Over the summer, the Institute for Energy Research (IER) hosted a conference entitled, “A U.S. Carbon Tax: The Rest of the Story.” We picked experts from both academia and policy analysis to demonstrate that the American public has been getting a very biased perspective on the case for a carbon tax. Even if we accept at face value the official position of the IPCC on the natural physical science of greenhouse gas emissions and climate change, the economic science doesn’t automatically point to a U.S. carbon tax the way its proponents would have us believe.

In this four-part series, I will post the video of each presentation from our panel of experts, along with my commentary on the most crucial take-away messages. By the end of the series, it will be clear that the cutting edge, peer-reviewed research in the economics journals shows that the case for a carbon tax its much weaker than the public debate indicates.

Robert P. Murphy on “The ‘Social Cost’ of Carbon: Some Surprising But Little-Known Facts”

As IER’s Senior Economist and one of the organizers of the panel, I gave the first presentation, titled, “The ‘Social Cost’ of Carbon: Some Surprising But Little-Known Facts.” The YouTube link is here, or you can watch the video below:

For those with limited time, let me summarize some of my key points:

- The “social cost of carbon” (SCC) is purported to reflect the external damages from future climate change that an additional unit of carbon dioxide emissions, measured in dollars at the moment of the emission. For example, the Obama Administration’s Working Group in its May 2013 update estimated the 2020 SCC at $43 per ton of carbon dioxide (using a 3 percent discount rate).

- The SCC is a theoretical concept in the economics of climate change literature, but in recent years it has become very relevant to policy discussions because the federal government is relying on estimates of the SCC in order to justify new regulations on power plants, automobiles, and even household microwaves. The SCC will thus greatly influence the lives of ordinary Americans, which is why they need to learn just how murky a concept it is.

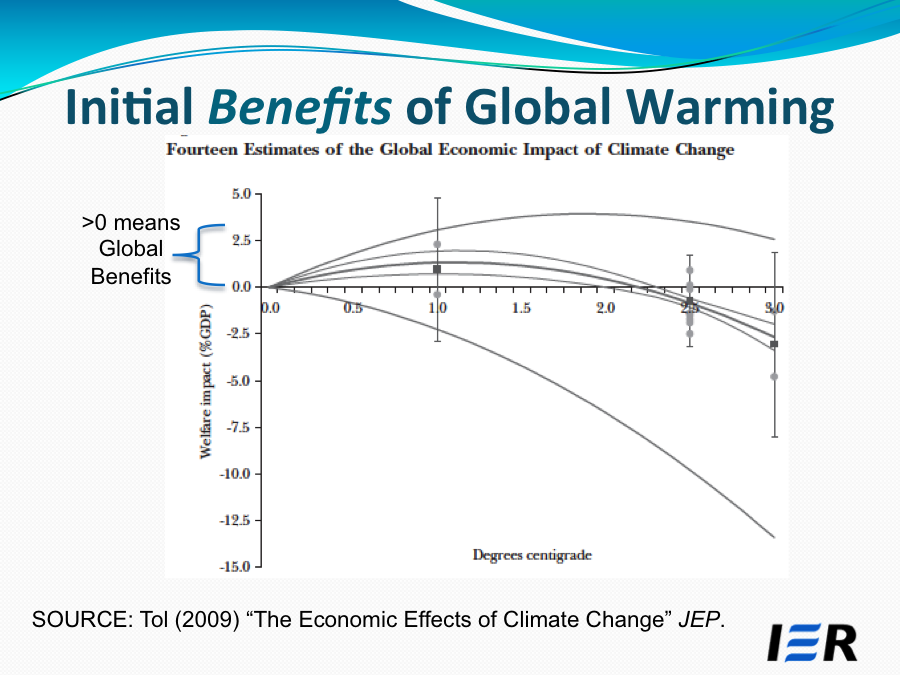

Several peer-reviewed studies project that global warming will confer net benefits on humanity for decades to come. Here is the relevant slide from my presentation:

- The slide above indicates that there are reasons to expect moderate warming (below two degrees Celsius) to confer net global benefits, because of increased agricultural productivity, fewer winter deaths, etc. The standard models do not project the earth surpassing this threshold of warming until after the year 2050.

