In the U.S. debate over a carbon tax, one of the alleged smoking guns is the experience of British Columbia. The Canadian province established a C$10/ton carbon tax in 2008, which was ramped up gradually until maxing out at C$30/ton (or US$24/ton with current exchange rates) in July 2012. This works out to about 6.7 CDN cents per liter of gasoline, or about 21 US¢ per gallon. The tax is quite broad, with the BC government claiming its “carbon tax applies to virtually all emissions from burning fuels, which accounts for an estimated 70 per cent of total emissions in British Columbia.”

Of particular relevance to conservatives and libertarians, proponents claim that the BC carbon tax is very special because by construction it is revenue neutral, and because (they allege) it has been very effective in reducing BC’s CO2 emissions while not impairing economic growth. Thus, critics of a U.S. carbon tax seem to have had their strongest objections pulled out from under them.

In this post, I will cast serious doubts on the claim that BC’s carbon tax has done wonders in promoting a “low-carbon economy.” In a future post, I will return to the alleged benignity of BC’s carbon tax on its economic performance.

The Praise for BC’s Carbon Tax

To assure the reader that I’m not attacking a strawman, let me validate my claim that the BC episode is perhaps the single strongest example that proponents of a U.S. carbon tax have been citing.

In 2012, Yoram Bauman and Shi-Ling Hsu wrote an op-ed in the New York Times, extolling the virtues of BC’s carbon tax. Yoram Bauman is a PhD primarily known among his economist colleagues for two things: he calls himself the “stand-up economist” and he is the author of a cartoon book explaining the economics of climate change. For his part, Shi-Ling Hsu is a PhD economist who, most recently, is the expert on carbon tax swaps for the Niskanen Center. Thus it is fair to say that these two men are experts who have been pushing a carbon tax, one coming from the progressive left and the other from the conservative right. Here is how they described the relevance of the BC carbon tax to the U.S. policy debate in the New York Times:

On Sunday, the best climate policy in the world got even better: British Columbia’s carbon tax — a tax on the carbon content of all fossil fuels burned in the province — increased from $25 to $30 per metric ton of carbon dioxide, making it more expensive to pollute.

This was good news not only for the environment but for nearly everyone who pays taxes in British Columbia, because the carbon tax is used to reduce taxes for individuals and businesses. . . .

The only bad news is that this is the last increase scheduled in British Columbia. In our view, the reason is simple: the province is waiting for the rest of North America to catch up so that its tax system will not become unbalanced or put energy-intensive industries at a competitive disadvantage.

The United States should jump at the chance to adopt a similar revenue-neutral tax swap. It’s an opportunity to reduce existing taxes, clean up the environment and increase personal freedom and energy security.

…

A carbon tax makes sense whether you are a Republican or a Democrat, a climate change skeptic or a believer, a conservative or a conservationist (or both). We can move past the partisan fireworks over global warming by turning British Columbia’s carbon tax into a made-in-America solution. [Bauman and Hsu, bold added.]

Two years later, in July 2014, The Economist magazine’s blog also provided favorable coverage of the BC carbon tax, implying (if not stating explicitly) that the naysayers had been wrong. Here’s an excerpt:

BC’s levy started at C$10 ($9) a tonne in 2008 and rose by C$5 each year until it reached C$30 per tonne in 2012. That works out to 7 cents of the C$1.35 per litre Vancouver residents pay at the pump to fill up their vehicles. Because the tax must, by law in BC, be revenue-neutral, the province has cut income and corporate taxes to offset the revenue it gets from taxing carbon. BC now has the lowest personal income tax rate in Canada and one of the lowest corporate rates in North America, too.

BC’s fuel consumption is also down. Over the past six years, the per-person consumption of fuels has dropped by 16% (although declines levelled off after the last tax increase in 2012). During that same period, per-person consumption in the rest of Canada rose by 3%. “Each year the evidence becomes stronger and stronger that the carbon tax is driving environmental gains,” says Stewart Elgie, an economics professor at University of Ottawa and head of Sustainable Prosperity, a pro-green think-tank. At the same time, BC’s economy has kept pace with the rest of the country. [The Economist, bold added.]

These two examples suffice to make my point: In the climate change policy debate, the proponents of a stiff U.S. carbon tax are pointing to the example of British Columbia as an apparent success story. It’s therefore important to look at these claims more closely to see if they hold up.

