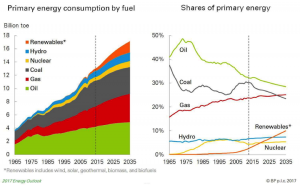

BP’s Energy Outlook provides global energy supply and demand forecasts through 2035. In its 2017 edition, global energy demand is expected to increase by 30 percent to 2035 (an average annual growth rate of 1.3 percent) due to increasing prosperity in developing countries. Like other outlooks, BP projects that oil, natural gas, and coal remain the major sources of energy through 2035, supplying over 75 percent of total energy in that year, but lower than the 86 percent they supplied in 2015. Natural gas is the fastest growing fossil fuel and overtakes coal as the second largest global fuel source before 2035. Non-hydroelectric renewable energy increases and supplies 20 percent of global electricity generation by 2035. Carbon dioxide emissions continue to grow, but at less than a third of the rate in the past 20 years increasing by 13 percent by 2035.[i]

Source: http://www.ogj.com/articles/2017/01/bp-energy-outlook-global-energy-demand-to-grow-30-to-2035.html

Oil

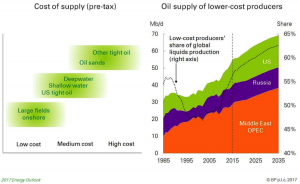

Oil demand is expected to grow at an average annual rate of 0.7 percent.[ii] The transportation sector is expected to consume most of the world’s oil with its share of global demand remaining near 60 percent in 2035. The transportation sector accounts for about two thirds of the growth in oil demand over the forecast period. Oil demand for cars increases by around 4 million barrels per day due to a doubling of the global car fleet by 2035. The number of electric cars is assumed to increase from 1.2 million in 2015 to about 100 million in 2035, or about 5 percent of the global car fleet.

While the rate of oil demand growth is expected to slow toward the end of the forecast period, global oil resources are expected to be abundant. The abundance of oil supply results in low-cost producers, such as the Middle East OPEC, Russia, and the United States, to use their competitive advantage to increase their market share at the expense of higher-cost producers. OPEC is expected to account for almost 70 percent of global supply growth, increasing production by 9 million barrels per day, while non-OPEC supply grows by just over 4 million barrels per day–led by the United States.

Source: http://www.ogj.com/articles/2017/01/bp-energy-outlook-global-energy-demand-to-grow-30-to-2035.html

Natural Gas

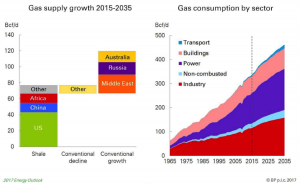

Natural gas demand is expected to grow at an average rate of 1.6 percent per year between 2015 and 2035—faster than the growth in either oil or coal, overtaking coal as the second-largest fuel source before 2035. Shale gas production grows at 5.4 percent per year and accounts for about two-thirds of the increase in natural gas supplies, led by the United States where shale production more than doubles.

The growth in liquefied natural gas (LNG), driven by increasing supplies in Australia and the United States, is expected to lead to a globally integrated natural gas market anchored by U.S. gas prices. The BP outlook expects LNG to supply over half of traded gas by 2035. About a third of LNG’s growth occurs over the next 4 years as projects currently under development come on-line.

Source: http://www.ogj.com/articles/2017/01/bp-energy-outlook-global-energy-demand-to-grow-30-to-2035.html

Coal

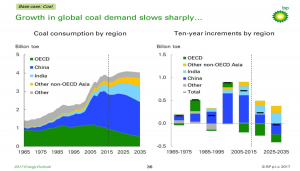

Growth in global coal demand is expected to increase at only 0.2 percent per year compared to 2.7 percent per year over the past 20 years. While China remains the largest market for coal, India is the largest growth market for coal, with its share of world coal demand doubling from around 10 percent in 2015 to 20 percent in 2035.

