There are various versions of the “peak oil” theory, but for decades it garnered high-fives because it had been right about the U.S. Specifically, geophysicist M. King Hubbert published a theory of oil field development in 1956 that predicted total U.S. oil production would “peak” by about 1971 (at the latest) after which it would decline. Hubbert also predicted that the world would see a decline in total oil production by about 2006. Hubbert was wrong about the world, but for a while it looked like he had nailed the U.S. Yet the development of shale resources, and expanded use of “fracking” and horizontal drilling, in the United States during the last few years show that “peak oil” no longer applies even to its one success story.

A Chart of U.S. Crude Oil Production

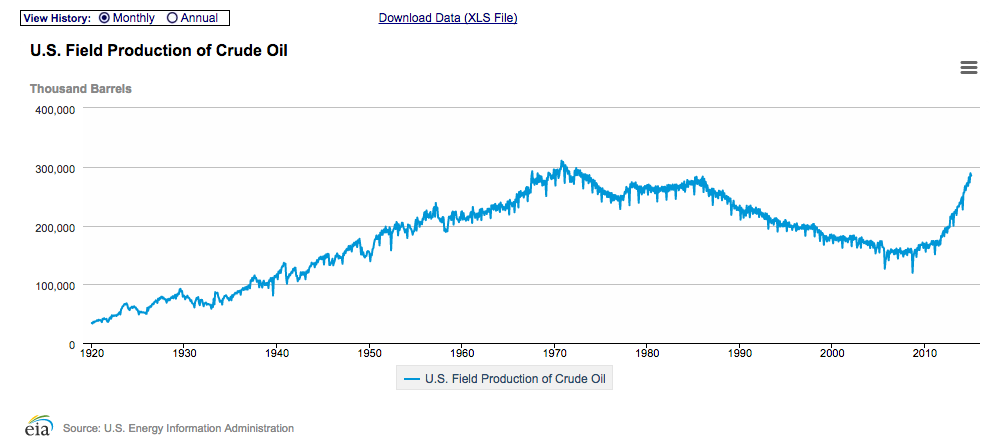

The chart below is the latest from the Energy Information Administration (EIA) showing the history of monthly U.S. crude oil production:

The chart above shows why Hubbert was considered such a visionary, at least for a while. After his 1956 prediction, U.S. production did indeed rise and then peak just in time for the window Hubbert had given himself. The gentle decline in U.S. production from the mid-1970s through the early 2000s was also consistent with Hubbert’s theory, which treated the total national output as an aggregation of individual wells, each with a technically defined, bell-shaped curve lifecycle of output.

Yet as the chart also shows, the nice bell shape started turning around in 2009 and took off like a rocket in 2011. Looking at monthly figures, U.S. field production of crude in December and January were the highest values since 1972, and not far behind the all-time record set in 1970. Although the sharp decline in the world price of oil since last year may halt the rapid spike in U.S. output, it is obvious from the chart that the mechanistic model of “peak oil” theory is incorrect.

“Finite” Resources Never Run Out With Enough Ingenuity

The fundamental problem with “peak oil” theory is that it adopts a Malthusian mindset, in which we view humanity as the stewards of a single pool of oil that gets smaller every time we burn a barrel. Although oil (as far as we know) is indeed a finite, depletable resource, nonetheless economically the real constraint is always one of human creativity—as the works of Julian Simon and Robert Bradley emphasize.

Humanity doesn’t need technocrats micromanaging energy usage policies, because their technical expertise often overlooks the entire field of economics. The insight of geologists and other experts will be reflected in market prices, particularly futures contracts and more exotic derivatives. No human institution is perfect, of course, but the free operation of the market economy will foster the optimal development of energy from the various sources available. If history is any guide, we can expect that humanity will continue to use oil and other fossil-based fuels until private-sector innovations make something else even more efficient.

We don’t need to fear an energy shortage. To paraphrase the Doritos slogan: When it comes to crude oil, burn all you want; we’ll find more. The only threat to plentiful, affordable energy is political interference—in other words, “peak government.”