In May, China’s and India’s oil imports from Russia hit an all-time high due to the discounted prices of Russian oil, which are reducing their oil imports from the Middle East and Africa. The G7, the European Union and Australia agreed in December, 2022, to impose a $60-per-barrel price cap on Russian seaborne oil and also set an upper price limit for Russian oil products to deprive Russia of revenues for its invasion of Ukraine. However, India and China are buying the vast majority of Russian oil so far at prices above the Western price cap. India and China have not agreed to abide by the price cap, but the West had hoped the threat of sanctions might deter traders from helping those countries buy oil above the cap. It clearly has not.

China and India, the world’s No. 1 and No. 3 oil importers, respectively, are top buyers of Russian oil, importing over 110 million barrels in May, up nearly 10 percent from the prior month despite U.S. warnings against price cap evasion. According to one estimate, Russian oil shipments in India reached a record high of 8.6 million metric tons (62.8 million barrels) while China received 6 million metric tons (44.8 barrels), about the same as April. Another data service has India hitting a record of 66.7 million barrels and China’s Russian imports rising to 49.2 million barrels. China and India have been aggressively adding refining capacity to add value to raw imports.

China

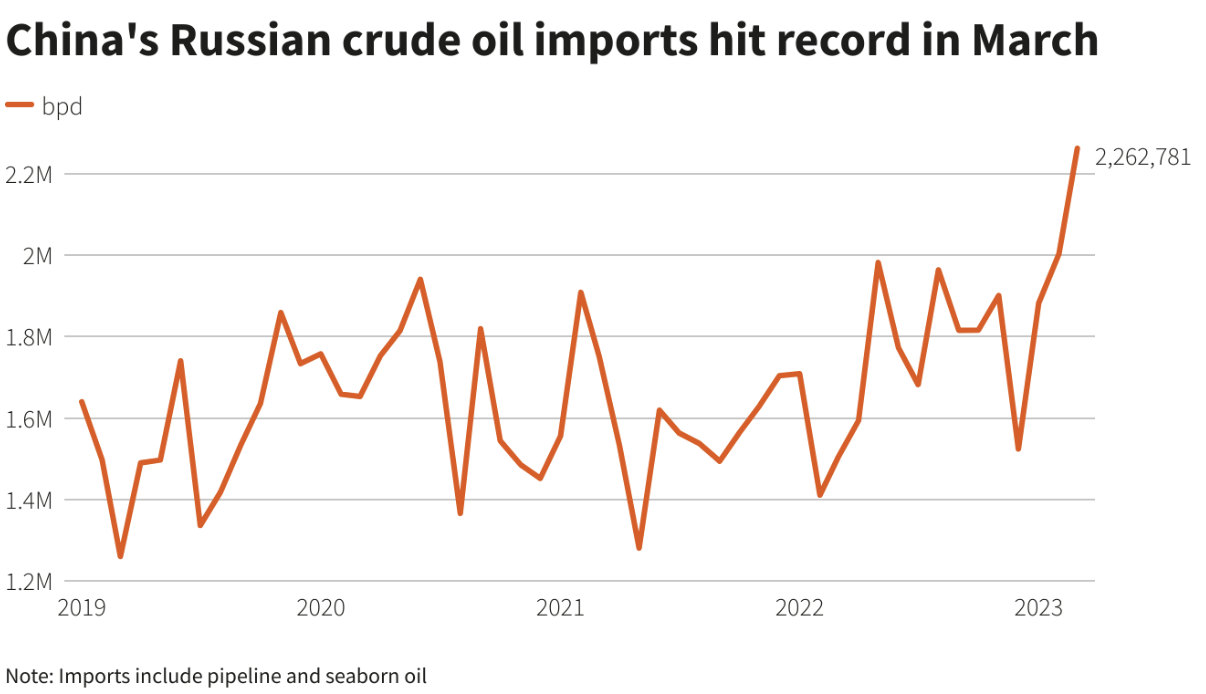

In China, refiners are cutting feedstock costs and improving refining margins amid a slower-than-expected economic recovery. Large private oil refiners started buying Russian oil earlier this year and have increased volumes in recent months. The lump sum freight rates for tankers carrying oil from Kozmino to northern China fell to $2.2 million after hitting an all-time high of $2.4 million in mid-March.

