According to the International Energy Agency (IEA) in its World Energy Outlook 2020, the coronavirus pandemic reduced the average growth rate of the global economy over the next 10 years by 0.6 percent from an annual rate of 3.6 percent to 3.0 percent. While IEA forecasts global energy supply and demand through 2040, IEA chose to focus more heavily on the next 10 years, which could be pivotal in changing the global energy sector.

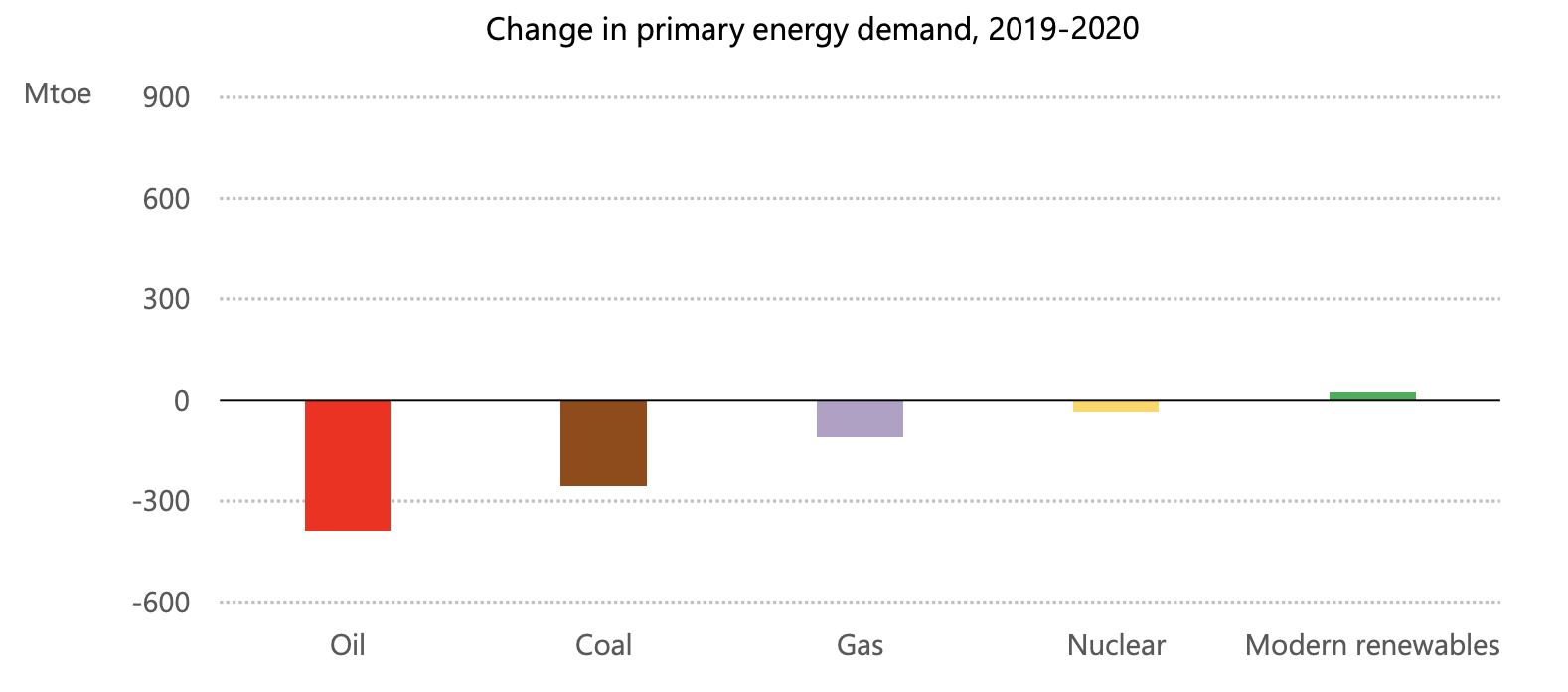

IEA’s assessment of 2020 is that the pandemic caused global energy demand to drop by 5 percent, energy-related carbon dioxide emissions to fall by 7 percent taking them back to the level of a decade ago, and energy investment to drop by 18 percent. The agency expects global oil demand in 2020 to fall by 8 percent, coal demand to drop by 7 percent, and natural gas demand to fall by 3 percent—the largest decline since it became a major source of fuel in the 1930s. It expects global electricity demand to drop by 2 percent.

IEA evaluated four future scenarios:

- Stated Policies Scenario, in which the global economy returns to pre-coronavirus levels in 2021. This scenario reflects announced government policy intentions and targets that are backed up by detailed measures.

