Oklahoma is the nation’s second largest wind generator, behind Texas. Last year, Oklahoma generated 31.3 percent of its electricity from wind, nearly double the share of Texas’s wind production and three times wind’s national share. It got there by giving the wind industry lucrative incentives—a 5-year exemption from local property taxes and a tax credit for zero emissions electricity generation. Fifteen years after these incentives were created, Oklahoma is faced with a massive state budget crisis that has led the state to phase out key tax incentives for wind. Oklahoma’s zero emission tax credit for wind expired in July 2017, which means that the state incentive is no longer available for new wind facilities. The five-year property tax exemption for wind was also ended.

In May 2016, Oklahoma had to borrow $5 million from other funds to pay refunds due to corporations that month, including $3.3 million in zero emission credits to wind companies.

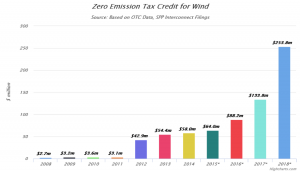

Oklahoma’s zero emissions subsidy for wind production is a 10-year tax credit of 0.5-cents per kilowatt hour generated. According to preliminary estimates from the Tax Committee, the subsidy for wind production was nearly $74 million in 2016. Another source estimates it at $88.2 million in 2016, increasing to $133.8 million in 2017.

*Estimated

Source: http://www.thewindfallcoalition.com/facts.html

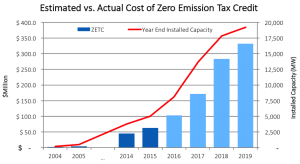

The zero emission tax credit was originally estimated to cost the state less than $2 million per year. It was amended and extended, resulting in an increase of unsustainable dimensions.

Source: 1. Easley, The Oklahoman, 2001. Estimates for 2014-15 based on 2013-14 installed capacity.

Source: 2. State of Oklahoma Incentive Evaluation Commission, Tax Credit for Zero Emission Facilities, November 28, 2016

Source: Ibid.

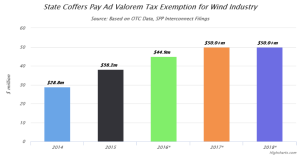

A five-year property tax exemption on wind facilities rose from about $1 million in 2004 to more than $60 million in 2017.

*Estimated

Source: Ibid.

Wind facilities in Oklahoma also qualify for the manufacturers’ sales tax exemption and a 15-year investment tax credit based on up to 2 percent of the cost of the qualified depreciable property. The investment tax credit expired on January 1, 2017.

Over a third (37 percent) of Oklahoma’s wind facilities are foreign owned. Only 7 percent of wind company ownership is Oklahoma-based. The rest (56 percent) are owned by companies in other states, including Texas, Maryland, Connecticut, Virginia, Kansas, North Carolina, Florida, New York, Massachusetts, Illinois, Georgia, and New Jersey.

The Wind Catcher Project

Wind Catcher, a new 2,000 megawatt, $4.5 billion wind project, including a 350-mile transmission line, is facing stiff resistance in Oklahoma and may be scrapped altogether. If completed, it would be one of the largest wind facilities in America.

Public Service Company of Oklahoma (PSO), which is investing $1.3 billion in the project, claims Wind Catcher will save Oklahoma electric customers an estimated $2 billion over 25 years. The company is asking the state to approve a rate hike to help finance the investment, claiming that the added cost to consumers will be canceled out by the savings of wind power. Other sources claim the Wind Catcher project is likely to cost consumers around $320 million. Development of the line route began in the summer of 2017. The overall project is expected to deliver wind energy to customers by the end of 2020 in order to capture the federal production tax credit, if it is not scrapped.

Opposition to Wind Projects

Much of the opposition to wind projects is centered in the Midwest, where the nation’s greatest concentration of wind turbines are located. Opponents are trying to block wind projects in at least half a dozen states, including Nebraska, South Dakota, Indiana, and Michigan. Disputes are also being waged in Iowa, Minnesota, Illinois and Maryland. Parts of the Northeast, including Maine, New York, and Vermont are also experiencing opposition.

Reasons for opposition range from wind turbines blotting homeowners’ views of the landscape to wind turbines causing sleepless nights due to the noise. Some opponents claim that the turbines make them dizzy as well. The whooshing noise and vibration from the blades force them to close windows and blinds and use white noise to mask the mechanical sounds. Still other homeowners expect lower property values, as fewer people will want to buy a home overlooking a wind facility.

In Lincoln County, South Dakota, residents successfully had officials block a proposed 150-turbine development. When the wind power company collected signatures and put the matter on the ballot, opponents easily won the vote.

In Maine, plans to erect turbines atop ridges outraged people worried about marring the landscape and hurting tourism. The group Friends of Maine’s Mountains has been fighting wind-energy developments in the state Legislature, before regulatory panels and in the courts. It has slowed or stopped nearly all of the wind turbine proposals.

Nonetheless, the wind industry has seen incredible growth, with over 54,000 turbines in 41 states, Guam and Puerto Rico, according to the American Wind Energy Association. The amount of electricity generated by wind has increased more than fivefold from a decade ago. Yet, despite the federal and state subsidies, it only represents about 6 percent of total generation.

Conclusion

States are finding that subsidies for renewable power may not be sustainable. Oklahoma, the second-largest generator of wind power among the states, has ended most of its wind subsidies for new projects. Opposition to wind energy, while found mainly in the Midwest where most of the wind facilities are located, is also found in parts of the Northeast. Homeowners are unhappy with wind power due to its noise, vibration, obstruction of views, and lowering of property values.