Oil and natural gas production are expected to reach increasingly high levels as production on private lands continues to grow and as shale formations continue to increase their output of oil and gas using hydraulic fracturing and directional drilling technology. Several states have been at the forefront of the shale production movement, but the best recognized is North Dakota, whose unemployment rate is less than half that of the nation, whose economy is growing at over 13 percent per year, and whose state revenues are overflowing. Several other states are now interested in following in North Dakota’s footsteps to get themselves financially healthy. These states include but are not limited to California, Illinois, North Carolina, and Ohio.

Increasingly High Levels of Oil and Natural Gas Production Expected

The Energy Information Administration (EIA) in its September Short-Term Energy Outlook expects U.S. crude oil production to increase from an average of 6.5 million barrels per day in 2012 to 7.5 million barrels per day in 2013 and 8.4 million barrels per day in 2014, which is an average growth rate of almost 14 percent per year. According to the agency, the bulk of the growth in production is in tight oil plays in the onshore Williston, Western Gulf, and Permian basins. Offshore production from the Federal Gulf of Mexico continues to lag behind the onshore gains, forecast to average 1.26 million barrels per day in 2013, the same level as in 2012, and to average to 1.38 million barrels per day in 2014—a slight increase.[i]

In 2005, net imports of petroleum fuels reached a high of 12.5 million barrels per day, and its share of U.S. consumption peaked at more 60 percent. But those statistics have fallen largely due to the hydraulic fracturing revolution, but also to lower demand and increased biofuels production. Total net petroleum imports fell to 7.4 million barrels per day in 2012 (40 percent of U.S. petroleum liquids consumption), and are expected to decline to 5.4 million barrels per day in 2014 (29 percent of liquids fuels consumption in 2014)–the lowest level since 1985.

Natural gas production is also increasing and continues to set records. Marketed production is expected to increase from 69.2 billion cubic feet per day in 2012 to 69.9 billion cubic feet per day in 2013 and to 70.4 billion cubic feet per day in 2014. Onshore production, particularly on private and state lands, again due to hydraulic fracturing and horizontal drilling, increases over the forecast period; federal Gulf of Mexico production continues to decline. Except for a few years where production increased slightly, federal offshore production in the Gulf of Mexico has been on a steady decline.

EIA is right to expect increasing natural gas and oil production. Hydraulic fracturing has resulted in record levels of natural gas reserves and high oil reserves, both of which have been increasing according to EIA data. And, this has occurred without the participation of many states that have shale resources, but have not developed them. For example, Ohio shares the Marcellus shale formation with states that are already producing shale gas and its Utica shale formation contains both shale oil and gas. While production is just beginning in these shale formations in Ohio, it is expected to increase substantially by 2015. Currently, shale wells account for less than 1 percent of the almost 51,000 gas and oil wells in the state. However, their output in 2012 represented 12 percent of the state’s total oil production and 16 percent of the state’s total gas production.

In Texas, increased oil production is primarily attributable to output from the Eagle Ford Shale formation, a 400-mile-long, 50-mile-wide, crescent-shaped field in the south central part of Texas. According to the Texas Railroad Commission, its production in March rose 77 percent from a year earlier to 529,900 barrels per day. In 2011, Eagle Ford supported 38,000 full-time jobs, generated $10.8 billion in gross regional product and poured millions into state and local tax coffers. But the Wolfcamp Shale formation, yet to be developed, is expected to dwarf the Eagle Ford in size. Early estimates indicate that this shale formation could contain 50 billion barrels of recoverable oil, which would make it the biggest oil field in the country and the second-largest in the world.

Other State Interest

Recently, California Governor Jerry Brown signed into law new regulations regarding the use of hydraulic fracturing, which will allow exploration of oil-rich areas in and around the San Joaquin Valley.[ii] According to Governor Brown, “fracking presents a fabulous economic opportunity.” An analysis by IHS Global Insight released last December showed California obtained almost $3 billion in extraction taxes in 2012.[iii] In March, a University of Southern California study estimated that the Monterey Shale formation, which runs through the San Joaquin Valley, could bring in almost $25 billion in tax revenue, and create 2.8 million jobs by 2020.[iv]

In June, Illinois Governor Pat Quinn signed similar legislation that imposes regulations on the industry, but simultaneously invites companies to invest in oil and gas exploration. The push for such legislation came from the Illinois Chamber of Commerce and the state Manufacturer’s Association along with the state AFL-CIO because increased hydraulic fracturing results in more jobs, which will help economically struggling Central Illinois.[v]

Clearly, state governments need the billions in tax revenue that results from oil and gas production. The state legislature in North Carolina is planning to evaluate the issue next year. New York’s Governor Andrew Cuomo is still debating the issue with a pending moratorium, but the actions of other states may propel him to act, which will help to fund the state’s budget.