- Delayed Recovery Scenario contains the same policy assumptions as in the Stated Policies Scenario, but the pandemic keeps the global economy from returning to its pre-coronavirus levels until 2023, with the lowest rate of energy demand growth over the next decade since the 1930s.

- Sustainable Development Scenario assumes a surge in clean energy policies and investment resulting in the energy system achieving sustainable energy objectives, including the Paris Agreement, that will put global emissions on a path to reach net-zero by 2070. The assumptions on public health and the economy are the same as in the Stated Policies Scenario.

- Net Zero Emissions by 2050 case extends the Sustainable Development Scenario so that global carbon dioxide emissions would reach net zero by 2050 and illustrates what will be needed in the next ten years to achieve that goal.

Renewable Energy

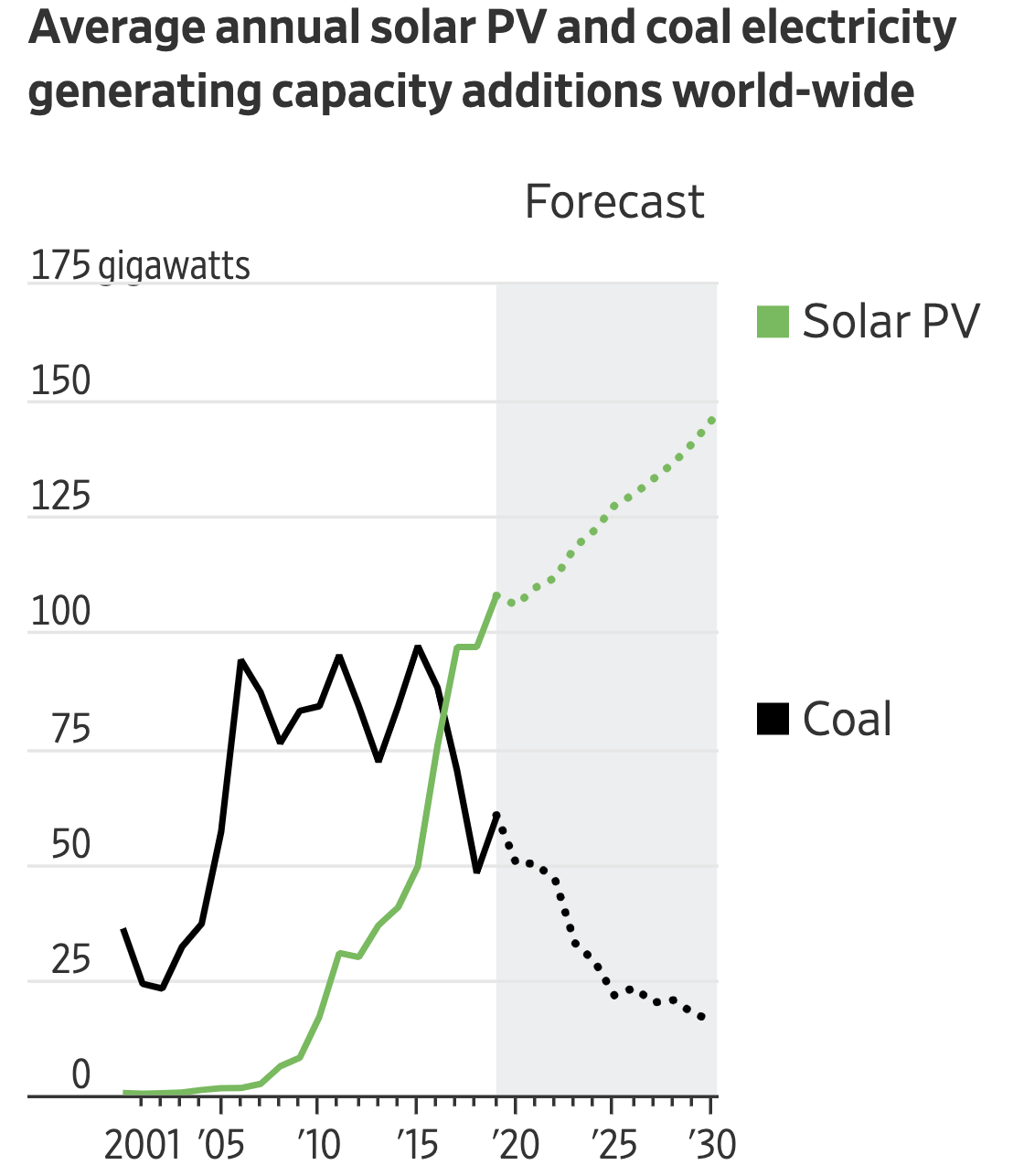

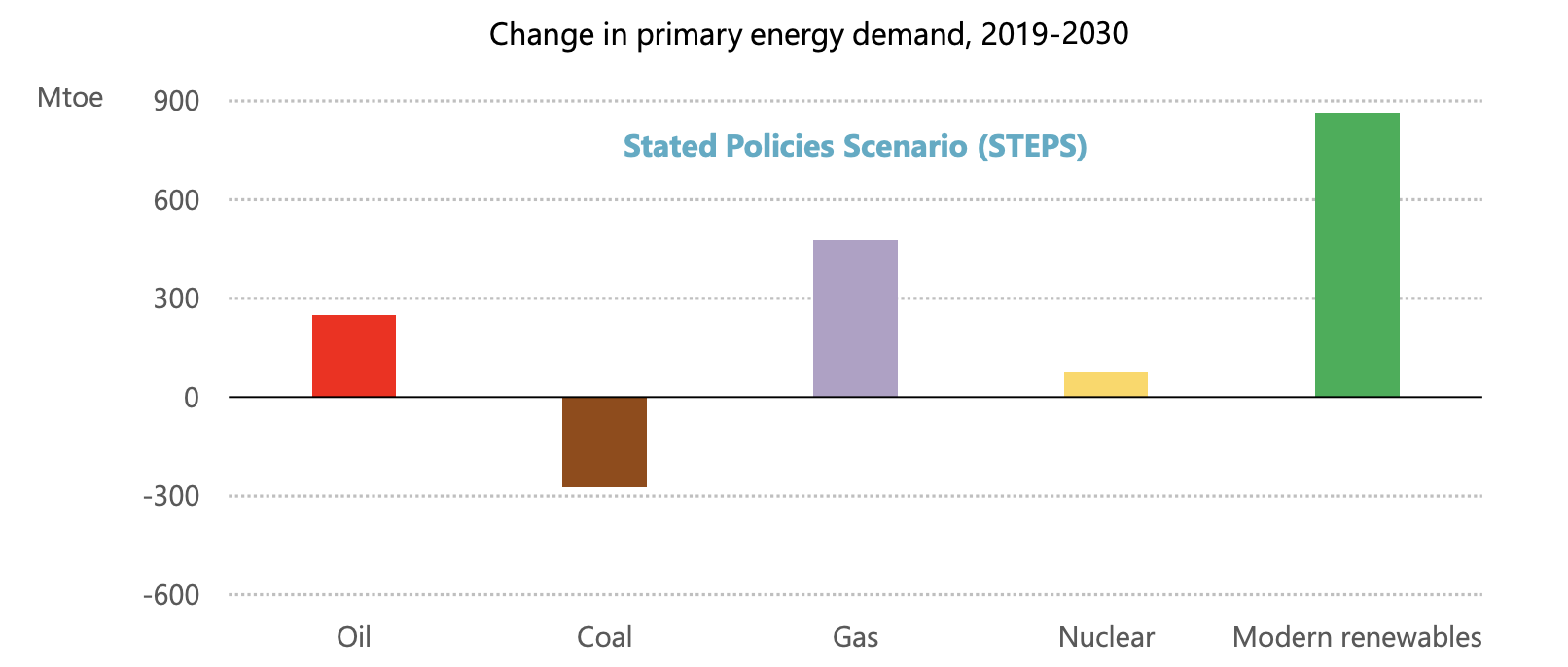

Renewable energy is the major area of growth in the IEA forecast over the next ten years. In the Stated Policies Scenario, renewables meet 80 percent of global electricity demand growth over the next decade. IEA expects renewable energy, including hydroelectric power, to overtake coal as the primary means of producing electricity by 2025.

Hydropower remains the largest renewable source in this forecast, but solar is the main source of growth, followed by onshore and offshore wind. The agency assumes that solar PV is consistently cheaper than new coal- or gas-fired power plants in most countries, given government incentives. Solar- and wind-energy projects benefit from widespread government support and monetary policies that support low interest rates. According to the agency, spending on oil and natural gas has fallen much more than investment in renewable energy.

The higher renewable demand results in a projected requirement for investments in new transmission and distribution lines worldwide, in order to move such sources from their remote locations to demand centers. In the Stated Policies Scenario, it is 80 percent greater over the next decade than the expansion seen over the last ten years. The importance of electricity networks is even higher in the scenarios with faster energy transitions.