Around 700,000 barrels per day of Urals oil may have reached China in April, up from 600,000 barrels per day in March. In April, Russia’s oil exports from western ports rose to the highest level since 2019, about 2.4 million barrels per day, despite Russia’s pledge to cut output. Discounts for Urals oil arriving to China in July have narrowed to about $9-$10 a barrel compared to Brent futures on a delivered ex-ship basis, from around $14 a barrel for March arrivals. Similarly, another oil type, ESPO, for June delivery traded at discounts of about $5.50 a barrel to Brent futures, up from discounts of $6 and $8.50 a barrel for cargoes arriving in May and March, respectively.

India

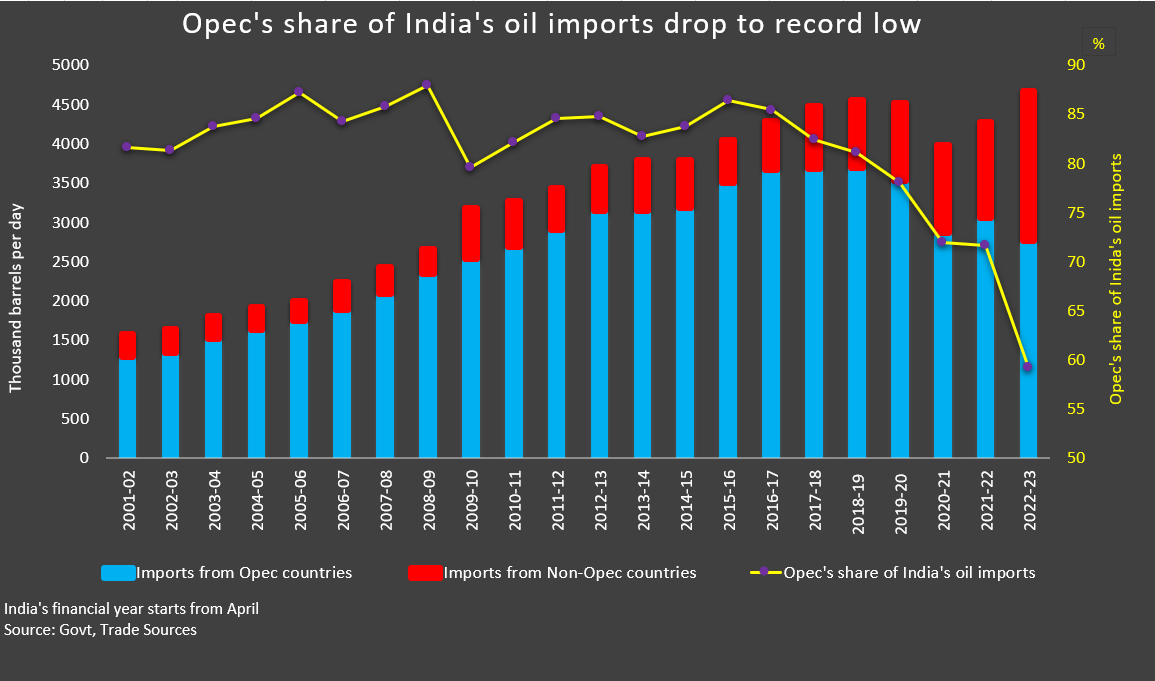

India, one of the largest importers of oil worldwide, has been diversifying away from Middle East oil over the last couple of years, and is importing more oil from Russia, dropping its reliance on OPEC to the lowest level in about 22 years. OPEC, mainly from members in the Middle East and Africa, saw its share of India’s oil market dip to 59 percent in the fiscal year to March 2023, from about 72 percent in 2021/2022. Russian oil is cheaper than OPEC oil despite being priced above the $60 a barrel cap imposed by the Group of Seven nations, European Union and Australia. Russia overtook Iraq to emerge as the top oil supplier to India, pushing Saudi Arabia down to Number 3.

