Whether it is oil production or natural gas production, output on Non-Federal lands (state and private) has consistently been significantly higher than output on Federal lands, despite the federal government owning much more mineral estate. That is true despite royalty rates on Federal lands being typically less than royalty rates on state or private lands. That is because of the red tape that the Federal government has implemented in order to obtain the rights to drill and operate on Federal lands. For example, in 2020, it took on average 142 days to complete an application for a Permit to Drill on Federal lands. In comparison, in Texas, in 2018 and 2019, it took an average of two days to process standard drilling permits. The 140-day difference in the permitting time is the reason that Texas has higher royalty rates than the federal government—a 2 day processing time is worth much more to a company than a 142 day processing time. Federal laws and bureaucracy makes it far more difficult and expensive to operate on federal lands.

The relative acreages of mineral estate available to the federal government versus state and private lands are instructive in this regard. The federal mineral estate contains 2.46 billion acres, made up of 1.76 billion acres in the Outer Continental Shelf and 700 million of onshore lands. The state and private land mineral estate is around 1.5 billion acres by comparison. Yet the vast majority of our oil and natural gas comes from private and state lands.

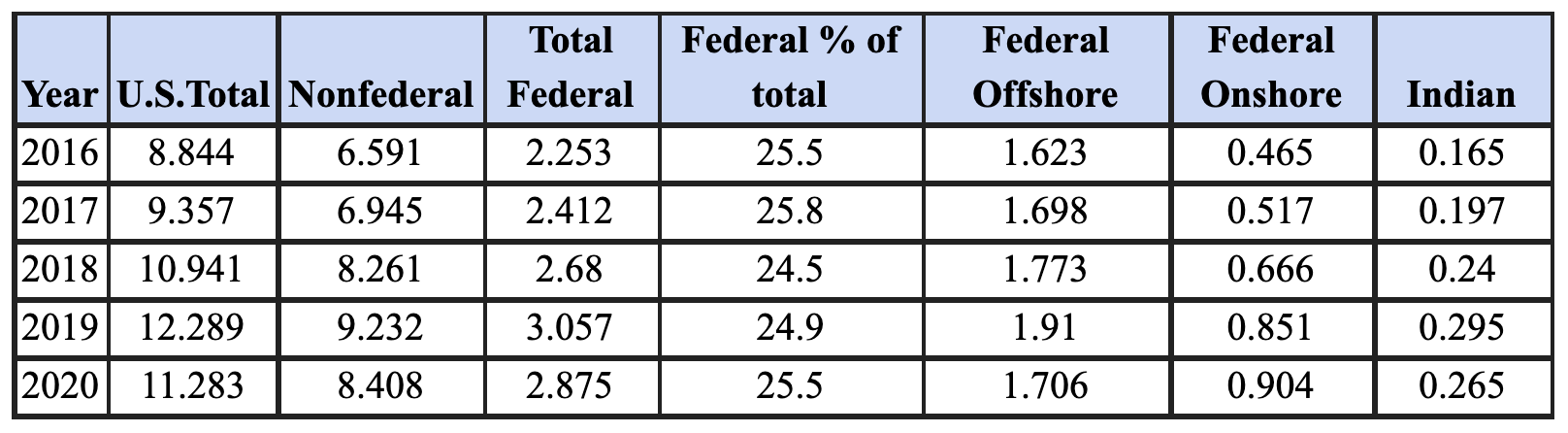

Oil Production

Historically, crude oil production on federal lands (onshore and offshore) was consistently under 20 percent of total U.S. production until the late 1990s. Then, production percentages increased on federal lands (primarily offshore) to over 30 percent in the early 2000s and reached a high point in 2009, coincident with declining production on non-federal lands in Alaska and other states. Most recent data from the Department of Interior and the Energy Information Administration show crude oil production on the federal offshore to be 15 percent of total U.S. oil production and 8 percent on federal onshore lands in 2020. Crude oil production on federal lands, particularly offshore, could continue to make a significant contribution to the U.S energy supply picture if laws and regulations would allow oil companies to make a profit from its production.

However, the Build Back Better Bill does just the opposite. It contains a long list of increases in federal royalties and fees, plus new fees, new taxes, and barriers to leasing in the Arctic National Wildlife Refuge, the Pacific, Atlantic, and eastern Gulf of Mexico. If passed, the arbitrary new fees would add millions of dollars in operating costs, pricing out U.S. production, and putting oil prices in the control of OPEC.

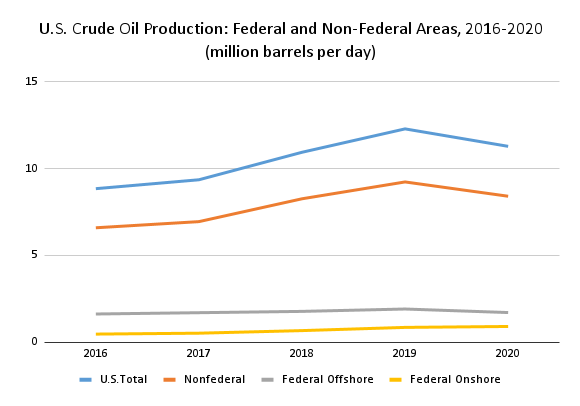

U.S. Crude Oil Production: Federal and Nonfederal Areas, 2016-2020

(million barrels per day)