Coal

Coal demand remains below its 2014 peak and does not return to pre-coronavirus levels in the Stated Policies Scenario, with its share in the 2040 energy mix falling below 20 percent for the first time since the Industrial Revolution.

Oil

IEA sees oil demand vulnerable to the economic uncertainties resulting from the pandemic. Changed habits such as working from home and reduced travel could reduce fuel demand permanently, despite the pandemic causing an aversion to public transportation and the popularity of SUVs continuing. Oil demand is expected to continue growing in developing economies such as China and India, leading overall global oil demand to recover to pre-pandemic levels in 2023 in the Stated Policies Scenario. The agency expects an increase in oil demand through 2030, at which point “oil demand reaches a plateau” in its forecasts. In the delayed recovery scenario, oil demand is not expected to recover until 2027.

Natural Gas

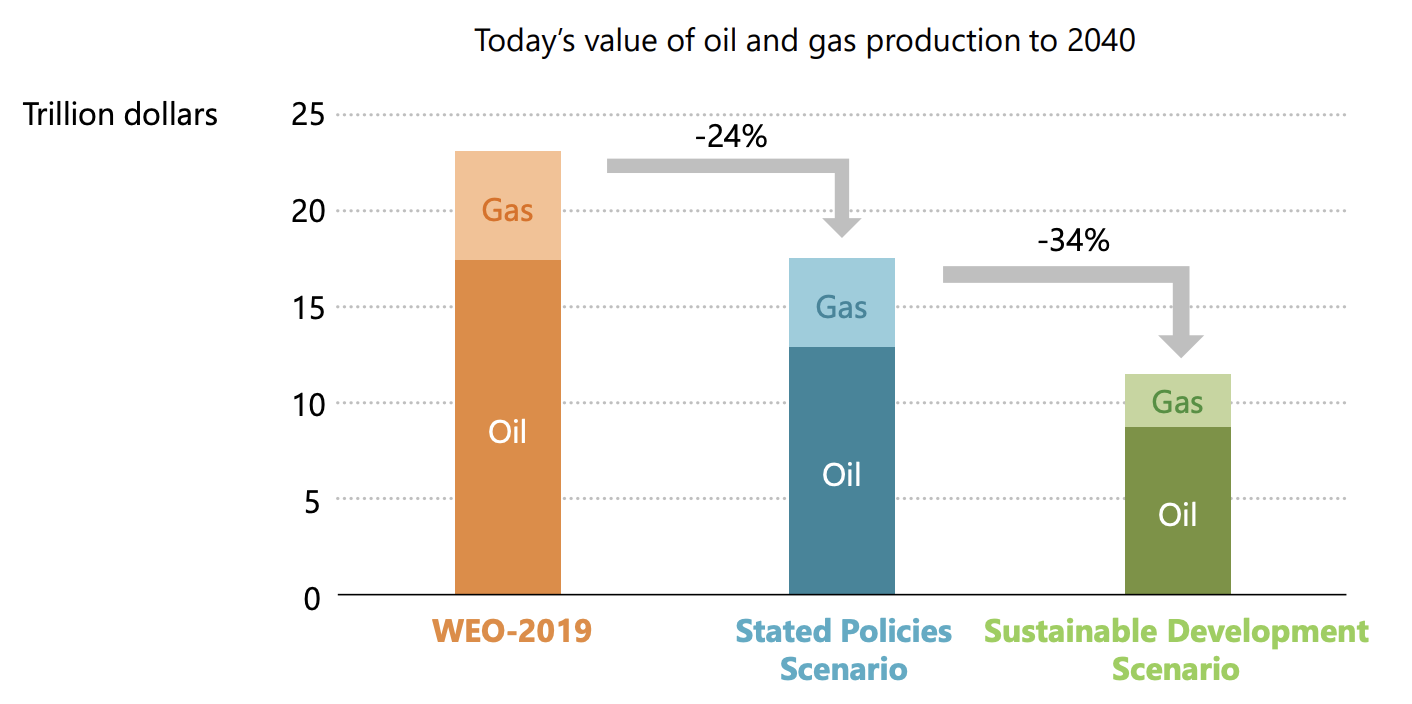

Global natural gas demand is concentrated in South and East Asia, increasing 30 percent in the Stated Policies Scenario by 2040. This is the first World Energy Outlook in which the Stated Policies Scenario projections show gas demand in advanced economies going into a slight decline by 2040. The IEA forecasts that oil and natural gas are still expected to make up nearly half of the global energy mix in 2040, even under a scenario that projects sustained government support for low-carbon investments.