India has had differences with Saudi Arabia, the world’s largest oil exporter in the past, and had sought out other sources of oil in the past few years. The nation was upset with OPEC when it elected not to raise output in 2021 despite a doubling of oil prices during that time, and India asked its refiners to diversify away from Middle East oil. Russia’s been able to fill that gap as its oil is heavily discounted because of sanctions from the West due to Russia’s invasion of Ukraine. The Middle East, however, still accounts for 55 percent of India’s imports.

OPEC’s share shrank as India, which in the past rarely bought Russian oil due to high freight costs, is now the top oil client for Russian seaborne oil. The decision by OPEC and their allies, a group known as OPEC+ to cut production in May could further squeeze OPEC’s share in India later this year if Russian supplies stay elevated. In fiscal 2022/23, higher intake of Russian oil raised the share of Commonwealth of Independent States countries to a record 26.3 percent, and reduced that of Middle Eastern and African nations to a 22-year low of 55 percent and 7.6 percent, respectively. In 2021/22, Middle East’s share was 64 percent while Africa’s was 13.4 percent. Latin America’s share declined to a 15-year low of 4.9 percent in 2022/23.

India’s oil imports in 2022/23 rose 9 percent from a year earlier, as state refiners met rising demand after private refiners turned to exports instead of selling fuel at below-market rates domestically. Local refiners together processed about 6 percent more crude in 2022/23 at about 5.13 million barrels per day. In March, India imported nearly 5 million barrels per day of oil, marginally higher than the previous month, with Russian oil accounting for about 36 percent of overall imports.

Dark Fleets Move Russian Oil

Tankers are taking extraordinary steps to hide moving Russian oil to buyers that are paying above the price cap in an effort to elude U.S. government oversight. In doing so, they are putting their American insurer at risk of violating recent sanctions on Russian crude oil. For years, ships wanting to hide their whereabouts have turned off the transponders that large vessels use to signal their location. But some tankers are using cutting-edge spoofing technology to make it appear they are in one location when they are really somewhere else. In at least 13 voyages, three tankers that pretended to be sailing west of Japan were actually at terminals in Russia and shipping oil to China.

The vessels are part of a so-called dark fleet, a term used to describe an array of ships that obscure their locations or identities to avoid oversight from governments and business partners. They have typically been involved in moving oil from Venezuela or Iran — two countries that have been hit by international sanctions. The latest surge of dark fleet ships began after Russia invaded Ukraine and the West placed sanctions on Russia’s oil revenue.

Since China does not recognize the West’s sanctions, the tankers are not in violation of shipping the oil. The issue, however, is that the tankers need to maintain insurance coverage, without which they cannot operate in most major ports. The only insurers financially able to cover tankers are mostly based in the West and are bound by the sanctions. If a clientship were to carry Russian oil that is being sold above the price limit, the Western insurer would be in violation of the sanctions and must drop coverage.

The three tankers mentioned above are insured by a U.S.-based company, the American Club. The United States has created safe harbor provisions to protect insurers from liability if they inadvertently cover ships violating sanctions.

Conclusion

China and India are taking advantage of discounted Russian oil, importing it in lieu of some oil imports from OPEC. Since neither country recognizes Western sanctions, they are paying a discounted price above the $ 60-a-barrel price cap placed on Russian oil, but less than the price of OPEC oil. Further, Russia is likely benefiting from OPEC’s oil production cuts, as it is able to sell more oil to these countries. In some identified cases, dark fleets are moving the oil from Russia and using spoofing technology that allows them to appear in one location when they are actually in another. If they get caught moving Russian oil sold above the price cap, their insurance coverage by Western companies would be dropped. Clearly, China and India are benefiting from discounted Russian oil due to the war in Ukraine.