Emissions Cutbacks in BC, or Serious “Leakage”?

In a future post, I will return to the issue of BC’s economy in the wake of its carbon tax. For now, let’s focus on its alleged success in drastically reducing emissions. A highly cited 2013 Sustainable Prosperity study concluded, “Since the carbon tax took effect (July 1, 2008), BC’s fuel consumption has fallen by 17.4% per capita (and fallen by 18.8% relative to the rest of Canada).”

A more sophisticated 2012 econometric study, by Nicholas Rivers and Brandon Schaufele, concluded that not only did the BC carbon tax lead to large cutbacks in BC emissions, but that it did so far more than economists would have expected from mere price effects alone. Here’s how they explained their findings:

Our main result is that the BC carbon tax generated demand response that is 4.9 times larger than is attributable to an equivalent change in the carbon tax-exclusive price. In our preferred model, a five cent increase in the market price of gasoline yields a 2.2% reduction in the number of litres of gasoline consumed in the short-run, while a five cent increase in the carbon tax, a level approximately equal to a carbon price of $25 per tonne, generates a 10.6% short-run reduction in gasoline demand. These results lead us to claim that the carbon tax is more salient than market-determined price changes: carbon taxes produce larger demand responses than tax-exclusive price increases. [Rivers and Schaufele, pp. 2-3, bold added.]

On the face of it, this is rather surprising. After all, the public has been beaten on the head for years now about the importance of “putting a price on carbon,” in order for the normal wonders of supply and demand to do their thing.

Yet now, when analyzing the official data after the imposition of the BC carbon tax, researchers are finding that it is apparently five times more potent than market prices in curbing demand. What gives?

The authors provide an explanation that perhaps BC drivers have a “resentment of free-riding,” and so people who normally would have scaled back their emissions—out of concern for global warming—would not do so before the introduction of the carbon tax. This is because (so our authors hypothesize) the environmentally conscious BC residents would know that their unilateral efforts would have little environmental benefit, because other BC drivers would simply increase their emissions. In their words (p. 28), “Without a price on carbon, one outcome of her decision to drive fewer kilometres is that it lowers the cost of driving for the non-environmentally conscious driver, enabling him to drive more. This is a form of leakage where actual emission reductions from the environmentally conscious driver are eliminated by increases in emissions from other drivers.”

However, this resentment is quashed (so our authors speculate) with the introduction of the BC carbon tax. Now the BC drivers who want to help the environment can scale back their driving with gusto, knowing that everybody else is on the same playing field. So this is why—according to our authors—BC drivers cut back on buying BC gasoline so much, fully five times more than they would have in the presence of market-driven hikes in the price of gas.

There’s one huge problem with this theory: The free-rider effect applies almost as much to British Columbia as a whole, as it does to any individual BC driver. That is, if a single province in Canada cuts back its usage of gasoline, this lowers the world price and allows every other driver on Earth to get slightly cheaper gas. The “leakage” effect at a provincial level is still enormous.

Buying Gas Elsewhere?

There is a much more plausible explanation for the results. The studies touting BC’s declining gasoline consumption don’t actually directly measure consumption but rely on the proxy of gasoline sales within British Columbia. Therefore, if millions of drivers in BC are at least partially responding to the new carbon tax by occasionally driving into neighboring Alberta or Washington State (on their southern border) to fill up, then the official gas sales in British Columbia would drop while those in neighboring jurisdictions would rise.

Furthermore, notice that this hypothesis explains the alleged “salience” of carbon taxes versus normal market price hikes: If the price of gas in British Columbia goes up because of genuine changes in world supply and demand, then prices in Alberta and Washington State would presumably also rise accordingly; the BC drivers would have no choice but to either pay higher prices or to buy less gas.

In contrast, if the price of gas in British Columbia goes up because of a self-imposed and unilateral BC carbon tax, then there is no reason for gas in Alberta or Washington State to rise accordingly. This then provides a definite advantage to cross-border gas shopping, giving another option to BC drivers. They don’t simply have to pay higher prices or cutback on consumption. Now, they can plan cross-border trips to fill up.

Quantifying the Results

To their credit, Rivers and Schaufele admit that their results could partially be due to cross-border gas shopping, but they do not pursue the possibility in their paper. They claim, “It is doubtful that a sizeable share of residents suddenly began cross-border shopping because of the carbon tax.”