Source: BP Power Point, http://www.bp.com/en/global/corporate/energy-economics/energy-outlook.html

Non-hydroelectric Renewable Energy

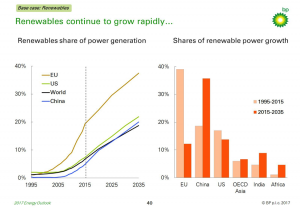

Non-hydroelectric renewables in the power generation sector are projected to be the fastest growing fuel source, growing at an average rate of 7.6 percent per year, quadrupling over the outlook, due to increasing competitiveness of solar and wind power and the move to de-carbonization. Non-hydroelectric renewable energy accounts for 40 percent of the growth in power generation, with their share of global power increasing from 7 percent in 2015 to almost 20 percent by 2035.

The European Union is expected to continue its penetration of renewable energy in the power sector, with the share of renewable energy doubling over the forecast period, reaching almost 40 percent by 2035. However, China is the largest overall source of growth in renewable energy over the next 20 years.

Source: BP Power Point, http://www.bp.com/en/global/corporate/energy-economics/energy-outlook.html

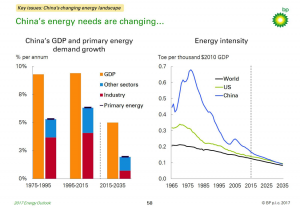

China

China is expected to account for half of the oil demand growth in the forecast that comes entirely from developing countries. China’s natural gas consumption grows faster than its domestic production, so by 2035, imported gas comprises nearly 40 percent of total consumption, up from 30 percent in 2015. However, towards the end of the forecast period, China becomes the second largest shale gas supplier.

China’s coal consumption is projected to peak in the mid-2020s, due to China’s move towards lower-carbon fuels. However, China still remains the world’s largest market for coal, accounting for nearly half of global coal consumption in 2035.

China is expected to account for almost three-quarters of the increase in nuclear generation, roughly equivalent to introducing a new nuclear reactor every three months for the next 20 years. China’s increased nuclear generation helps maintain nuclear’s share and modest growth rate of 2.3 percent per year as other countries close some of their nuclear units.

China is the largest source of growth in non-hydroelectric renewable energy over the next 20 years, adding more renewable power than the European Union and the United States combined.

Source: BP Power Point, http://www.bp.com/en/global/corporate/energy-economics/energy-outlook.html

Carbon Dioxide Emissions

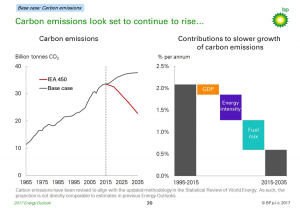

Carbon dioxide emissions are projected to grow at less than a third of the rate of the past 20 years – at 0.6 percent per year compared to 2.1 percent per year. Carbon dioxide emissions are expected to increase by 13 percent by 2035, and thereby are not forecast to comply with the Paris Agreement, where they would need to decrease to achieve the agreement’s goals. The chart below shows base case emissions compared to another scenario (International Energy Agency’s 450 Scenario) where emissions decline by 30 percent to meet the goals of the Paris Agreement.

The slowdown in carbon dioxide emissions growth reflects the accelerating decline in energy intensity (energy consumption per unit of GDP) and the change in the fuel mix, with coal consumption slowing and natural gas, nuclear power, hydroelectric power and renewable energy together supplying almost 80 percent of the increase in energy demand.

Source: BP Power Point, http://www.bp.com/en/global/corporate/energy-economics/energy-outlook.html

Conclusion

BP is forecasting that fossil fuels will remain the dominant source of world energy despite the growth in less carbon and zero carbon intensive fuels. However, natural gas, nuclear power, hydroelectric power and renewable energy together supply almost 80 percent of the increase in forecasted energy demand through 2035. BP also expects the goals of the Paris Agreement not to be met with carbon dioxide emissions increasing, rather than decreasing, in the forecast.

[i] BP, Energy Overview-base case, http://www.bp.com/en/global/corporate/energy-economics/energy-outlook/energy-overview-the-base-case.html and BP Energy Outlook, http://www.bp.com/en/global/corporate/energy-economics/energy-outlook.html

[ii] Oil & Gas Journal, BP Energy Outlook: Global energy demand to grow 30% to 2035, January 25, 2015,http://www.ogj.com/articles/2017/01/bp-energy-outlook-global-energy-demand-to-grow-30-to-2035.html