If President Biden thought he had supply chain issues before, he will be overwhelmed by them soon due to rising diesel prices. Diesel prices have hit a record high and are continuing to rise due to several reasons including the closures of a number of refineries, the conversion of some refineries to biofuels consistent with Biden’s energy transition, high natural gas prices used in refinery operations, diesel exports to Europe to replace Russian imports there, the switch to low sulfur fuel for maritime use, and skyrocketing oil prices. The U.S. trucking industry, mainly composed of small fleets, cannot keep up with the out-of-control costs, partially due to the Russian invasion of Ukraine, but also encouraged by federal government policies by the Biden administration. If truckers cannot afford to drive, goods will not move and Americans will face more shortages and higher prices than they have already experienced.

Diesel Prices

On May 9, 2022, the average national price of a gallon of diesel fuel was $5.623, setting a record. It was 67 percent higher than a year ago when it was $2.437 a gallon lower. In New England, diesel prices hit $6.339 a gallon, over 100 percent higher than a year ago when it was $3.224 lower. New England diesel prices are just behind those of California where they are $6.461 a gallon.

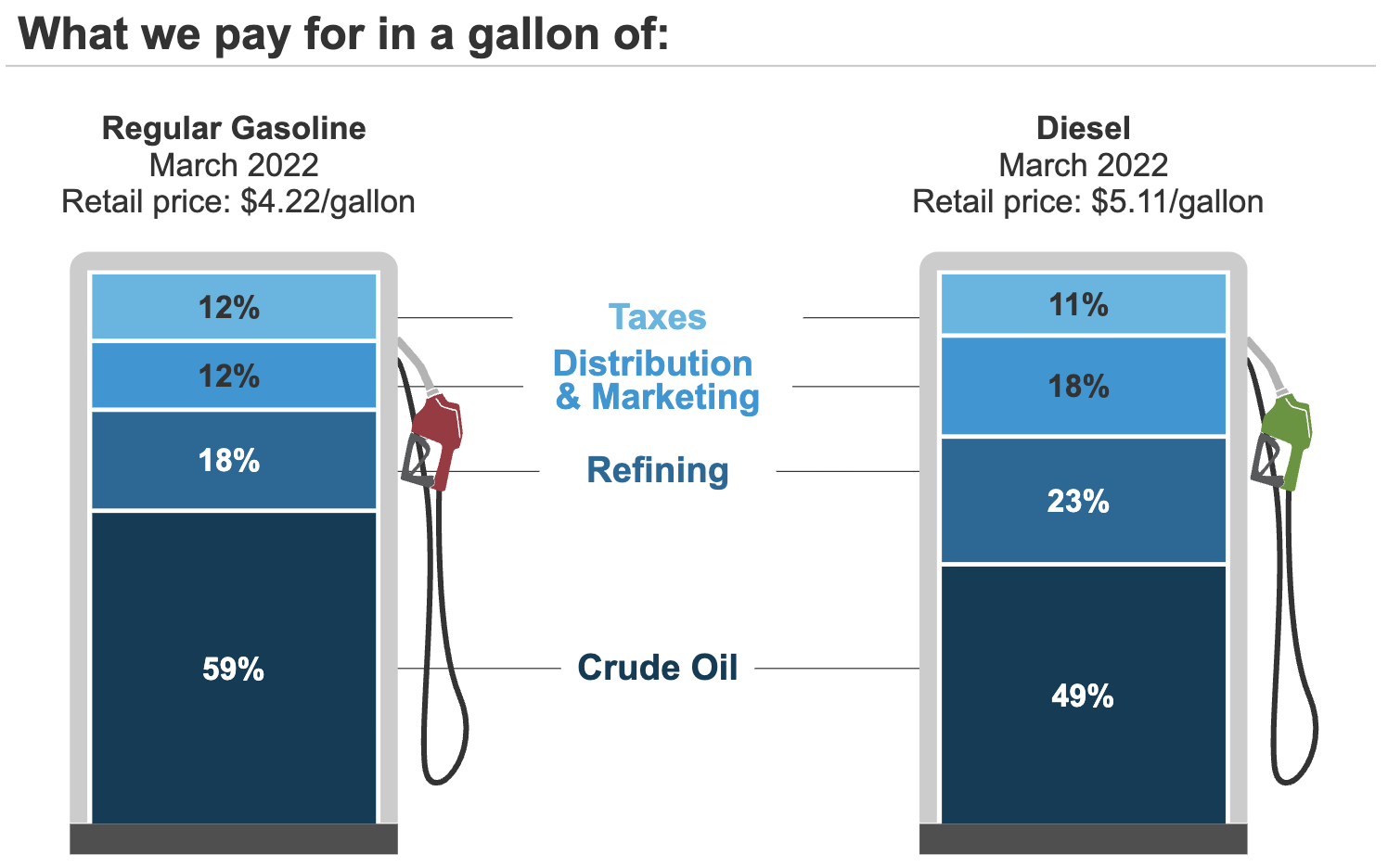

In March, the average national diesel price was 21 percent higher than the average gasoline price. Both the distribution and marketing component and the refining component had a higher share of the cost for diesel than for gasoline as the graph below depicts.

Trucking Industry

With high diesel prices, truckers are pinched because often their costs are increased without their revenue increasing. Independent truckers and small trucking companies are particularly hurt by the price increases because markets do not always compensate for the increased fuel cost. More than 95 percent of the trucking companies in the country are composed of small fleets that operate 20 or fewer trucks. These companies, which are the backbone of the industry, are struggling to keep up due to increasing diesel costs. This means that Americans’ expenses will be going up for just about everything including food at the grocery store, taking a cruise or a plane trip, or just plain necessities such as paper products. Fuel prices also will increase because of higher transportation costs.

To understand the price increase for a typical truck, consider the following example based on the May 9 diesel price. For retail diesel price at $5.623 per gallon and a truck getting 6.5 miles per gallon, the per-mile price for fuel would be $0.865. An owner-operator doing 7000 miles per month, would be getting a fuel bill of $6,055, an increase of $2,625 per month since a year ago.