Oil and Gas Production on Federal Lands

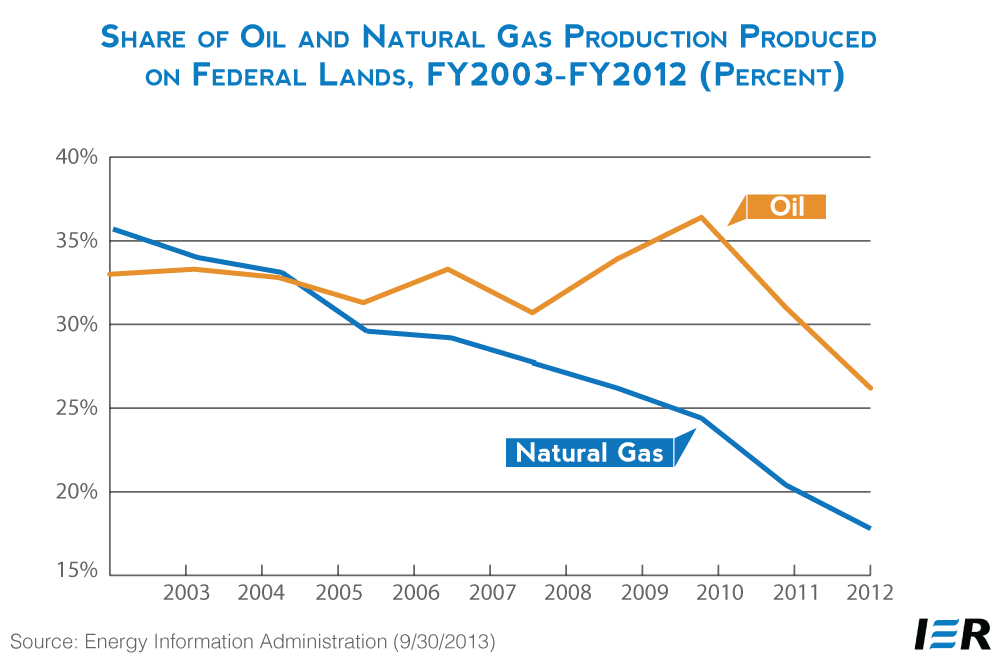

While oil and gas production on private and state lands has been booming, production on federal lands has been a disappointment. Natural gas production on federal lands has been on a downturn for years. Oil production, however, was increasing and hit a high in fiscal year 2010. But due to Obama Administration policies after the Deepwater Horizon accident in the Gulf of Mexico, offshore oil production has been in a decline and is not expected to turn around until 2014.

The graph below shows the share of oil and natural gas production that came from federal lands. As you can see, the share of oil production from federal lands peaked in fiscal year 2010 at 36.4 percent, but has declined by 10 percentage points to just 26.2 percent in fiscal year 2012. Natural gas production on federal lands peaked at 35.7 percent in fiscal year 2003, the first year that EIA reports the data, and has declined ever since reaching half that share in fiscal year 2012–17.8 percent.[vi]

Source: Energy Information Administration, http://www.eia.gov/analysis/requests/federallands/

Source: Energy Information Administration, http://www.eia.gov/analysis/requests/federallands/

The fact that production on federal lands is declining so much as a share of total production should not be a surprise. Drilling in the offshore came to a stop when President Obama put a moratorium on both shallow and deep water offshore drilling in 2010, followed by a de facto moratorium when required permitting on all leases was at a stand-still in government offices despite the lifting of the actual moratorium six months after it was imposed.

