At the September 22nd United Nations meeting, China committed to peak its carbon dioxide emissions before 2030 and to be carbon neutral before 2060. However, pledges are not the same as actions, particularly given that China is still building new coal-fired power plants that last 50 or 60 years—well beyond the 2060 date set for carbon neutrality. China is currently planning to build 250 gigawatts of coal-fired generating capacity—more than the entire coal-fired capacity that the United States currently has in its generating fleet—and 21 percent more than planned in 2019 (206 gigawatts). Once built, China will have more coal-fired capacity than the entire generating fleet in the United States from all power sources.

China added 32 gigawatts of coal-fired capacity in 2018 and 44 gigawatts of new coal capacity in 2019. Almost 100 gigawatts are under construction and another 152 gigawatts are in planning. In an apparent move to stimulate its domestic economy, China has surged its new coal plant permitting. From January 1 to June 15, 2020, China permitted 17.0 gigawatts of new coal-fired capacity for construction, more than the amount permitted in all of 2018 and 2019 combined (12.0 gigawatts). Nearly half (7.9 gigawatts) of the 17.0 gigawatts permitted are to power long-distance transmission lines from coal and renewable power plants in the West to demand centers on the coast. The remaining coal power will most likely add to the country’s coal overcapacity.

By building coal-fired plants that operate for 50 or more years, it is hard to believe that China will be carbon neutral in 40 years and that its carbon dioxide emissions will peak in less than 10 years. Once built, it will be politically difficult to tear down a new coal-fired plant that is employing workers and supporting a mining operation, making it difficult for China to transition away from coal.

China’s Coal Profile

China has substantial domestic coal reserves—142 billion metric tons as of the end of 2019—13 percent of the world total and the fourth largest in the world, and as such coal is a secure domestic energy source for China and a reliable generating fuel. China’s local governments favor coal-fired power plants as tools for economic development and the baseload power that they provide, which is essential for reliability.

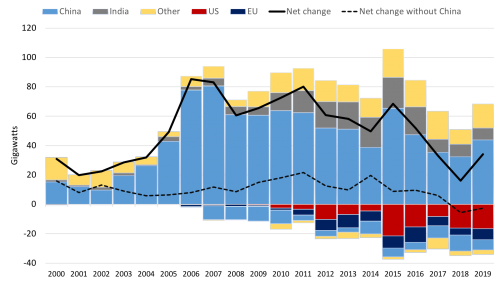

While global coal consumption decreased in 2019 by 0.6 percent, China’s coal consumption increased by 2.3 percent and accounted for 57.6 percent of its energy use and 51.7 percent of the world’s total coal use. Despite the world’s lower coal usage, the global coal fleet increased by 34 gigawatts in 2019—the first increase in net capacity additions since 2015. Nearly two-thirds (43.8 gigawatts) of the 68.3 gigawatts of newly commissioned capacity was constructed in China.

Since 2000, China’s coal fleet has grown five-fold and now totals 1,040 gigawatts—nearly half the global total. China is one of 80 countries in the world using coal power—up from 66 in 2000. Coal generated 36 percent of the world’s electricity in 2019, close to its highest share in decades and a greater share than any other generating fuel. China, however, almost doubled that share, generating 65 percent of its electricity from coal in 2019, using a very young coal fleet with generators averaging 14 years of age.

Coal power capacity additions and retirements, and the net change.

China’s Carbon Dioxide Emissions

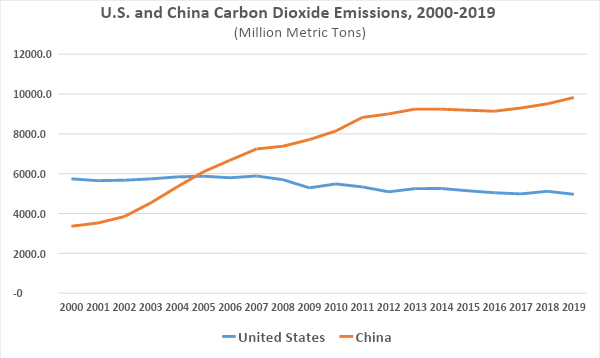

Between 2000 and 2019, China’s annual carbon dioxide emissions almost tripled. In 2019, China accounted for almost 30 percent of the world’s total carbon dioxide emissions, compared to less than 15 percent for the United States.

China’s carbon dioxide emissions have surged back from the coronavirus lockdown, increasing by 4 to 5 percent year-on-year in May. The increase in carbon dioxide emissions in May was driven by coal power, cement, and other heavy industries, which appear to be bouncing back faster than other sectors of China’s economy. In May, there were nine percent increases in thermal power (mainly coal-fired) generation and in cement output. Thermal power rebounded much faster than overall power demand due to poor hydropower operating conditions this year and fewer installations of non-fossil energy since last summer. For example, solar photovoltaic power installations declined by 32 percent in 2019. This was due to changes in subsidy policies in China, where it seems that subsidies are a principal stimulant for solar panel deployment.

Cement production accounted for one fifth of the overall increase in monthly carbon dioxide emissions compared to last year. Cement demand is driven by real estate and infrastructure investment, which have not fully recovered.

Conclusion

China claims to be following through with its Paris climate accord commitments, but its actions are far different, and include constructing coal-fired power plants despite over-capacity in its generating sector. China’s current fleet of coal-fired power plants is young and with more coming down the conveyor belt, it is hard to believe that the country will peak its carbon dioxide emissions prior to 2030 and become carbon neutral before 2060, as Xi Jinping claimed at the recent U.N. meeting. Sometimes officials of countries promise things at international gatherings to please the crowd at the moment, when they have no intention of following through on those promises. What is surprising is that policymakers in the United States may try to use China’s verbal promises to justify similar commitments from the United States, even when the facts run counter to the narrative.