Carbon Dioxide Emissions

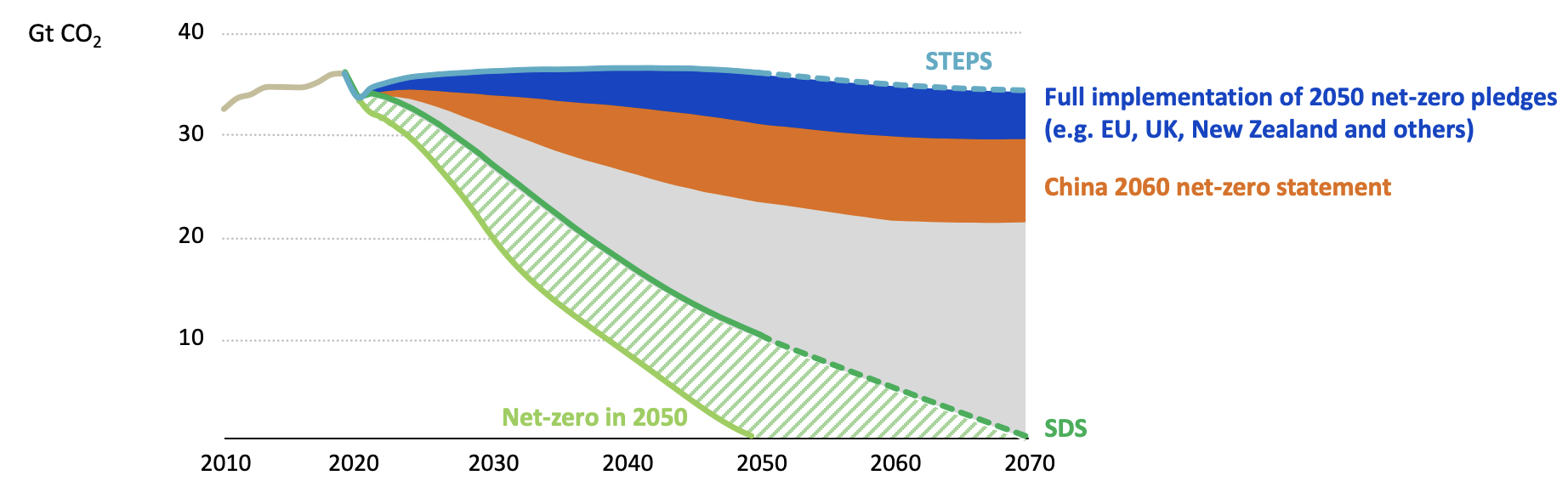

According to the IEA, global carbon dioxide emissions are set to bounce back more slowly than after the financial crisis of 2008 to 2009. But, the IEA forecast shows that the world is still far from putting carbon dioxide emissions into a decisive decline even with the rosy assumptions regarding the cost of renewable technologies embedded in the forecast. The graph below shows the carbon dioxide emissions levels under the various IEA scenarios. The top line is the Stated Policies Scenario (STEPS). At the bottom are the Sustainable Development Scenario, reaching net zero carbon dioxide emissions by 2070 and the Net-Zero 2050 case getting there 20 years sooner.

While the pandemic has caused fossil-fuel investment to drop in the short run with a 7 percent decline expected in energy-related greenhouse gas emissions in 2020, those impacts are not expected to be a long-term trend, particularly when China’s carbon dioxide emissions have already returned to pre-pandemic levels. The IEA sees the next decade as crucial in determining whether the transition to clean energy pushes “emissions into structural decline.” For example, according to IEA’s executive director Fatih Birol, every other automobile sold in 2030 would have to be an electric vehicle, up from only 3 percent of global car sales today. By 2050, all new cars would have to be electric. With the push for electric vehicles, there will be increased emissions from the mining sector to provide the various minerals needed for electrification of cars.

Conclusion

IEA warns that, even with its rosy assumptions, getting to net zero carbon dioxide emissions will probably not be on the horizon unless countries make major changes now to rid themselves of the use of fossil fuels. However, the push to get countries to implement policies that will eliminate hydrocarbons is unfathomable in a time when economic recovery from the coronavirus lockdowns is needed. Certainly, China, the first country to recover from the virus, is not obeying IEA’s push since they are building 250 gigawatts of coal-fired plants—more than the total coal plants that the United States has in its generating fleet presently. China’s actions should provide insight for other nations on how to recover and get their economies moving again.