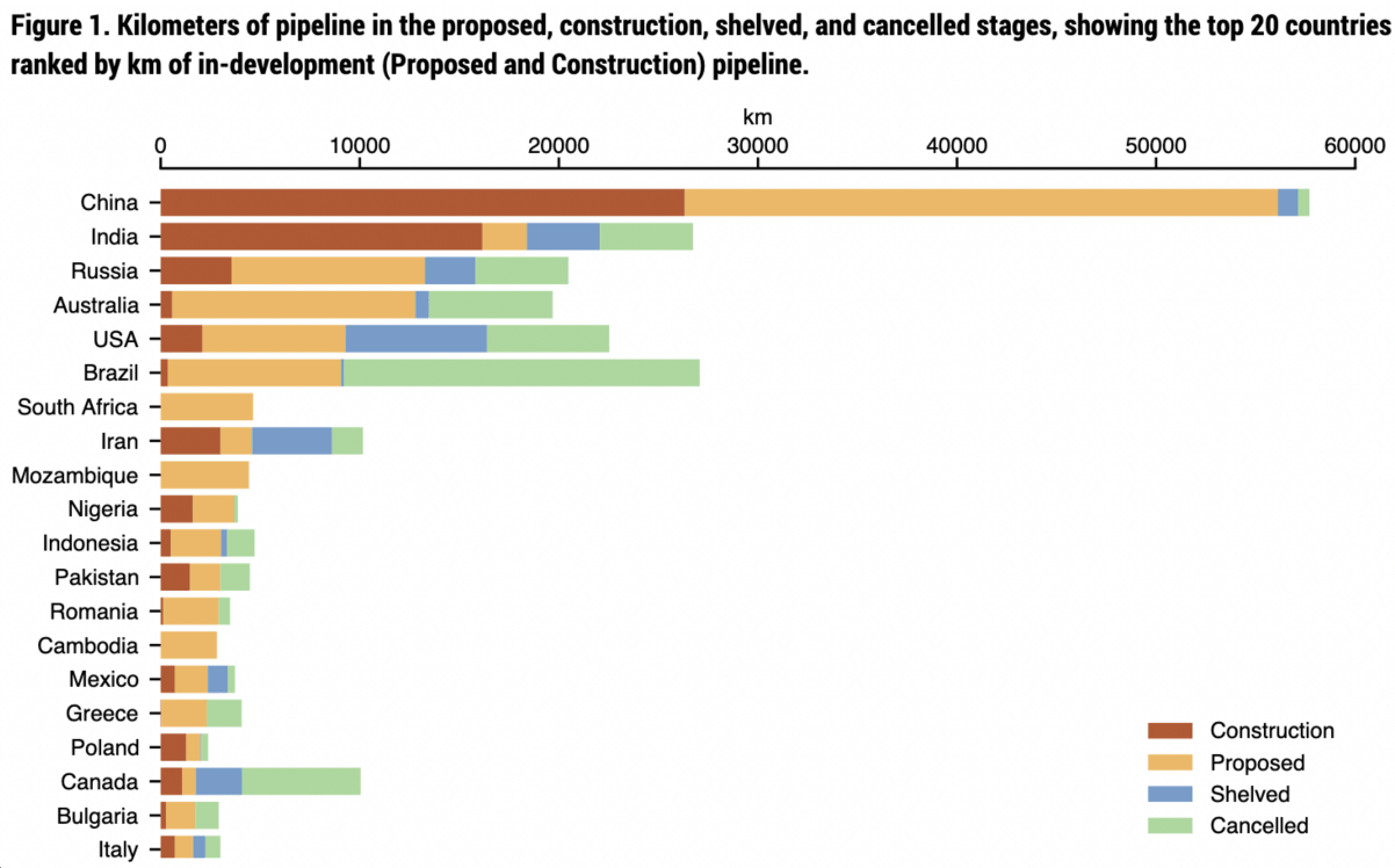

While the United States has pipeline projects shelved and canceled, China and India have a great deal of pipeline construction underway, as the graph below depicts. In the United States, opposition activists, and a shifting legal and regulatory landscape under the Biden administration contributed to the cancellation of several high-profile pipelines. And others are having trouble. The 303-mile Mountain Valley Pipeline is years behind schedule and over budget, now costing $6.6 billion—up from its initial estimated cost of $3.5 billion. The project was originally set for completion in 2018 and while it is 94 percent complete, it is stonewalled by activists in federal court where a needed permit was rejected.

Conclusion

While Europe, Asia and North America need natural gas for heating, electricity generation and manufacturing uses, the Biden Administration is providing regulatory bottlenecks for pipeline infrastructure to get the natural gas to consumers. The United States, despite being the world’s largest producer of natural gas, has fewer pipeline miles proposed and under construction than it has shelved and canceled. The Permian Basin in Texas has limited pipeline capacity, making the natural gas produced there close to worthless, even while New England risks power and energy shortages due to a shortage of natural gas this winter.

That might be Biden’s goal as he wants to rid the United States from using fossil fuels as part of his climate policy, which seems to be the central organizing principle of his Administration. As Europe’s energy crisis shows, renewable energy is not ready to substitute for the coal and natural gas currently used for electric generation, much less be able to handle all the new demand that Biden’s climate policies would produce, which the National Renewable Energy Laboratory has indicated might require a doubling or tripling of its capacity.