Some quick calculations suggest that they should revisit the possibility. The data for Alberta offer no smoking gun—yes, its fuel sales rose sharply as British Columbia’s fell, but this also went hand in hand with the booming Alberta population growth—but British Columbia’s population is not concentrated on its border with Alberta. In contrast, the Greater Vancouver area (on BC’s southern border) has some 2.5 million people (out of total BC population of 4.6 million), meaning that cross-border traffic with Washington State might have sharply responded to the new BC carbon tax instituted in 2008. The following chart suggests that this is precisely what happened:

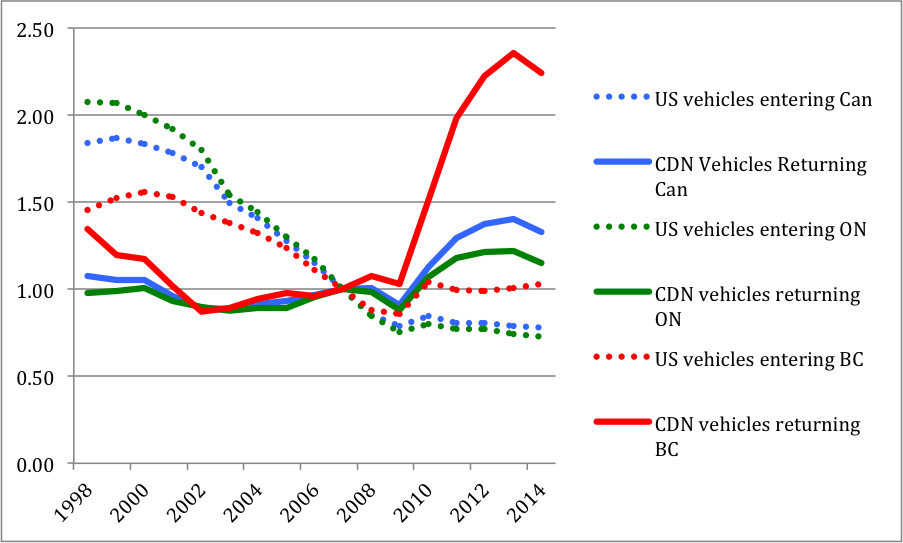

Figure 1. Annual Vehicle Border Crossings, U.S. vs. Select Canadian Regions, Index 100 = 2007

Source: Statistics Canada, Table 427-0002.

The above table shows border crossing for Canadian and U.S. vehicles, either returning to or entering Canada, for Canada as a whole, British Columbia, and Ontario. Note that the chart above is an index, showing the annual values relative to their 2007 levels.

The chart makes it clear that there was a giant surge in Canadian vehicles crossing from British Columbia into the United States (solid red line) starting shortly after introduction of the BC carbon tax (in mid-2008). This can’t be explained (as some have tried) by reference to easier checkpoints on the BC/U.S. border, because we see no comparable increase in U.S. visitors to BC (the dotted red line).

Furthermore, the BC surge can’t be solely attributed to the fall in the Canadian dollar relative to the USD (as some have tried to do), because the surge in Ontario is not nearly as pronounced. In particular, Ontario vehicles crossing into the U.S. and then returning to Ontario were up only 22 percent relative to the 2007 level, whereas for British Columbia the traffic was up 136 percent (i.e. well more than a doubling) in 2013.

For obvious reasons, the proponents of the BC carbon tax are trying their best to pooh-pooh these results; see here and here, for example. Yet it is odd that we have been lectured for years on the wondrous power of a “price on carbon” to alter behavior. It will (we have been told) cause drivers to give up their guzzling SUVs and switch to hybrids, it will cause soccer moms to carpool, it will induce executives to start biking to work, and it will beat coal-fired power plants into wind turbines.

Yet when cynics come along and say, “And maybe it will induce people in British Columbia to drive an extra hour to fill up their gas where it’s a lot cheaper?” the proponents of a carbon tax all of a sudden scoff that that is a serious factor.

Conclusion

In the U.S. policy debate, the British Columbia carbon tax is one of the go-to examples of (alleged) success. It supposedly exhibited a sharp fall in emissions while maintaining economic growth comparable to the rest of Canada. However, the claims of large drops in gasoline consumption may partially reflect huge increases in cross-border shopping, which would obviously undercut the apparent environmental benefit—it hardly helps the environment if drivers have to go farther to fill up their vehicles.