Refinery Closures

According to the Energy Information Administration, U.S. operable atmospheric crude oil distillation capacity, the primary measure of refinery capacity in the United States, dropped 4.5 percent to a total of 18.1 million barrels per calendar day at the start of 2021. The end-of-year 2020 total is 0.8 million barrels per day less than the 19.0 million barrels per day of refining capacity at the start of 2020. According to the data in the annual Refinery Capacity Report, the beginning of 2021 marks the lowest annual capacity figure to start the year since 2015. At the beginning of 2021, 129 refineries were either operating (124) or idle (5) in the United States, down from 135 operable and idle refineries listed at the beginning of 2020. The additional refinery closures largely reflect the impact of reduced demand due to the COVID-19 lockdowns on the U.S. refining sector.

In 2020, the pandemic contributed to a substantial decrease in demand for motor fuels and refined petroleum products, which put downward pressure on refinery margins and made market conditions more challenging for refinery operators. The following refineries are classified as having closed in 2020:

- The Philadelphia Energy Solutions refinery in Philadelphia, Pennsylvania: 335,000 barrels per day

- The Shell refinery in Convent, Louisiana: 211,146 barrels per day

- The Tesoro (Marathon) refinery in Martinez, California: 161,000 barrels per day

- The HollyFrontier refinery in Cheyenne, Wyoming: 48,000 barrels per day

- The Western Refining refinery in Gallup, New Mexico: 27,000 barrels per day

- The Dakota Prairie refinery in Dickinson, North Dakota: 19,000 barrels per day

Conversion to Biofuels

In addition to challenging market conditions and over capacity, some refiners have decided to reconfigure petroleum refineries to biofuels. Several oil refineries across the western United States are being converted into biofuel plants. There are eight projects totaling over 1.1 billion gallons per year of capacity being constructed with targeted completion dates in the next several years. Refiners including Phillips 66, Marathon and HollyFrontier Corp have announced plans to ramp up production.

Phillips 66 is converting an oil refinery in California into a biofuel plant. According to Phillips 66, its 120,000 barrel-a-day Rodeo refinery near San Francisco will become the world’s biggest plant that makes renewable diesel, gasoline and jet fuel out of used cooking oil, fats, greases and soybean oils. The Rodeo plant is well suited for conversion because of its dock and rail access for receiving the tallows, vegetable oils and used cooking oils that will feed into the plant.