- To be clear, the economists publishing such projections might support a carbon tax, at least in principle, because they are concerned about putting more CO2 “in the pipeline” that will eventually cause net damages. But it’s important for Americans to realize that when certain officials or policy analysts speak of the alleged disaster of manmade climate change being upon us already, they are ignoring the peer-reviewed economics literature.

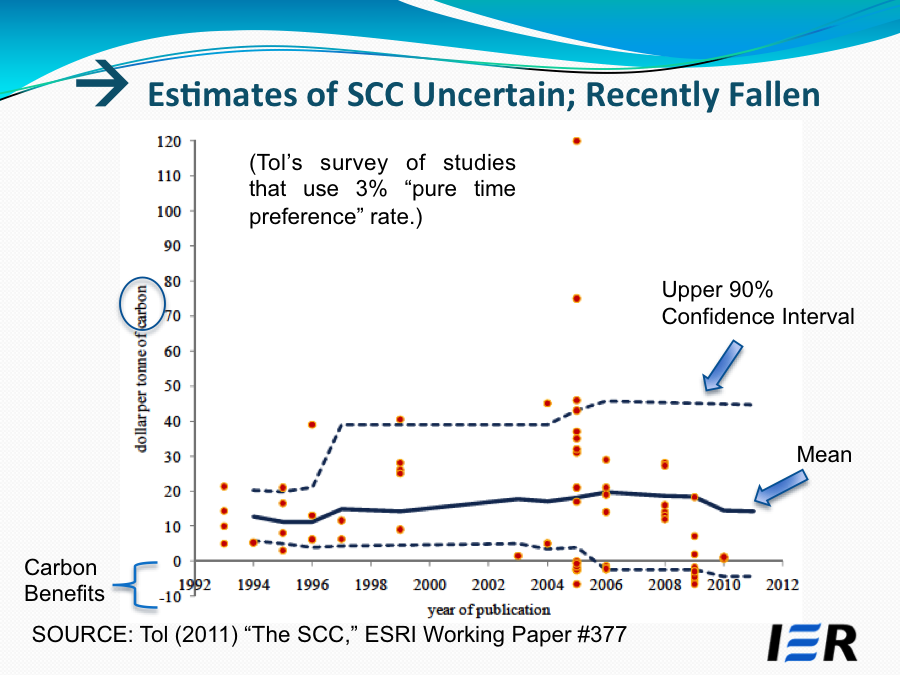

- As of a 2011 literature review by Richard Tol, the estimates of the SCC in the literature had generally been falling for several years, and the range of estimates has grown dramatically over the last 20 years. Moreover, many published studies provide estimates of a negative social cost of carbon, meaning that carbon dioxide emissions provide external benefits to third parties (over and above the direct benefit they give to the people driving their cars, using electricity, etc.). The slide below (from my presentation) shows how uncertain the estimate of the SCC is. The area between the dotted lines is the area that economist Richard Tol carves out as the 90 percent confidence interval for the “true” SCC, given the published estimates.

Naturally, for a more comprehensive explanation of the slide, you should watch the video.

- Finally, I explained that the Obama Administration Working Group had ignored two clear guidelines from the Office of Management and Budget (OMB) when providing its estimates of the SCC. First, the Working Group should have calibrated the SCC in terms of domestic impact, rather than global. Second, the Working Group should have included an estimate of the SCC using a 7 percent discount rate. Had the Working Group heeded either (but especially both) of these conditions, the estimated SCC would be very close to $0/ton, if not negative—a situation meaning that the government should subsidize coal-fired power plants, if we take their own logic seriously.

Conclusion

Even professional economists will probably be surprised at the material contained in IER’s carbon tax conference. In my next post in this series, I’ll walk through some of the key points from Dr. Ross McKitrick, who exploded the common claim that it’s “good for the economy” to tax carbon dioxide in order to lower income tax rates. This is just one of many myths that we debunked at the IER conference, relying on the peer-reviewed literature and actual historical case studies