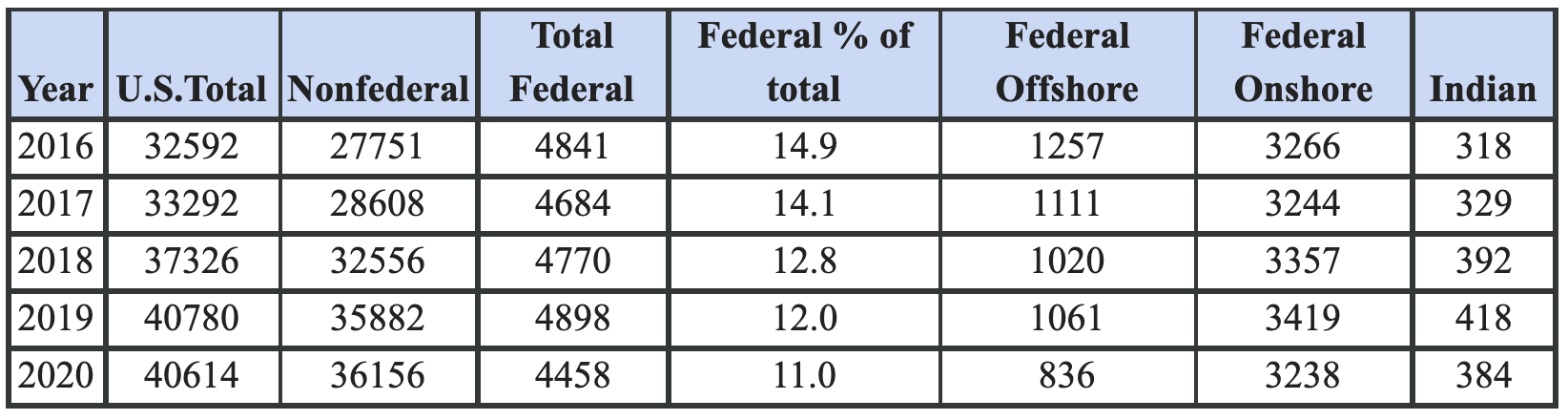

Natural Gas Production

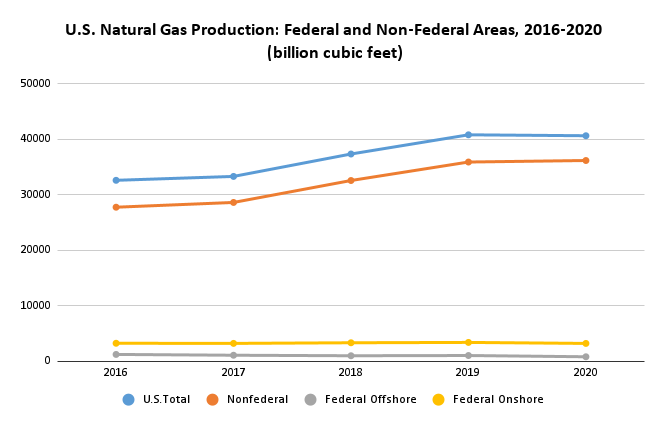

Natural gas production in the United States has basically steadily increased since 2008, while production on federal lands has declined each year from 2009 to 2017, increasing in 2018 and 2019, and dropping again in 2020. Much of the decline was due to a decrease in offshore production. Federal natural gas production fluctuated around 30 percent of total U.S. production for much of the 1980s through the early 2000s, after which there began a steady decline (as a percent of U.S. total production) through 2020. Most recent data from the Department of Interior and the Energy Information Administration show natural gas production on the federal offshore to be 2 percent of total U.S. natural gas production and 8 percent on federal onshore lands in 2020.

As noted from the table below, there has been significant growth in nonfederal production. The picture of natural gas production is different than that of federal crude oil in that federal natural gas had accounted for a much larger portion of total U.S. natural gas production over the previous few decades. The shale gas renaissance is the reason for the growth in natural gas production from nonfederal lands because shale plays are primarily situated on nonfederal lands where most of the growth in production has occurred in recent years.

U.S. Natural Gas Production: Federal and Nonfederal Areas 2016-2020

(billion cubic feet)

Conclusion

President Biden has taken a series of destructive measures to hurt the oil and gas industry in the United States by killing pipelines, shutting down oil and gas leasing (before a court order mandated Biden to allow them to resume), and looking to increase fees of all kinds on oil and gas drilling to name just a few. These actions result in energy being harder to produce and more challenging to discover. Therefore, gasoline and home heating prices are higher than they have been in quite some time. But Biden has not made the connection between his disastrous policies and the rise of energy prices. Instead, he is asking the Federal Trade Commission to investigate whether or not energy companies are gouging their prices to squeeze more money out of consumers, after failing to convince OPEC and Russia to produce more energy to moderate prices.

Under the Trump administration, the United States became energy independent—a goal that U.S. governments wanted to reach for decades. The United States had become the world’s leading oil and natural gas producer, thanks to the American energy renaissance, and Americans were reaping its benefits from low gasoline prices, inexpensive natural gas home heating, and nearly flat electricity prices. But the Biden administration’s anti-oil and gas policies are making those realities go away as it transitions the U.S. economy to a net zero carbon based economy. The policies of the Biden administration and the Democrat-controlled Congress have increased energy prices and will continue to do so as more and more of these negative policies are implemented, particularly those contained in the Build Back Better Bill, should it pass in the Senate.