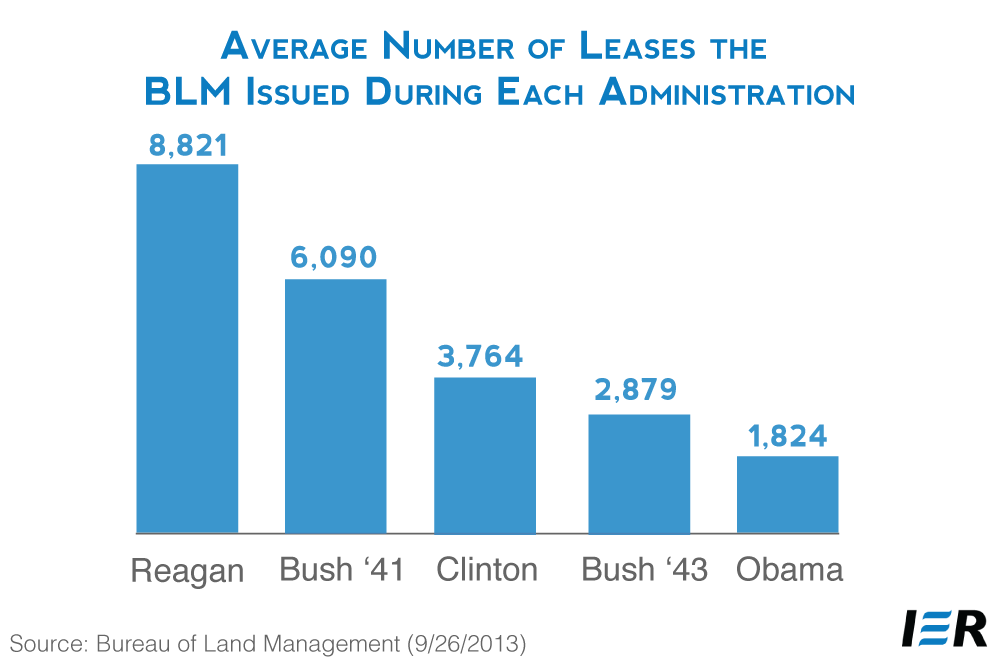

While the Deepwater Horizon accident is the conduit for the offshore drilling decline, the track record set by the Obama Administration on new onshore leases is abysmal. The following chart shows the average number of new leases that the Bureau of Land Management issued during each administration. While the trend is down under all administrations covered, the Obama Administration had the lowest—half that of the Clinton Administration and a third less than the George W. Bush Administration.[vii]

Source: Bureau of Land Management, http://www.blm.gov/pgdata/etc/medialib/blm/wo/MINERALS__REALTY__AND_RESOURCE_PROTECTION_/energy/oil___gas_statistics/data_sets.Par.62098.File.dat/table04.pdf

Source: Bureau of Land Management, http://www.blm.gov/pgdata/etc/medialib/blm/wo/MINERALS__REALTY__AND_RESOURCE_PROTECTION_/energy/oil___gas_statistics/data_sets.Par.62098.File.dat/table04.pdf

Conclusion

Oil and natural gas production in the United States is setting records, reducing the need for imports and bringing billions to state and federal government treasuries. States like North Dakota are clearly finding new riches, with low unemployment and a hugely growing state economy. Other states are clearly using North Dakota’s example to add to their coffers by enticing companies to their states to produce the same “miracle”. Oil and natural gas companies have certainly shown how the United States can grow economically in the future, providing jobs and much needed revenues. But, our federal government still needs to get the message.

[i] Energy Information Administration, Short-Term Energy Outlook, September 2013, http://www.eia.gov/forecasts/steo/report/

[ii] Los Angeles Times, Brown signs bill on fracking upsetting both sides of oil issue, September 20, 2013, http://www.latimes.com/local/la-me-brown-bills-fracking-20130921,0,5029067.story

[iii] IHS Inc., America’s New Energy Future: The Unconventional Oil and Gas Revolution and U.S. Economy, December 2012, http://www.api.org/~/media/Files/Policy/SOAE-2013/Americas_New_Energy_Future_State_Highlights_Dec2012.pdf

[iv] Bloomberg, California Fracking Fight has $25 Billion Taxes at Stake, March 17, 2013, http://www.bloomberg.com/news/2013-03-17/california-fracking-fight-has-25-billion-taxes-at-stake.html

[v] Washington Post, Slowly, Democrats embrace fracking, September 25, 2013, http://www.washingtonpost.com/blogs/govbeat/wp/2013/09/25/slowly-democrats-embrace-fracking/

[vi] Energy Information Administration, Sales of Fossil Fuels Produced from Federal and Indian Lands, FY 2003 through FY 2012, May 30, 2013, http://www.eia.gov/analysis/requests/federallands/

[vii] Bureau of Land Management, Number of New Leases Issued During the Fiscal Year, December 5, 2012, http://www.blm.gov/pgdata/etc/medialib/blm/wo/MINERALS__REALTY__AND_RESOURCE_PROTECTION_/energy/oil___gas_statistics/data_sets.Par.62098.File.dat/table04.pdf