The facility has two hydrocrackers that are needed for the conversion process and a plentiful supply of hydrogen. Phillips 66 plans to invest $700 million to $800 million in the conversion including constructing pre-treatment facilities. The Rodeo plant could start operating as early as 2024, producing 680 million gallons a year of about 70 percent renewable diesel, 10 percent gasoline, and 20 percent jet fuel. The San Francisco refinery has an additional project under way that is expected to produce 120 million gallons a year of renewable diesel. Phillips 66 also plans to close its 45,000 barrel-a-day plant in Santa Maria in 2023 due to years of declining retail gasoline sales in California.

The California market is possibly the strongest in the world for renewable diesel. California’s Low Carbon Fuel Standard credits as well as other credits generate about $3.32 a gallon in subsidies for renewable diesel producers, sufficient to cover most of the production costs. Fuel suppliers in California buy credits from renewable energy producers as part of a program that is designed to reduce the region’s transportation-related emissions 20 percent by 2030.

Marathon Petroleum Corp. is planning to convert two refineries into renewable diesel plants. It will convert its Martinez, California refinery into a terminal facility that may include a 48,000 barrel-a-day renewable diesel plant. The company is also turning its 19,000 barrel-a-day North Dakota plant into a renewable diesel plant. HollyFrontier Corp. is planning to turn its Cheyenne, Wyoming refinery into a renewable diesel plant.

Reducing Sulfur Content of Maritime Fuel

The International Maritime Organization—the United Nations body that sets standards for the global marine industry—required ships to reduce the sulfur content of their exhaust by over 85 percent by 2020. Ship owners met the requirement by switching to a lower-sulfur fuel or by installing scrubbers in their smokestacks. The emission mandate affected at least 60,000 vessels and cost the industry up to $50 billion. The rule is the biggest change in ship propulsion since the maritime industry moved from coal to heavy oil early in the 20th century. The higher costs will result in a significant jump in freight rates that were not experienced during the COVID lockdowns, but which are a part of the diesel price increase now occurring.

The new formulation of low-sulfur fuel is supposed to replace bunker fuel, which has 3.5 percent sulfur content. The new maritime fuel will be limited to a sulfur content of 0.5 percent. However, ship operators can either use low-sulfur fuel or continue using bunker fuel and add scrubbers that trap sulfur in the exhaust system before the sulfur emissions are released in the atmosphere. The scrubbers cost $3 million to $10 million per ship. Carriers that installed scrubbers believe they can recover the cost in about two years by continuing to use bunker fuel instead of the more expensive low-sulfur fuel.

As the price of low-sulfur fuels increases to meet the new demand, the prices of diesel and jet fuel will also increase, making the impact of the regulation go beyond the shipping and refining industries. The increase in the price of diesel means the cost of moving goods on trucks will be more expensive. And, because the price of jet fuel is closely linked to the new shipping fuels, airline profits will be affected as well as air fares.

Oil Prices

Oil prices have more than doubled since January of 2021 when they were around $50 a barrel. By January 2022 they were around $80 a barrel—60 percent higher due to Biden’s policies affecting the oil and gas industry, including cancellation of the Keystone XL pipeline, a moratorium on oil and gas leasing on public lands, and a moratorium on all oil and natural gas leasing activities in the Arctic National Wildlife Refuge. A month later, they were around $90 a barrel. For a complete list of Biden’s actions affecting oil prices, see Chronology of Biden’s Gasoline Price Hike that also pertains to oil prices as they represent 59 percent of price of gasoline. Now, oil prices are well over $100 a barrel being affected by Biden’s continued actions against the oil and gas industry and by Russia’s invasion of Ukraine. As shown in the graph above, oil prices in March were 49 percent of the price of diesel.

High Natural Gas Prices

Oil refineries can produce more diesel through hydrocracking. Hydrocracking “cracks” or breaks heavy hydrocarbons and then saturates them with hydrogen. Almost all hydrogen for industrial use comes from natural gas, whose prices in the United States have more than doubled in the last year. In 2020, industrial natural gas prices averaged $3.32 per thousand cubic feet and by January 2022, they were $6.64 per thousand cubic feet.

Conclusion

Americans need to watch their pocketbooks because the Biden administration is doing all it can to increase domestic oil, diesel and gas prices so that the energy transition touted by President Biden will be forced to occur. The diesel price increases are hurting the trucking industry big time and it will most likely result in some companies going out of business and even more supply chain problems to result. That means shortages of goods and higher prices for Americans.